- United States

- /

- Professional Services

- /

- NYSE:BR

Did IDC’s Wealth Tech Leadership Nod Just Shift Broadridge Financial Solutions' (BR) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier in 2025, IDC MarketScape named Broadridge Financial Solutions a Leader in its inaugural Worldwide Wealth Management Technology Services for Investment Advisors report, recognizing the company’s capabilities and strategy among 13 global providers.

- This leader ranking underlines how Broadridge’s integrated, front‑to‑back wealth platform and acquisition‑enhanced advisor tools are strengthening its position in technology‑driven wealth management services.

- Next, we’ll examine how this IDC MarketScape leadership recognition could influence Broadridge’s investment narrative around technology leadership and recurring revenue.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Broadridge Financial Solutions Investment Narrative Recap

To own Broadridge, you need to believe in its role as a core technology and communications utility for global finance, with sticky, recurring revenues offsetting event driven volatility. IDC’s recognition of Broadridge as a Leader in wealth management tech reinforces that story, but does not materially change the near term risk that slower GTO sales cycles and a normalization in event driven revenues could weigh on growth.

Among recent announcements, the dividend increase to US$0.975 per share and 19th consecutive year of dividend growth stands out, because it reflects management’s confidence in Broadridge’s recurring cash flows that underpin its technology investments. For investors watching how the IDC MarketScape recognition ties into the broader thesis, this steady capital return policy can be viewed alongside investments in tokenization, AI enabled platforms and wealth tools that aim to deepen client relationships.

Yet behind the technology leadership story, investors should be aware that prolonged macro uncertainty and lengthening GTO sales cycles could...

Read the full narrative on Broadridge Financial Solutions (it's free!)

Broadridge Financial Solutions' narrative projects $8.0 billion revenue and $1.1 billion earnings by 2028. This requires 5.3% yearly revenue growth and an earnings increase of about $260 million from $839.5 million today.

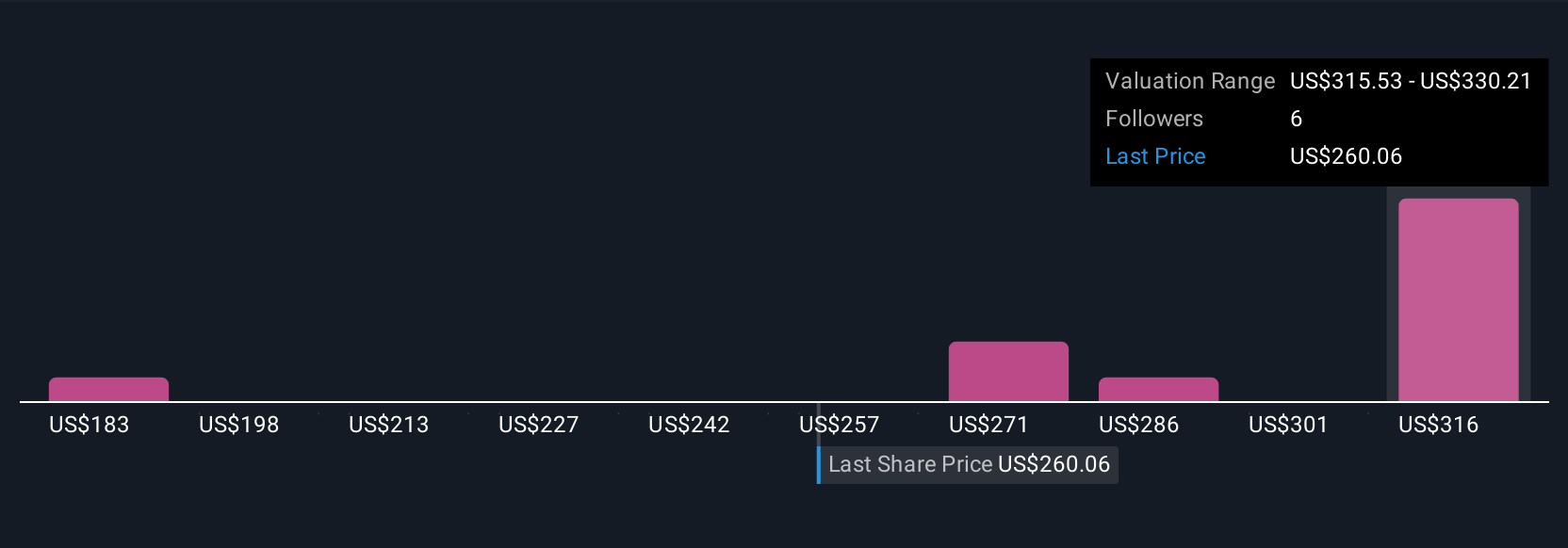

Uncover how Broadridge Financial Solutions' forecasts yield a $269.38 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from US$269.38 to US$314.97 per share, showing how widely opinions can differ. Set against this, the reliance on event driven revenues and signs of longer sales cycles in key segments raise questions about how consistently Broadridge can translate its wealth tech leadership into future earnings growth, which readers may want to explore through several alternative viewpoints.

Explore 3 other fair value estimates on Broadridge Financial Solutions - why the stock might be worth as much as 37% more than the current price!

Build Your Own Broadridge Financial Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Broadridge Financial Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadridge Financial Solutions' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadridge Financial Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BR

Broadridge Financial Solutions

Provides investor communications and technology-driven solutions for the financial services industry in the United States and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026