- United States

- /

- Professional Services

- /

- NYSE:AMTM

Amentum’s Return To Profitability And 2026 Outlook Might Change The Case For Investing In AMTM

Reviewed by Sasha Jovanovic

- Amentum Holdings reported full-year results for the period ended October 3, 2025, with sales rising to US$14.39 billion from US$8.39 billion, and net income improving to US$66 million from a net loss of US$82 million a year earlier.

- The shift from a loss to positive earnings per share, alongside newly issued 2026 revenue guidance of US$13.95–US$14.30 billion, gives investors clearer visibility into the company’s operational progress and future expectations.

- We’ll now examine how Amentum’s return to profitability and newly issued 2026 revenue outlook shape the company’s broader investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

What Is Amentum Holdings' Investment Narrative?

To own Amentum, you have to believe that its mix of long-cycle government and defense contracts, plus nuclear and space infrastructure work, can support more consistent profitability after years of volatility. The latest full-year results, with revenue up to US$14.39 billion and a swing to a US$66 million profit, strengthen that case and show the business is at least earning through its heavy contract load. At the same time, the 2026 revenue outlook of US$13.95–US$14.30 billion signals management is not guiding to another big leap, which may temper some of the more optimistic growth narratives that had built up. Short term, the key catalysts still cluster around contract execution and margin improvement, while balance sheet pressure and relatively high earnings multiples remain front-of-mind risks, only partly eased by this return to profit.

Despite retreating, Amentum Holdings' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

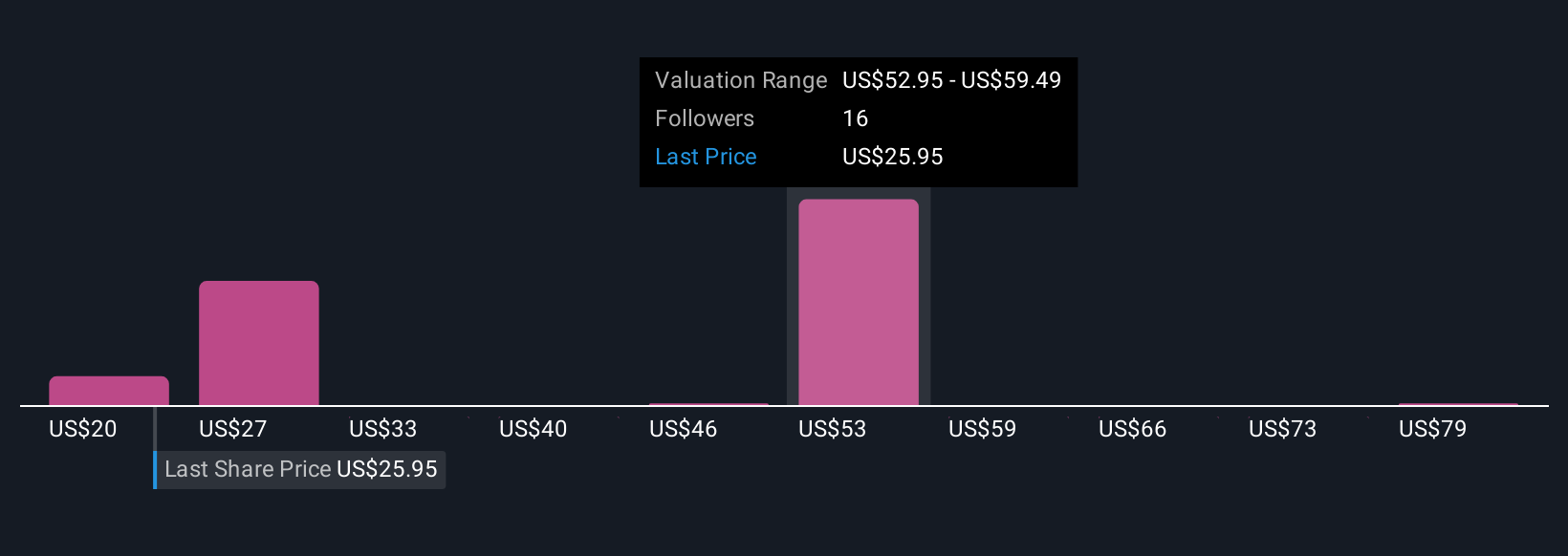

The Simply Wall St Community’s seven fair value estimates for Amentum stretch from US$20.24 to US$85.66, underscoring how differently individual investors are sizing up its prospects. Set that against a business that has only just turned profitable and still faces questions over interest coverage and execution on large, complex contracts, and you can see why opinions diverge so sharply. Exploring several of these viewpoints can help you judge whether recent earnings progress offsets those lingering risks.

Explore 7 other fair value estimates on Amentum Holdings - why the stock might be worth 31% less than the current price!

Build Your Own Amentum Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amentum Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Amentum Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amentum Holdings' overall financial health at a glance.

No Opportunity In Amentum Holdings?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMTM

Amentum Holdings

Engages in the provision of engineering and technology solutions in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion