- United States

- /

- Professional Services

- /

- NYSE:AMTM

Are Large Shareholder Sales Shaping Insider Confidence at Amentum Holdings (AMTM)?

Reviewed by Sasha Jovanovic

- Amentum Holdings recently filed a shelf registration for the potential sale of over 90 million shares of common stock, totaling approximately US$2.16 billion, by existing stockholders.

- The fact that Amentum will not receive any proceeds from these sales highlights that major shareholders may be seeking to reduce their positions, raising questions about insider sentiment.

- We’ll examine how this potential increase in share supply might affect Amentum’s investment narrative and perceptions of insider confidence.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Amentum Holdings' Investment Narrative?

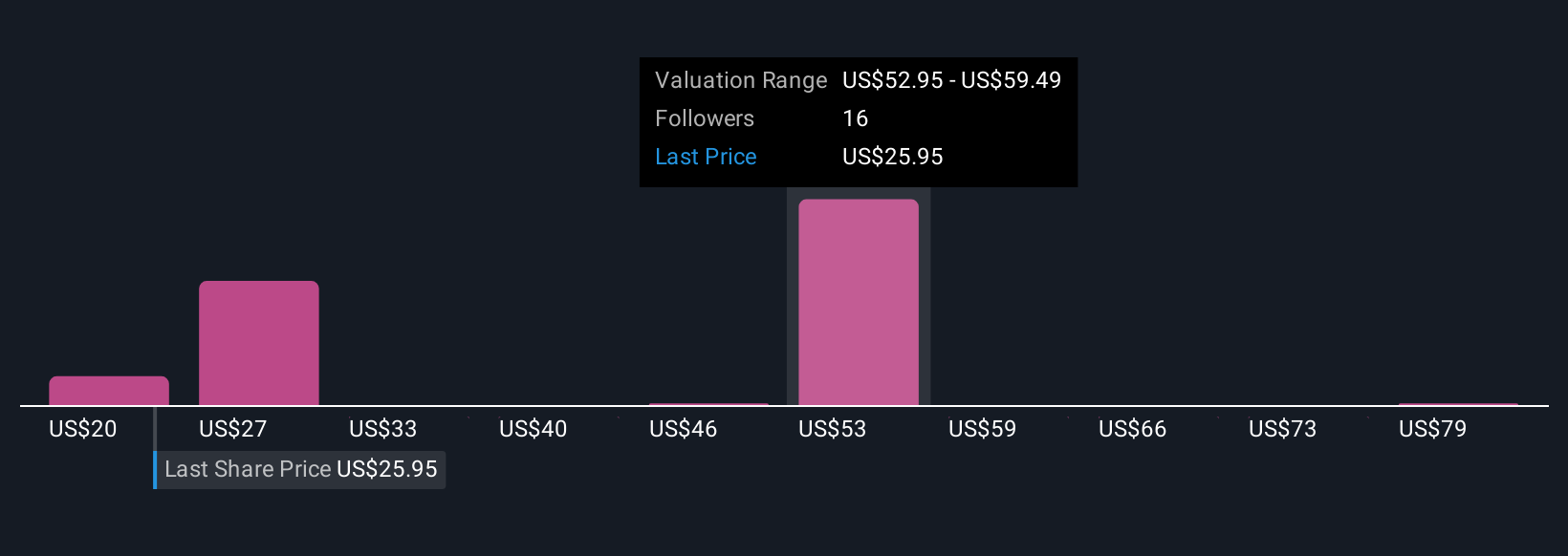

The big picture for Amentum Holdings focuses on its rapid transition to profitability, growing defense and nuclear contracts, and a forecast of significant earnings growth over the next three years. For investors, believing in Amentum means having confidence in its ability to turn recent contract wins, merger plans, and expanding market presence into sustainable profit, despite a relatively inexperienced management team and board. While the shelf registration news about the potential sale of over 90 million shares by existing holders did trigger a short-term pullback, market reaction suggests this shift may not be material to Amentum’s main investment catalysts, like revenue growth and contract momentum, at least for now. Still, with insiders reducing exposure, the risk of share price volatility and changing market sentiment could become more prominent, even as previously highlighted risks such as high valuation multiples and coverage of interest payments remain in play.

But even with strong earnings forecasts, sudden insider selling is a key risk to consider. Amentum Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Amentum Holdings - why the stock might be worth 20% less than the current price!

Build Your Own Amentum Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amentum Holdings' overall financial health at a glance.

No Opportunity In Amentum Holdings?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Provides engineering and technology solutions to the U.S.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives