- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

Should Upwork’s (UPWK) Profitability Gains Shift Investor Focus Away From Slower Revenue Growth?

Reviewed by Sasha Jovanovic

- Upwork Inc. recently announced that it will report its third quarter 2025 financial results on November 3, 2025, after market close, alongside a live Q&A conference call with management and a webcast available for investors.

- The company has reported significant improvement in profitability, with adjusted EBITDA margins rising sharply and its enterprise and AI-driven strategies positioning it for greater operational efficiency and future expansion, despite experiencing a temporary slowdown in revenue growth.

- We'll look at how Upwork's expanded profitability and margin growth could reshape expectations for its ongoing investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Upwork Investment Narrative Recap

Investors in Upwork need to believe in the company’s ability to expand margins and drive sustainable profitability, particularly as it pivots toward enterprise and AI-driven growth while handling slower revenue momentum. The recent announcement about the upcoming earnings report aligns with regular disclosure practices and does not materially affect the key short-term catalyst: successful enterprise adoption, nor the major risk, which remains exposure to fluctuating client budgets and uncertain macro conditions.

Among recent announcements, the launch of Lifted, the new subsidiary focused on serving enterprise clients, is especially relevant. As Upwork intensifies its push into larger-scale contracts, the performance of Lifted will be closely watched as a bellwether for progress on its enterprise and operational efficiency goals.

However, despite surging profitability, a key factor investors should be aware of is that larger enterprise contracts also mean greater exposure to…

Read the full narrative on Upwork (it's free!)

Upwork's outlook projects $906.3 million in revenue and $147.8 million in earnings by 2028. This assumes a 5.5% annual revenue growth rate but a decline in earnings, falling by $97.6 million from the current $245.4 million.

Uncover how Upwork's forecasts yield a $19.90 fair value, a 24% upside to its current price.

Exploring Other Perspectives

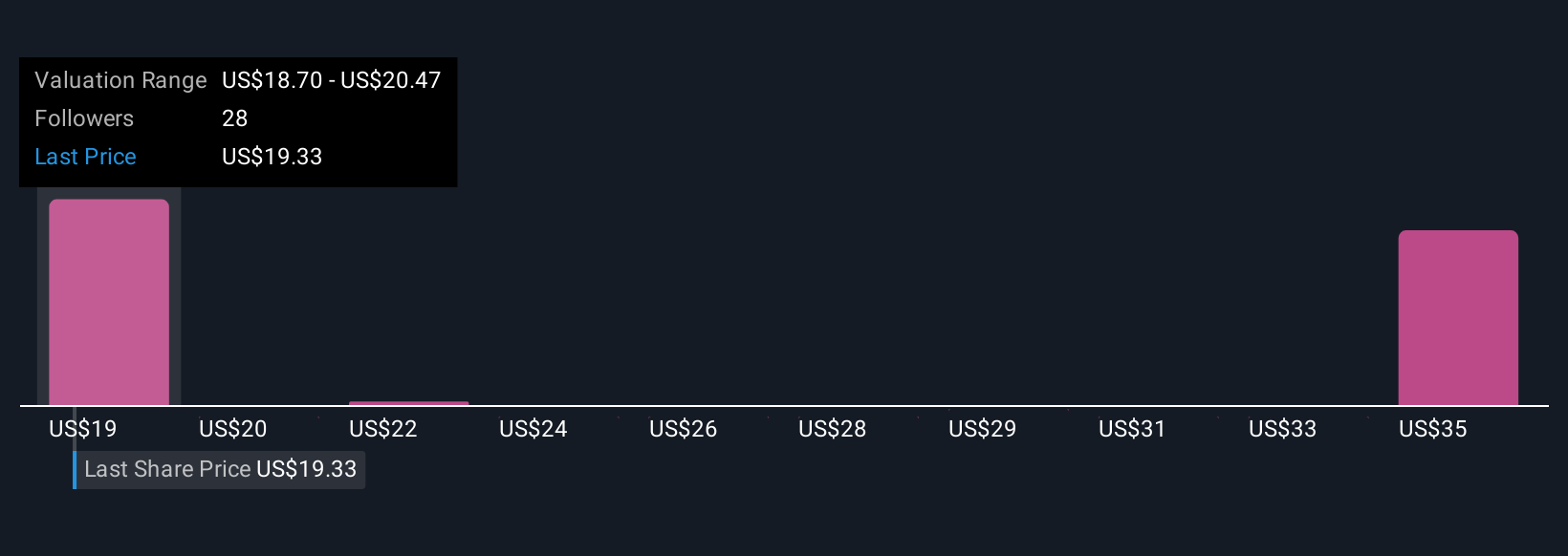

Four fair value estimates from the Simply Wall St Community range from US$19.90 to US$36.37 per share, showing substantial differences in expectations. While many cite Upwork's enterprise initiatives as a driver for optimism, risks from economic pressures and client spending could weigh on sentiment and future results, explore how your outlook compares.

Explore 4 other fair value estimates on Upwork - why the stock might be worth just $19.90!

Build Your Own Upwork Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upwork research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Upwork research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upwork's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives