- United States

- /

- Professional Services

- /

- NasdaqGM:WLDN

A Fresh Look at Willdan Group (WLDN) Valuation After Securing National Grid Massachusetts Deal

Reviewed by Kshitija Bhandaru

Willdan Group (WLDN) has just landed a deal with National Grid to provide energy efficiency services for small businesses in Massachusetts. This partnership allows Willdan to enter a new market and expand its presence in the Northeast.

See our latest analysis for Willdan Group.

Willdan’s recent expansion into Massachusetts comes amid a year marked by powerful momentum. The stock has soared over 150% year-to-date, with a 115% total shareholder return in the past year and an eye-catching 647% gain over three years. While shares have cooled slightly after such rapid appreciation, that performance reflects shifting market sentiment about Willdan’s growth potential, especially as institutional investors continue to hold a commanding stake.

If you’re interested in finding similarly dynamic companies, this could be a great opportunity to broaden your search and explore fast growing stocks with high insider ownership

With such an extraordinary run behind it and analyst price targets implying further upside, investors must ask if Willdan is still a bargain or if all the future growth is already reflected in the current share price.

Most Popular Narrative: 28% Undervalued

Compared to the last close of $95.27, the most widely followed narrative values Willdan significantly higher, suggesting a notable gap between market sentiment and this consensus. The stage is set for a deeper exploration into the assumptions driving that bold estimate.

Strategic acquisitions that deepen technical capabilities and expand Willdan's geographic and sector footprint are accelerating organic growth through cross-selling and enabling entry into larger, more complex energy and infrastructure projects. This is driving both revenue and earnings expansion. Long-term and increasing utility and municipal contracts, typically 3-5 years in duration and funded through stable sources, are contributing to recurring revenue and improved earnings visibility. This reduces earnings volatility and supports higher net margins.

Think Willdan’s future is already priced in? The narrative hinges on game-changing growth drivers, ambitious margin targets, and high double-digit profit boosts that rival elite tech names. Crucial projections for revenue and profitability set the tone. If you want the forecast details that shape this bullish valuation, now’s your moment to peel back the curtain.

Result: Fair Value of $132.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in government policy or rising integration costs from acquisitions could quickly test these optimistic assumptions and reshape the growth story in the future.

Find out about the key risks to this Willdan Group narrative.

Another View: What About Multiples?

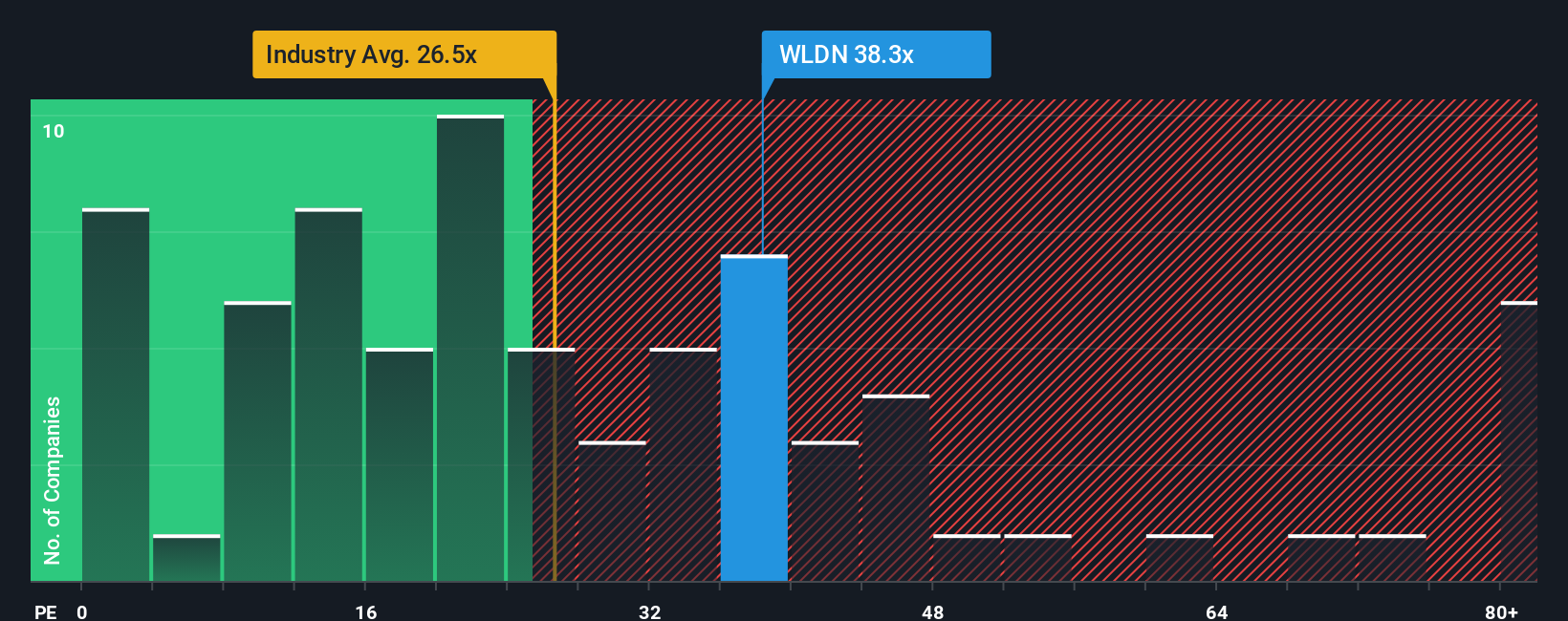

Step back from future earnings forecasts for a moment and consider how Willdan’s current price-to-earnings ratio stacks up. It trades at 39.7x, which is much higher than the US Professional Services industry average of 26.2x and also above peers at 30.7x. The fair ratio for the stock stands at 29.2x, a level the market could realistically revert to. This means that, despite all the growth optimism, Willdan carries a premium compared to its sector and what fundamentals might justify. Is this a mark of quality or a valuation risk waiting to unwind?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willdan Group Narrative

Have your own take or want to see the numbers firsthand? Shape your own perspective in just a few minutes: Do it your way

A great starting point for your Willdan Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Level up your strategy and stay ahead of market trends by checking out these hand-picked opportunities that can appeal to savvy investors seeking the next big mover.

- Capture high yields and consistent returns by targeting income plays through these 19 dividend stocks with yields > 3%.

- Tap into tomorrow’s breakthroughs with these 32 healthcare AI stocks and unlock innovation across medicine and AI-powered healthcare solutions.

- Jump on the future of finance with these 78 cryptocurrency and blockchain stocks and spot companies driving blockchain adoption and new digital currency models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willdan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WLDN

Willdan Group

Provides professional, technical, and consulting services primarily in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives