- United States

- /

- Professional Services

- /

- NYSE:BGSF

Here's Why It's Unlikely That BGSF, Inc.'s (NYSE:BGSF) CEO Will See A Pay Rise This Year

BGSF, Inc. (NYSE:BGSF) has not performed well recently and CEO Beth Garvey will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 04 August 2021. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for BGSF

Comparing BGSF, Inc.'s CEO Compensation With the industry

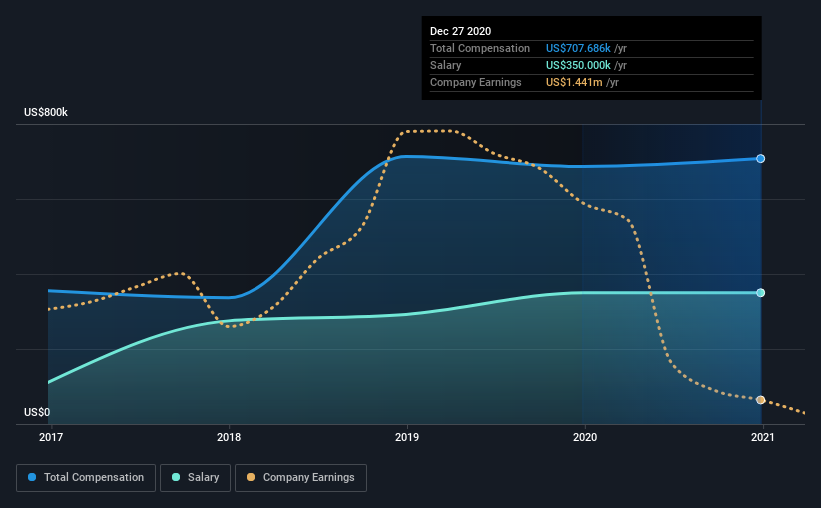

According to our data, BGSF, Inc. has a market capitalization of US$124m, and paid its CEO total annual compensation worth US$708k over the year to December 2020. That's a modest increase of 3.1% on the prior year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$350k.

On comparing similar-sized companies in the industry with market capitalizations below US$200m, we found that the median total CEO compensation was US$473k. Accordingly, our analysis reveals that BGSF, Inc. pays Beth Garvey north of the industry median. Furthermore, Beth Garvey directly owns US$343k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$350k | US$350k | 49% |

| Other | US$358k | US$336k | 51% |

| Total Compensation | US$708k | US$686k | 100% |

Talking in terms of the industry, salary represented approximately 21% of total compensation out of all the companies we analyzed, while other remuneration made up 79% of the pie. It's interesting to note that BGSF pays out a greater portion of remuneration through salary, compared to the industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

BGSF, Inc.'s Growth

Over the last three years, BGSF, Inc. has shrunk its earnings per share by 57% per year. Its revenue is down 9.4% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has BGSF, Inc. Been A Good Investment?

Few BGSF, Inc. shareholders would feel satisfied with the return of -48% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 4 warning signs for BGSF that investors should look into moving forward.

Switching gears from BGSF, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade BGSF, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BGSF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:BGSF

BGSF

Provides consulting, managed services, and professional workforce solutions in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives