- United States

- /

- Commercial Services

- /

- NYSE:ACVA

A Fresh Look at ACV Auctions (ACVA) Valuation Following Recent Share Price Moves

Reviewed by Simply Wall St

ACV Auctions (NYSE:ACVA) is drawing fresh attention after its recent share price moves, and investors are naturally wondering what the next chapter holds. While there is no major headline event driving the stock today, the company's trajectory over the past several months is enough to spark debate on whether this marks a turning point or continues the trend for shareholders evaluating their options.

Looking at the bigger picture, ACV Auctions has faced sustained pressure, with the share price down over 40% in the past year. This trend reflects both a challenging environment and some changes in how the market is assessing the company’s growth and risk profile. Given that context, questions about value have started to surface, especially as momentum has faded despite reported annual revenue growth topping 17%.

After this extended slide, is ACV Auctions at a bargain price, or is the market accounting for all of its future growth in the current valuation?

Most Popular Narrative: 43.2% Undervalued

The prevailing analyst narrative suggests that ACV Auctions is currently trading at a significant discount to its estimated fair value. According to this widely followed perspective, the company's future growth prospects are not fully accounted for in today's share price.

"Expanding partnerships with major dealer groups and scaling data-driven products like ClearCar and ACV MAX are creating deeper, high-value relationships and unique high-margin revenue streams (e.g., pricing as a service). This should boost recurring SaaS/data segment revenue and improve overall earnings quality."

Curious how analysts think ACV Auctions could soar from here? There is a bold vision driving this valuation that hinges on rapid platform expansion, sticky new services, and profit margins more in line with industry standouts. Wondering what aggressive growth forecasts might push the stock far higher and what assumptions support that price? Read on to uncover the numbers and trends that power this fair value call.

Result: Fair Value of $19.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as sluggish dealer volumes or delays in monetizing new ventures could quickly undermine these bullish expectations for ACV Auctions.

Find out about the key risks to this ACV Auctions narrative.Another View: A Multiples-Based Perspective

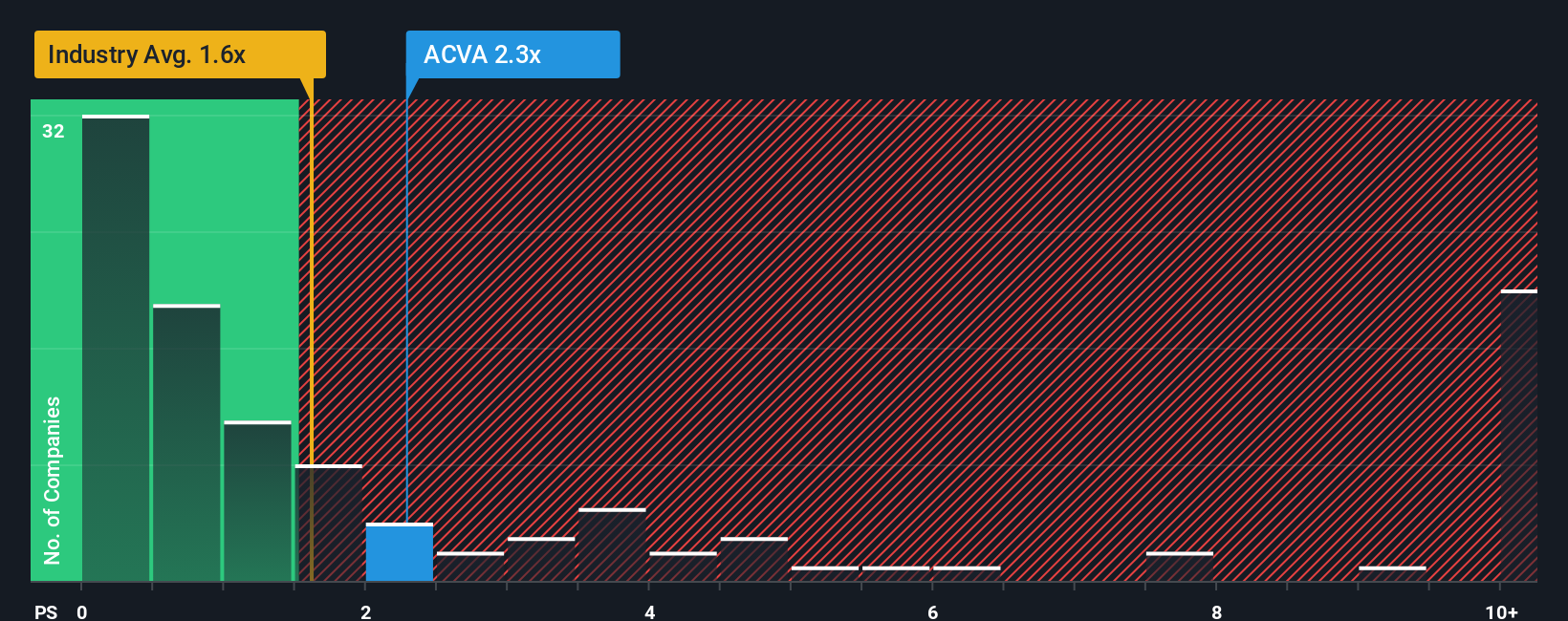

While some see ACV Auctions as undervalued, a look at its price-to-sales ratio tells a different story. Compared to the industry, ACV is priced higher, which suggests optimism may already be reflected. Which approach gets it right?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding ACV Auctions to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own ACV Auctions Narrative

If you see things differently or are inclined to dig into the numbers yourself, you can easily shape your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ACV Auctions.

Ready for More Smart Investment Options?

Make your next investment move count by tapping into untapped potential, rising technology, and resilient sectors. Don't miss your chance to uncover what others might overlook with these unique stock ideas:

- Snap up untapped value by hunting for stocks judged undervalued on future cash flows with our undervalued stocks based on cash flows.

- Boost your portfolio’s income by targeting shares offering substantial yields with our dividend stocks with yields > 3%.

- Position yourself at the forefront of technological progress by searching for opportunities in the next wave of healthcare innovation using our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ACVA

ACV Auctions

Provides a wholesale auction marketplace to facilitate business-to-business used vehicle sales between a selling and buying dealership.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)