- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

How will Upwork (NASDAQ:UPWK) Fare Against a New Major Player in the Work Marketplace

Key takeaways:

- Upwork's market share is threatened by LinkedIn Services, which has a similar offering but with a much larger reach.

- While Upwork has been innovative in the space, the company needs to build up proprietary barriers to entry, else it risks disruption.

- The company is still in a high growth phase, but needs to prove that the 2021 acceleration will stick as things normalize.

Upwork Inc. (NASDAQ:UPWK) had a pretty rough 12 months as the stock dropped 62.7% along with other tech growth stocks. Ever since Microsoft (NASDAQ:MSFT) launched LinkedIn Services, investors have become increasingly aware of the new competitor in the work marketplace. Today, we are going to analyze the differences between both products, and look at key performance fundamentals for Upwork.

See our latest analysis for Upwork

We will start by revisiting the financial performance of Upwork, as it will give us a better sense of the scale between the two competitors.

Fundamentals

Upwork is a US$2.3b market cap work marketplace. The company connects freelancers to businesses that need external services, often including: development, design, sales, writing, etc. The gross service value in 2021 was US$3.3b in 2021, which translated to US$503m in revenue.

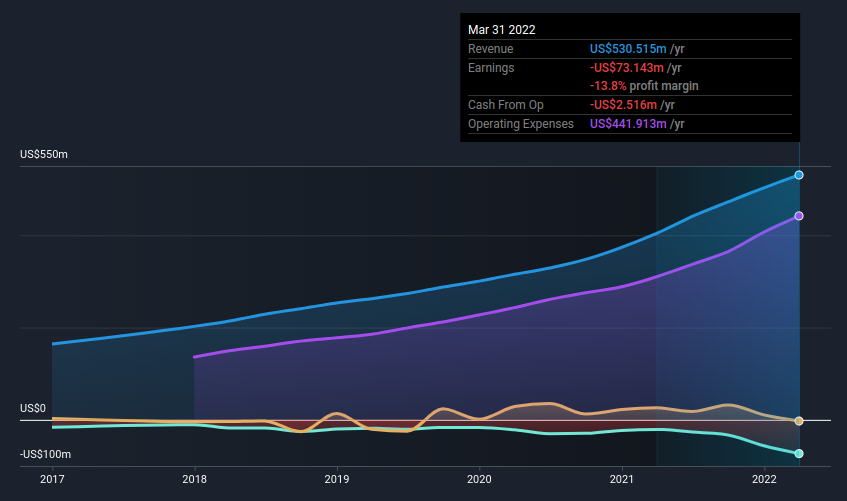

Upwork has outlined a growth plan, and expects to focus on brand marketing, client acquisition/retention and a general improvement of the service. In later stages, it envisions an expansion of the take rate, and our chart reveals why that is important for investors:

The most important thing to note from the chart above is that contrary to what one would expect from a software company, Upwork doesn't scale well, as operating expenses are growing along with revenue. This could be part of management's growth spending, but eventually investors are going to need to see costs go down and profit take hold.

While the company is unprofitable, it is not in any financial risk as it has a US$673m cash balance, and cash flows are disciplined around 0.

We will also notice that the company picked up growth during the pandemic as people switched to working online, however the key moment now is to see if that trend sticks or will growth subside to previous levels.

The New Competitor

Microsoft has been present in the HR landscape since the acquisition of LinkedIn, however some 6 months ago the company quietly launched LinkedIn services - a logical step forward, that connects the 800 million users to freelance services.

The company will leverage the existing HR infrastructure and access to companies to provide a superior marketplace.

For Upwork, this means that they need to build up competitive advantages and differentiate faster. Currently, LinkedIn marketplace does not offer work tracking and a payment solution like Upwork, so the company is still in a good relative position.

Conclusion

Upwork saw an increased growth on the back of the pandemic, but the company is not scaling expenses well, as it is still investing in expansion. Management has a disciplined approach to spending and the company is keeping cash flows around 0 with a strong cash reserve.

Microsoft has recently entered the work marketplace, which will make business tighter for smaller companies that do not have the reach and infrastructure of the new competitor. Upwork has made significant innovative strides in the freelance business, however the company needs to build up more competitive barriers to entry, else investors may feel uneasy about the future of the business.

With that in mind, we wouldn't be too quick to come to a conclusion on Upwork. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Upwork analysts - going out to 2024, and you can see them free on our platform here.

Before you take the next step you should know about the 3 warning signs for Upwork that we have uncovered.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives