- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

How Upwork’s US$100 Million Buyback Plan May Shape the Outlook for UPWK Investors

Reviewed by Simply Wall St

- Earlier this month, Upwork Inc. announced that its Board of Directors authorized a share repurchase program allowing the company to buy back up to US$100 million of its own stock, with no set expiration date.

- This share buyback gives Upwork flexibility to manage its capital structure and may reflect management’s belief in the company’s long-term value.

- In light of Upwork’s newly announced US$100 million share repurchase plan, we’ll explore how this capital allocation could influence the broader investment narrative.

This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

Upwork Investment Narrative Recap

To be an Upwork shareholder, you need to believe that the ongoing shift to flexible work and continued digitalization will drive sustained transaction growth, particularly through AI-powered innovations and expansion into enterprise clients. The recent US$100 million buyback program can signal confidence and may support the share price, but should not materially alter the fact that the crucial near-term catalyst remains Upwork’s ability to accelerate new client acquisition, while the biggest risk is persistent macro uncertainty limiting that growth.

Among the company’s recent announcements, the launch of its enterprise-focused subsidiary "Lifted" is both timely and relevant. This move aims to strengthen Upwork’s position among large organizations by streamlining talent sourcing and workforce management, building on recent acquisitions, and aligns directly with the company’s focus on long-term growth catalysts such as scaling enterprise adoption and increasing overall gross services volume.

By contrast, investors should also be aware that ongoing macroeconomic unpredictability could...

Read the full narrative on Upwork (it's free!)

Upwork's narrative projects $906.3 million revenue and $147.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $97.6 million decrease in earnings from $245.4 million today.

Uncover how Upwork's forecasts yield a $18.70 fair value, a 11% upside to its current price.

Exploring Other Perspectives

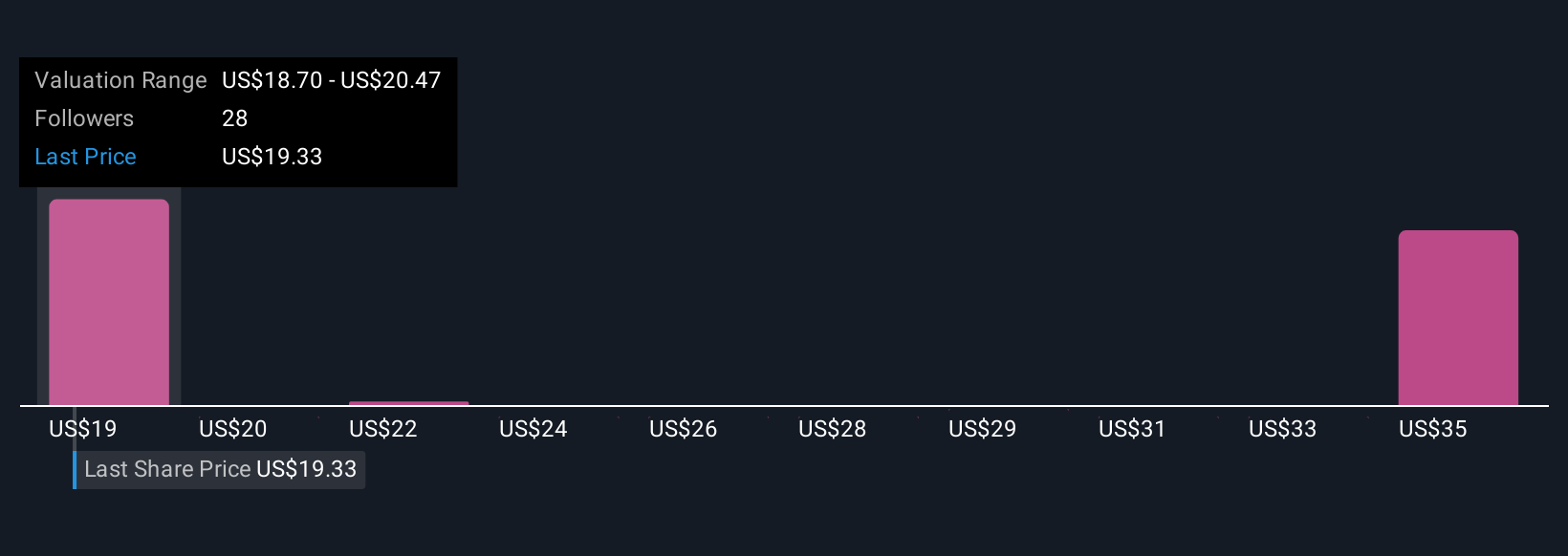

Five estimates from the Simply Wall St Community place Upwork’s fair value between US$18.70 and US$36.11. With macro uncertainty still challenging active client growth, you can explore how differing outlooks shape expectations for the company’s next moves.

Explore 5 other fair value estimates on Upwork - why the stock might be worth just $18.70!

Build Your Own Upwork Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upwork research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Upwork research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upwork's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives