- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

How Investors May Respond To Willdan Group (WLDN) Entering Massachusetts With National Grid Contract

Reviewed by Sasha Jovanovic

- Willdan Group, Inc. recently announced it has been selected by National Grid to deliver energy efficiency services to small businesses across Massachusetts under a two-year agreement, marking its entry into the Massachusetts market.

- This contract significantly extends Willdan's presence in the Northeast, reflecting tangible progress in expanding its geographic reach and client base.

- We’ll now explore how Willdan’s expanded Northeast footprint through National Grid may influence the broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Willdan Group Investment Narrative Recap

Shareholders in Willdan Group are typically those who believe in the sustained potential for energy infrastructure and decarbonization investment, as well as Willdan’s ability to secure recurring utility and municipal contracts. The recent National Grid contract, which establishes Willdan in Massachusetts, may support future revenue stability by expanding its utility client base in the Northeast, though it does not meaningfully reduce the business’s exposure to changes in government or utility energy efficiency funding, the company’s principal operational risk.

The most relevant recent announcement is Willdan’s five-year, US$330 million contract with the Los Angeles Department of Water and Power, reflecting strong traction in securing long-term utility-funded projects. Wins like this, together with the National Grid contract, reinforce the importance of large, recurring contracts as a catalyst for revenue visibility and earnings growth, an essential element underpinning investor confidence in the story.

By contrast, investors should be aware that Willdan’s heavy reliance on government and utility funding remains a key risk if energy efficiency priorities shift or budgets are reduced...

Read the full narrative on Willdan Group (it's free!)

Willdan Group's narrative projects $867.2 million revenue and $76.9 million earnings by 2028. This requires 11.3% yearly revenue growth and a $41.7 million increase in earnings from $35.2 million currently.

Uncover how Willdan Group's forecasts yield a $132.50 fair value, a 44% upside to its current price.

Exploring Other Perspectives

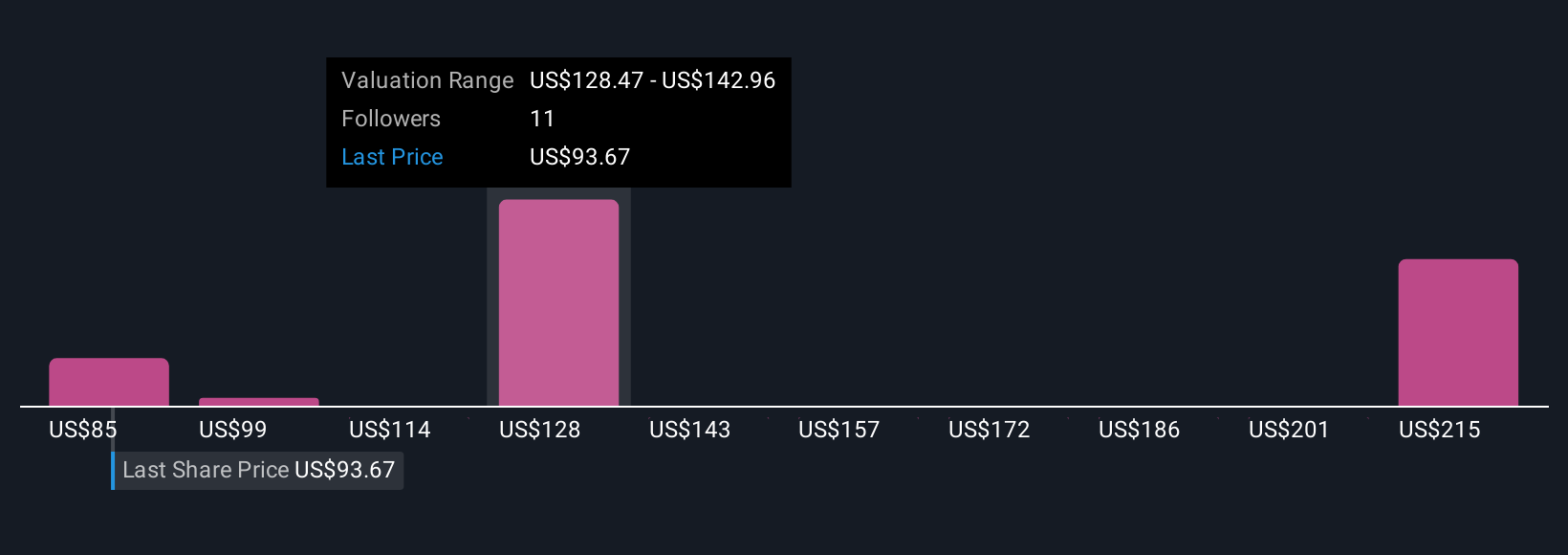

Community fair value estimates for Willdan Group range from US$85 to US$230, with input from four Simply Wall St Community contributors. While earnings growth is forecast to outpace the market, your viewpoint on future government or utility spending may shape your conclusions.

Explore 4 other fair value estimates on Willdan Group - why the stock might be worth 7% less than the current price!

Build Your Own Willdan Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Willdan Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willdan Group's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives