- United States

- /

- Professional Services

- /

- NasdaqGS:VRSK

Are Verisk Analytics's (NASDAQ:VRSK) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Verisk Analytics (NASDAQ:VRSK).

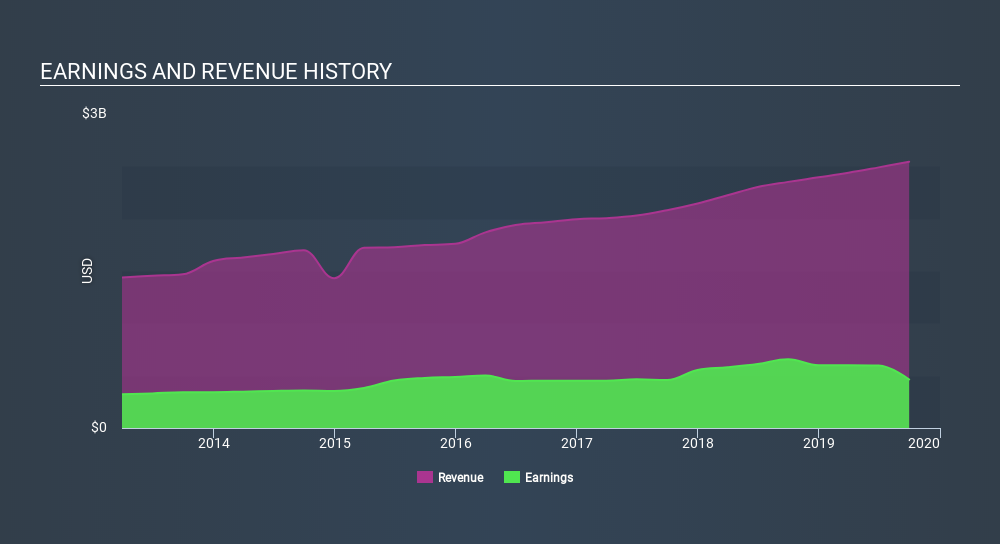

We like the fact that Verisk Analytics made a profit of US$463.9m on its revenue of US$2.54b, in the last year. Happily, it has grown both its profit and revenue over the last three years (though we note its profit is down over the last year).

View our latest analysis for Verisk Analytics

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will focus on the impact unusual items have had on Verisk Analytics's statutory earnings. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

To properly understand Verisk Analytics's profit results, we need to consider the US$132m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect Verisk Analytics to produce a higher profit next year, all else being equal.

Our Take On Verisk Analytics's Profit Performance

Because unusual items detracted from Verisk Analytics's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Because of this, we think Verisk Analytics's earnings potential is at least as good as it seems, and maybe even better! And on top of that, its earnings per share have grown at 5.7% per year over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. While it's really important to consider how well a company's statutory earnings represent its true earnings power, it's also worth taking a look at what analysts are forecasting for the future. So feel free to check out our free graph representing analyst forecasts.

This note has only looked at a single factor that sheds light on the nature of Verisk Analytics's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:VRSK

Verisk Analytics

Engages in the provision of data analytics and technology solutions to the insurance industry in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives