- United States

- /

- Professional Services

- /

- NasdaqCM:VRRM

How Investors Are Reacting To Verra Mobility (VRRM) Expanding AI School Bus Safety Program and Reporting Fewer Repeat Offenses

Reviewed by Sasha Jovanovic

- Verra Mobility recently marked National School Bus Safety Week by distributing a free toolkit to promote safe school transportation and highlighting its AI-enabled school bus stop arm program, which uses video evidence to assist law enforcement in reducing illegal bus passing incidents.

- A unique insight is that the company reported a very high rate of non-reoffense among cited drivers and significant year-over-year citation reductions, reflecting measurable progress in community safety outcomes as its technology expands to thousands of school buses nationwide.

- We'll explore how the expansion of Verra Mobility's AI-driven school bus safety technology may enhance its long-term earnings predictability and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Verra Mobility Investment Narrative Recap

To believe in Verra Mobility as a shareholder is to have conviction in the company’s ability to expand its technology-driven transportation safety solutions, translating legislation and public-private partnerships into recurring, higher-margin service revenues. The recent news highlighting the AI-enabled school bus stop arm program and substantial citation reductions is promising for public safety outcomes, but does not directly impact the most pressing near-term catalyst, the successful renewal of key government contracts, particularly with New York City, nor does it materially lessen the concentration risk that remains central to the stock’s outlook.

Of the recent announcements, the July rollout of an advanced speed safety program in San Francisco stands out as relevant in the context of the company’s efforts to expand automated enforcement, current market catalysts, and capitalize on legislative tailwinds. Both the school bus and speed safety technology initiatives show Verra Mobility’s continued execution on growth opportunities created by new regulations, even as the timeline for margin expansion in these segments remains affected by upfront investment and program ramp-up costs.

Yet, despite this technological momentum, investors should be aware that any delay or unfavorable resolution in the New York City government contract renewal could present a near-term revenue and margin shock...

Read the full narrative on Verra Mobility (it's free!)

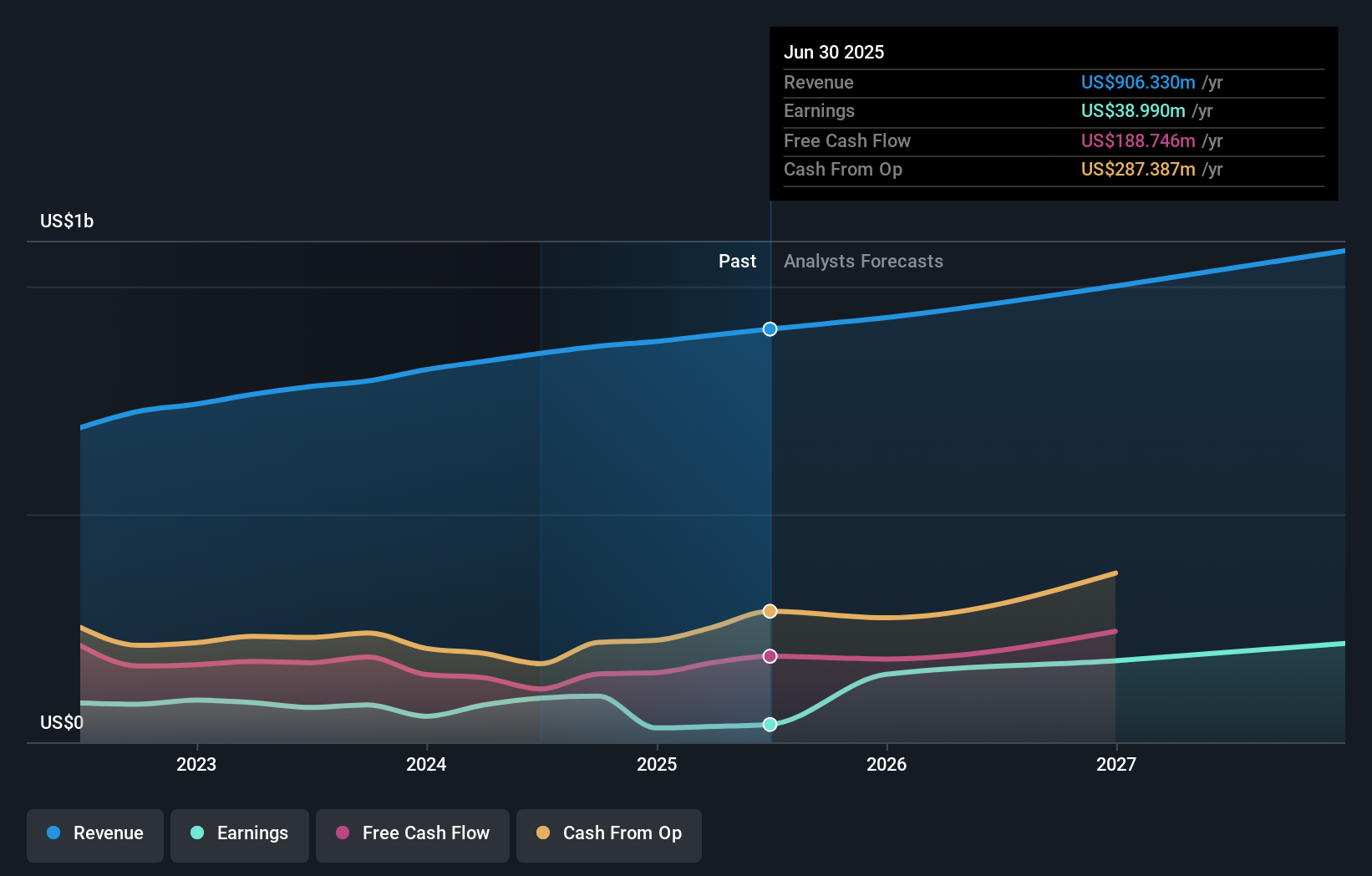

Verra Mobility's narrative projects $1.1 billion in revenue and $289.5 million in earnings by 2028. This requires 7.0% yearly revenue growth and a $250.5 million increase in earnings from the current $39.0 million.

Uncover how Verra Mobility's forecasts yield a $29.17 fair value, a 19% upside to its current price.

Exploring Other Perspectives

All 1 fair value estimate in the Simply Wall St Community points to a US$29.17 target. However, future returns could be affected if concentration risk in government contracts weighs on results, so consider exploring alternative viewpoints within the community.

Explore another fair value estimate on Verra Mobility - why the stock might be worth as much as 19% more than the current price!

Build Your Own Verra Mobility Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Verra Mobility research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Verra Mobility research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Verra Mobility's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VRRM

Verra Mobility

Provides smart mobility technology solutions in the United States, Australia, Europe, and Canada.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives