- United States

- /

- Professional Services

- /

- NYSE:BKSY

A Look at BlackSky Technology's Valuation Following Contract Wins and a New 52-Week High (BKSY)

Reviewed by Kshitija Bhandaru

BlackSky Technology (BKSY) just hit a new 52-week high following a string of wins, including a sizable contract with HEO and a two-year agreement for its Gen-3 offerings. Investors are taking notice as demand climbs.

See our latest analysis for BlackSky Technology.

After a remarkable run over the past month, BlackSky Technology’s share price has soared 80.8%, bringing its year-to-date gain to an eye-catching 181.3%. This explosive momentum has also driven a 377.3% total shareholder return in the past year, a testament to growing optimism around the company’s breakthroughs and new contracts.

If the recent string of wins has you wondering what other high-flyers could be next, it is worth broadening your search and discovering fast growing stocks with high insider ownership

Yet after such a powerful rally, the key question emerges: Is BlackSky Technology’s sky-high momentum truly justified by underlying value, or has all its future growth already been accounted for, leaving little room for a bargain buy?

Most Popular Narrative: 18.9% Overvalued

Despite the latest consensus narrative raising BlackSky Technology's fair value to $25.29, the last close price of $30.07 sits notably above it. This suggests the current market enthusiasm outruns even the most optimistic forecasts. The gap between share price and narrative fair value signals that all eyes should be on the business drivers behind this premium.

Heavy reliance on government and international contracts, significant capital investments, and unpredictable revenue streams increase financial risk and pose challenges to long-term stability. Catalysts about BlackSky Technology operate as a space-based intelligence company in North America, the Middle East, the Asia Pacific, and internationally.

Want to know what fuels this premium price tag? There is a battle between surging revenue optimism and unpredictable profit margins hidden in the projections. See what bold financial moves and betting on international expansion could mean for BlackSky’s future valuation.

Result: Fair Value of $25.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing U.S. government budget uncertainty or lower than expected Gen-3 adoption could still disrupt BlackSky Technology’s impressive growth outlook.

Find out about the key risks to this BlackSky Technology narrative.

Another View: SWS DCF Model Paints a Different Picture

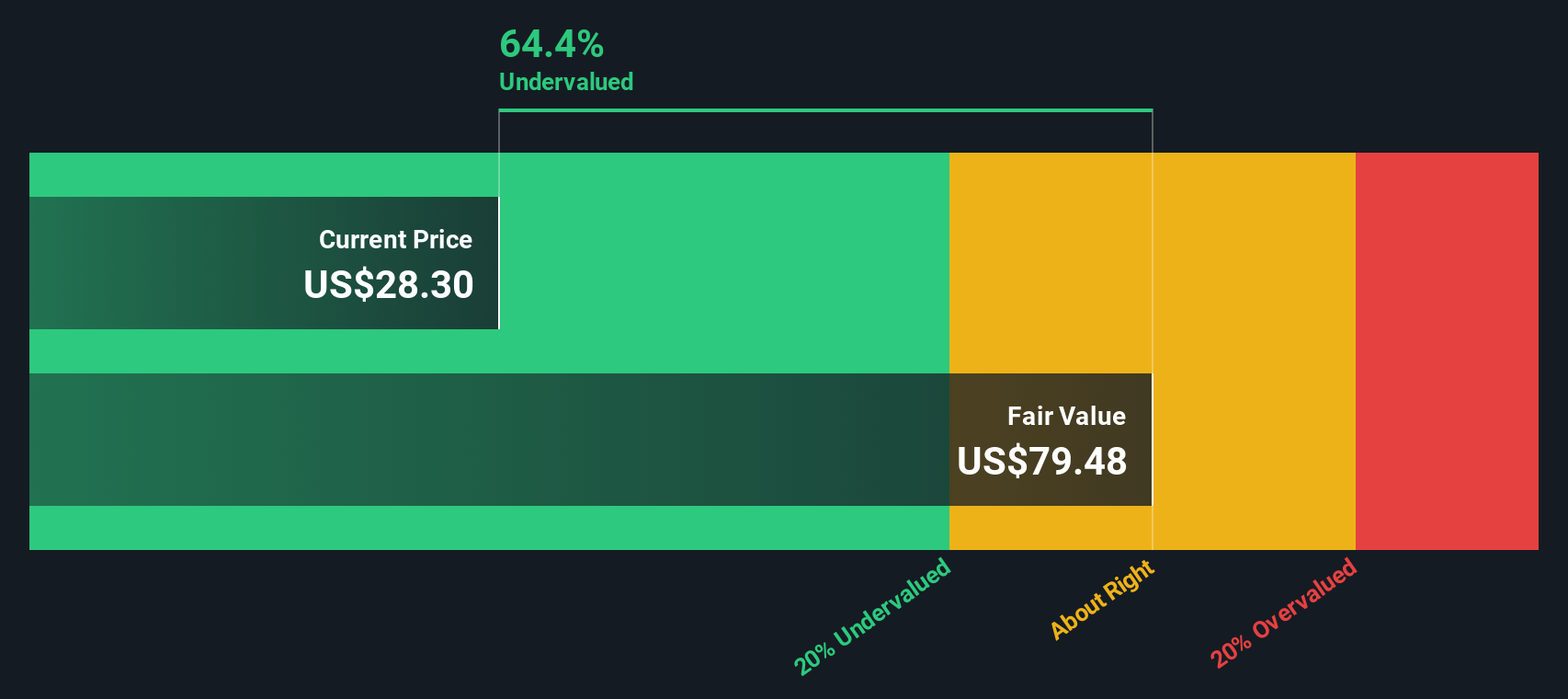

While multiples suggest BlackSky Technology is expensive compared to the industry, the SWS DCF model tells a contrasting story. According to this model, BKSY is actually trading well below its estimated fair value of $79.93, pointing to significant potential upside if long-term cash flows play out. But can this optimistic scenario hold up as market realities unfold?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BlackSky Technology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BlackSky Technology Narrative

If you have a different perspective or want to dig into the numbers yourself, shaping your own view takes just minutes. Do it your way

A great starting point for your BlackSky Technology research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart strategies come from continually searching the market for new opportunities and rewarding trends. Don’t miss your chance to strengthen your portfolio with ideas tailored for today’s changing landscape.

- Capture tomorrow’s market leaders by targeting these 25 AI penny stocks, which focus on breakthrough innovation and disruptive growth in artificial intelligence.

- Strengthen your portfolio's income stream by tapping into these 19 dividend stocks with yields > 3%, featuring impressive yields and stable financials.

- Capitalize on rapid market shifts with these 78 cryptocurrency and blockchain stocks, highlighting companies at the forefront of blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackSky Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKSY

BlackSky Technology

Operates as a space-based intelligence company in North America, the Middle East, the Asia Pacific, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives