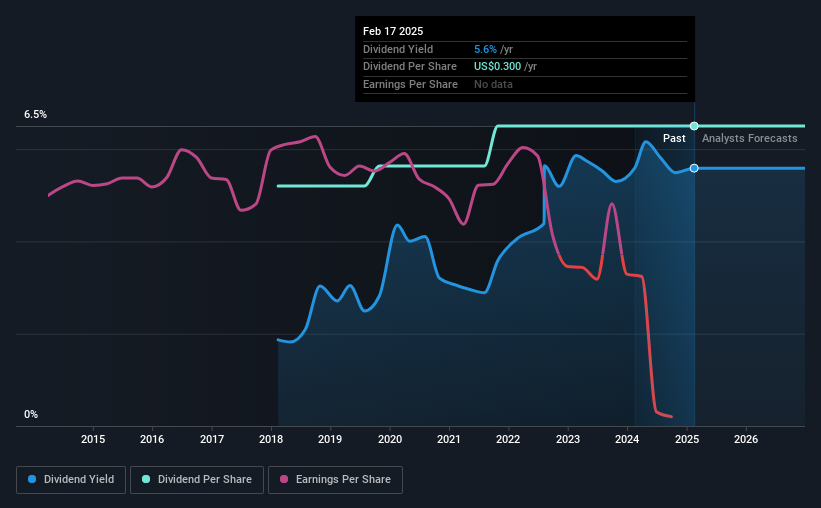

ACCO Brands Corporation's (NYSE:ACCO) investors are due to receive a payment of $0.075 per share on 26th of March. This makes the dividend yield 5.6%, which will augment investor returns quite nicely.

See our latest analysis for ACCO Brands

Estimates Indicate ACCO Brands' Dividend Coverage Likely To Improve

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. ACCO Brands is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Analysts expect a massive rise in earnings per share in the next year. If the dividend extends its recent trend, estimates say the dividend could reach 1.9%, which we would be comfortable to see continuing.

ACCO Brands Is Still Building Its Track Record

The dividend's track record has been pretty solid, but with only 7 years of history we want to see a few more years of history before making any solid conclusions. The dividend has gone from an annual total of $0.24 in 2018 to the most recent total annual payment of $0.30. This works out to be a compound annual growth rate (CAGR) of approximately 3.2% a year over that time. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Earnings per share has been sinking by 56% over the last five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. To that end, ACCO Brands has 2 warning signs (and 1 which is potentially serious) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ACCO

ACCO Brands

Designs, manufactures, and markets consumer, school, technology, and office products in the United States, Canada, Brazil, Mexico, Chile, Europe, the Middle East, Australia, New Zealand, and Asia.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives