- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

Verra Mobility (VRRM): Analyzing Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

See our latest analysis for Verra Mobility.

Although Verra Mobility’s share price has struggled to gain traction lately, with recent weakness following a modest drop, the bigger picture reveals momentum has faded after a long period of strong growth. While the 1-year total shareholder return is down about 11%, returns over three and five years remain solidly positive. These are clear signs that long-term investors have been rewarded even as near-term sentiment has cooled and the market waits for the next catalyst.

If you’re weighing your next move, now is a perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With Verra Mobility’s shares trading below analyst price targets and at a notable discount to intrinsic value, the question stands: Is this a window for buyers, or has the market already factored in the company’s future growth prospects?

Most Popular Narrative: 18.5% Undervalued

Based on the most popular narrative, Verra Mobility's fair value estimate is notably higher than its last close price of $23.77. This sets up a striking contrast between what the market currently prices in and the growth analysts expect. This gap puts the spotlight on the drivers that could unlock further upside if even part of the narrative's projections are realized.

Demand for automated enforcement solutions is accelerating, with $60M in new annual recurring revenue contracted over the past year, high win rates in competitive bids, and continued expansion into cities adopting new traffic safety programs. This supports predictable, high-margin, SaaS-like service revenue and long-term earnings growth.

Curious what explosive revenue tailwinds and aggressive margin forecasts are building into this bullish fair value? The narrative leans on future recurring revenues, high-margin contracts, and a winning formula for market expansion. Something big is hiding in the assumptions. Discover the strategic numbers, not just the story, by reading on.

Result: Fair Value of $29.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer churn or unexpected delays in major contract renewals could quickly undermine the bullish narrative built around Verra Mobility’s growth outlook.

Find out about the key risks to this Verra Mobility narrative.

Another Perspective: A High Market Premium

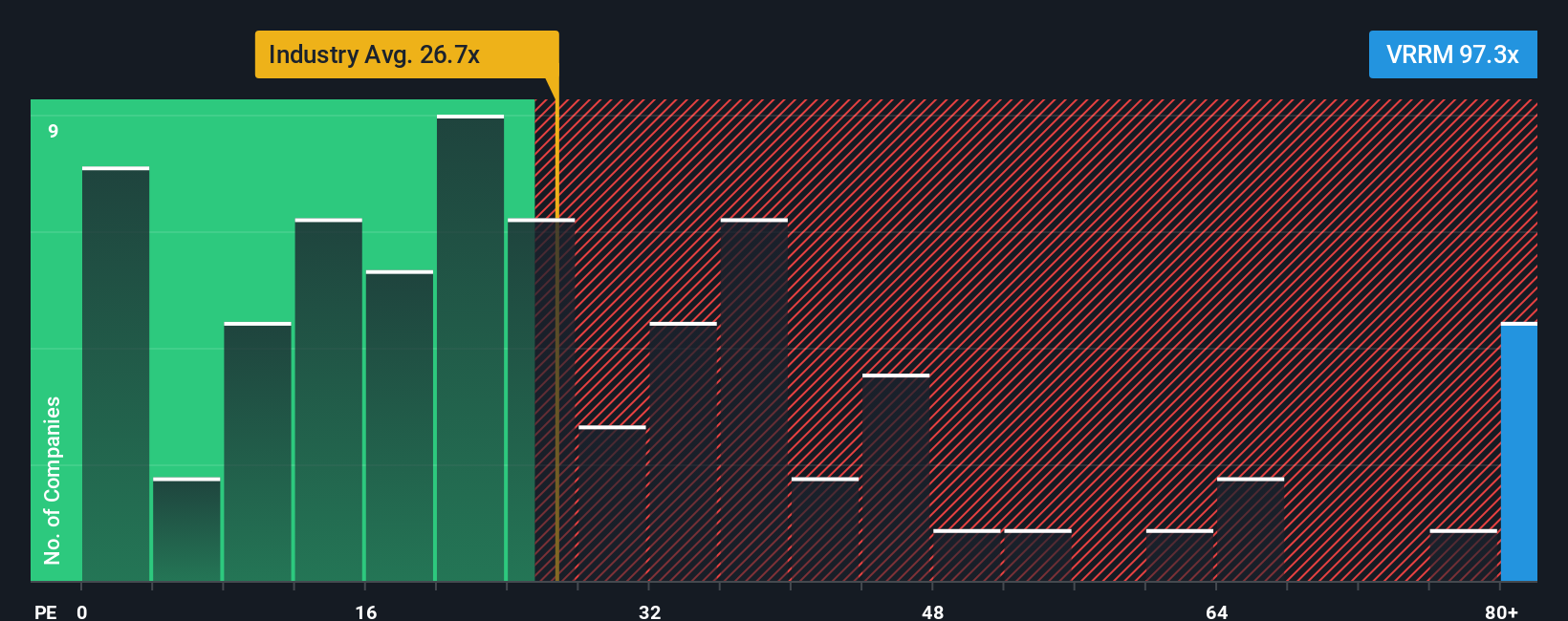

But looking at Verra Mobility through the lens of price-to-earnings, a different story emerges. The company trades at a lofty 97.3 times earnings, much higher than the industry average of 26.7 and ahead of the fair ratio of 42.4. This premium could mean investors are paying up for expected growth. The question remains whether the optimism is justified or if the market is getting ahead of itself.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Verra Mobility Narrative

If these perspectives do not align with your views or you prefer digging into the numbers yourself, you can craft your own Verra Mobility thesis in just minutes: Do it your way.

A great starting point for your Verra Mobility research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while others capitalize on the next big trend. Find your edge with these powerful, hand-picked opportunities right now:

- Turbocharge your portfolio with consistent income by targeting overlooked opportunities among these 19 dividend stocks with yields > 3%, which offer yields above 3%.

- Spot breakthrough technology early and stay ahead of the curve with these 24 AI penny stocks, which are at the forefront of artificial intelligence innovation.

- Capture the market’s most promising value plays by acting on these 902 undervalued stocks based on cash flows, which are trading below their intrinsic cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026