- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

Verisk Analytics (VRSK): Evaluating Valuation Following Analyst Downgrades on AccuLynx Acquisition Concerns

Reviewed by Kshitija Bhandaru

Shares of Verisk Analytics (VRSK) dipped 4% after Rothschild & Co downgraded the stock, following a similar move by Evercore ISI Group. The changes come as Verisk finalizes its $2.35 billion AccuLynx acquisition.

See our latest analysis for Verisk Analytics.

Verisk’s share price has faced a rough patch lately, sliding 4% in the wake of recent analyst downgrades tied to the AccuLynx acquisition. While the company has rolled out innovative solutions, such as new tools for commercial property and pet health insurance along with an AI partnership with Jopari, these launches have not eased investor concerns about rising financial risk. Momentum has clearly faded in the short term, with a 22% share price decline over the last 90 days. However, when viewed over a longer period, Verisk’s total shareholder returns remain firmly positive over three and five years.

If you’re keeping an eye on fast-moving trends and want to widen your search, this is a great moment to discover fast growing stocks with high insider ownership.

This kind of volatility often prompts a debate. Does Verisk’s current downturn hint at an undervalued opportunity, or are recent challenges an indication that future growth is already factored into the price?

Most Popular Narrative: 22.5% Undervalued

According to the prevailing narrative, Verisk Analytics’ fair value is set at $299.82, which is over $67 above its last close. Analysts see strong drivers fueling this premium, despite some dampened momentum in the near term.

The company is committed to maintaining disciplined cost management, resulting in margin expansion and profit growth. The focus on efficiency could lead to improved net margins and increased earnings, supporting shareholder value through higher EBITDA margins.

What’s the catalyst for this punchy valuation? Behind the scenes, analysts are banking on rising revenue and margins, powering higher future profits than many would expect. Want to know exactly what hinges on these expectations, and what projection is driving consensus? Discover the surprising quantitative leap in the full narrative.

Result: Fair Value of $299.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Persistent inflation and regulatory changes could pressure Verisk’s future revenues and margins, challenging the bullish outlook.

Find out about the key risks to this Verisk Analytics narrative.

Another View: Market Pricing Signals Caution

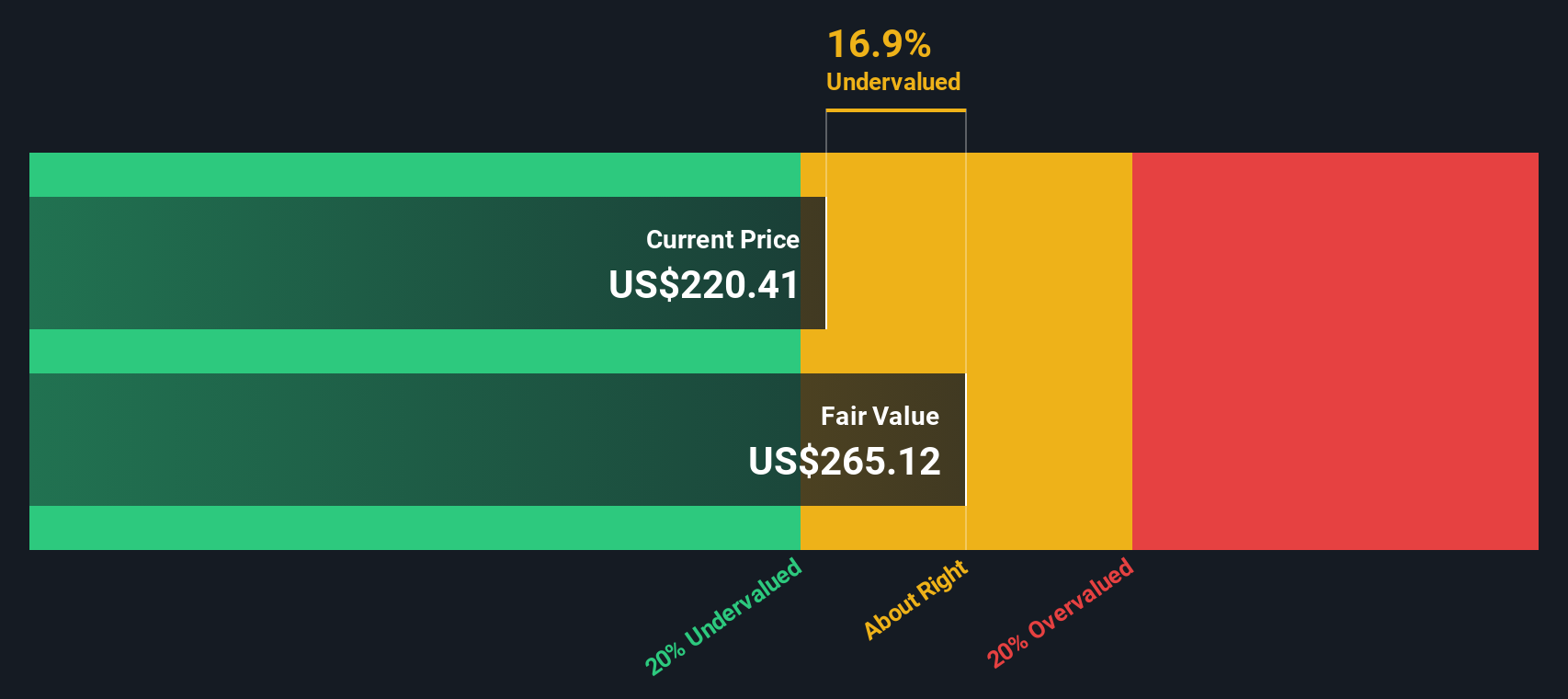

While analysts argue that Verisk is undervalued based on future growth, our DCF model comes to a conflicting conclusion. According to the SWS DCF model, the shares currently trade above their estimated fair value, suggesting the stock may be overvalued at these levels. Which narrative best captures reality: the optimistic growth story or a sober look at intrinsic value?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Verisk Analytics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Verisk Analytics Narrative

If you want to dig deeper or put your own spin on the story, you can uncover your own insights in just a few minutes. Do it your way.

A great starting point for your Verisk Analytics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock smarter investing by tapping into handpicked stock ideas you might be missing. The latest themes can help you stay a step ahead of the market.

- Boost your long-term returns with reliable income by tapping into these 18 dividend stocks with yields > 3% offering attractive yields above 3%.

- Get ahead of the curve and uncover emerging giants leading the AI game by checking out these 24 AI penny stocks.

- Stay sharp and spot overlooked bargains by searching through these 871 undervalued stocks based on cash flows priced below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives