- United States

- /

- Professional Services

- /

- NYSE:BAH

Booz Allen Hamilton Holding Corporation's (NYSE:BAH) 26% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

Booz Allen Hamilton Holding Corporation (NYSE:BAH) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The last month has meant the stock is now only up 4.7% during the last year.

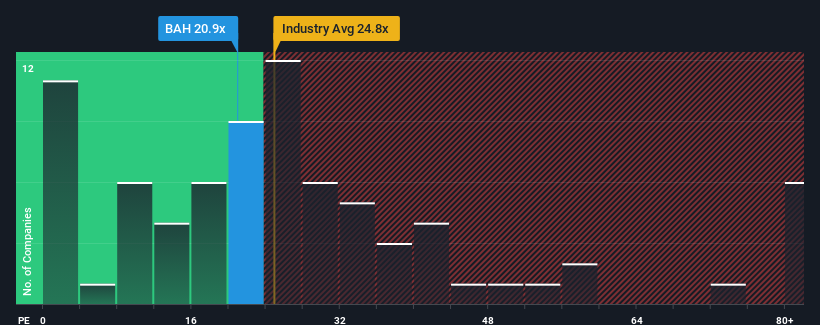

Even after such a large drop in price, it's still not a stretch to say that Booz Allen Hamilton Holding's price-to-earnings (or "P/E") ratio of 20.9x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 19x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Booz Allen Hamilton Holding as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Booz Allen Hamilton Holding

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Booz Allen Hamilton Holding would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 187%. The latest three year period has also seen an excellent 50% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 4.9% per year as estimated by the ten analysts watching the company. With the market predicted to deliver 11% growth each year, the company is positioned for a weaker earnings result.

In light of this, it's curious that Booz Allen Hamilton Holding's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Bottom Line On Booz Allen Hamilton Holding's P/E

Following Booz Allen Hamilton Holding's share price tumble, its P/E is now hanging on to the median market P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Booz Allen Hamilton Holding's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Booz Allen Hamilton Holding you should know about.

Of course, you might also be able to find a better stock than Booz Allen Hamilton Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Booz Allen Hamilton Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BAH

Booz Allen Hamilton Holding

Provides management and technology consulting, analytics, engineering, digital solutions, mission operations, and cyber services to governments, corporations, and not-for-profit organizations in the United States and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives