- United States

- /

- Professional Services

- /

- NYSE:BAH

If EPS Growth Is Important To You, Booz Allen Hamilton Holding (NYSE:BAH) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Booz Allen Hamilton Holding (NYSE:BAH). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Booz Allen Hamilton Holding

How Fast Is Booz Allen Hamilton Holding Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Booz Allen Hamilton Holding's EPS has grown 17% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

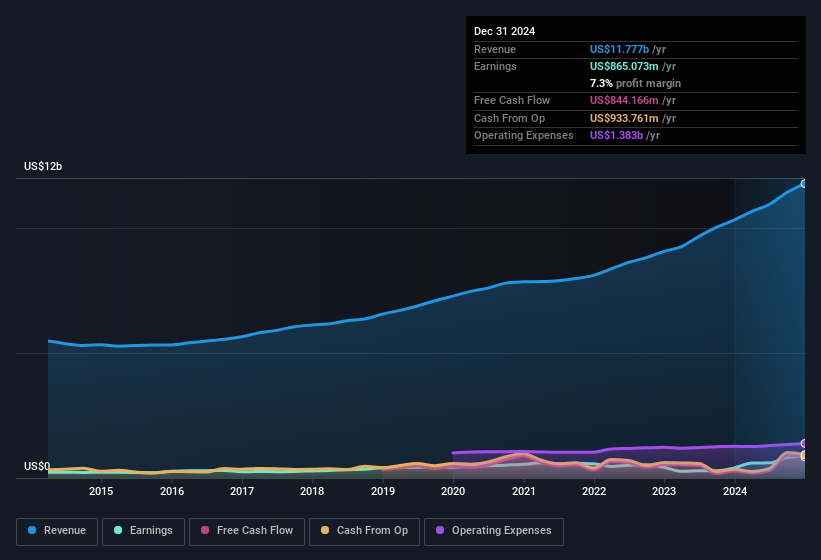

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Booz Allen Hamilton Holding remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 14% to US$12b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Booz Allen Hamilton Holding's future profits.

Are Booz Allen Hamilton Holding Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Booz Allen Hamilton Holding insiders reported share sales in the last twelve months. Even better, though, is that the Independent Director, Joan Lordi Amble, bought a whopping US$517k worth of shares, paying about US$143 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Booz Allen Hamilton Holding insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$219m. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Is Booz Allen Hamilton Holding Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Booz Allen Hamilton Holding's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. We don't want to rain on the parade too much, but we did also find 2 warning signs for Booz Allen Hamilton Holding that you need to be mindful of.

Keen growth investors love to see insider activity. Thankfully, Booz Allen Hamilton Holding isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Booz Allen Hamilton Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BAH

Booz Allen Hamilton Holding

Provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives