- United States

- /

- Commercial Services

- /

- NasdaqGM:VIRC

Cautious Investors Not Rewarding Virco Mfg. Corporation's (NASDAQ:VIRC) Performance Completely

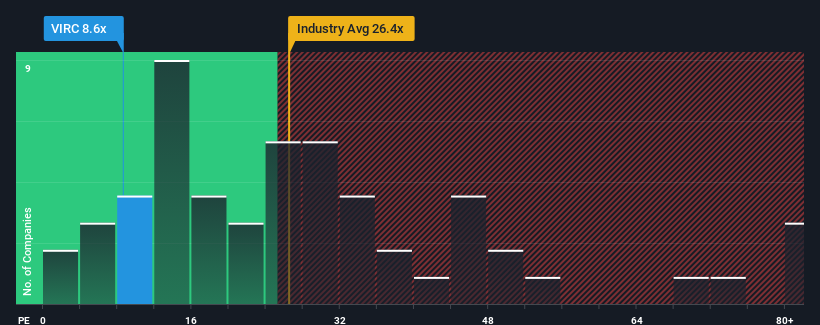

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 18x, you may consider Virco Mfg. Corporation (NASDAQ:VIRC) as an attractive investment with its 8.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Virco Mfg certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Virco Mfg

Is There Any Growth For Virco Mfg?

In order to justify its P/E ratio, Virco Mfg would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 31% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 19% as estimated by the only analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 13%, which is noticeably less attractive.

In light of this, it's peculiar that Virco Mfg's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Virco Mfg's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Virco Mfg's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Virco Mfg with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:VIRC

Virco Mfg

Engages in the design, production, and distribution of furniture in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives