- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:VSEC

VSE Corporation (NASDAQ:VSEC) Stocks Shoot Up 37% But Its P/E Still Looks Reasonable

VSE Corporation (NASDAQ:VSEC) shareholders have had their patience rewarded with a 37% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 100% in the last year.

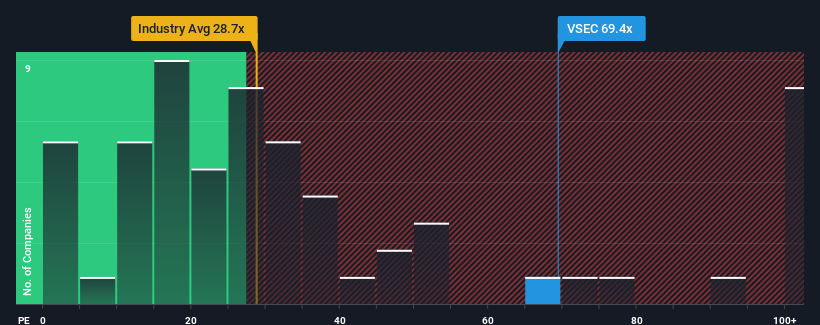

Since its price has surged higher, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider VSE as a stock to avoid entirely with its 69.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

VSE hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for VSE

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like VSE's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 187% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 45% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

In light of this, it's understandable that VSE's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Shares in VSE have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of VSE's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with VSE (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VSEC

VSE

Provides aviation aftermarket parts distribution and maintenance, repair, and overhaul services for air transportation assets for commercial and government markets.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives