- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

What SS&C Technologies Holdings (SSNC)'s Expanded Voss Mandate and Dublin Push Means For Shareholders

Reviewed by Sasha Jovanovic

- SS&C Technologies Holdings recently expanded its relationship with Houston-based Voss Capital, which selected SS&C GlobeOp as fund administrator for two funds with US$375 million in assets and its separately managed accounts, while the firm also grew its European wealth footprint through a MiFID-authorized Dublin wealth services entity and maintained its quarterly US$0.27 per-share dividend.

- These developments highlight SS&C’s push to win more alternative asset manager mandates and deepen its pan-European wealth management platform, reinforcing the breadth and scalability of its technology-enabled services model.

- We’ll now examine how SS&C’s MiFID-authorized Dublin expansion could influence its previously outlined investment narrative and growth assumptions.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

SS&C Technologies Holdings Investment Narrative Recap

To own SS&C, you generally need to believe its software and outsourcing model can keep attracting complex financial institutions, particularly in alternatives and wealth, while managing its sizeable debt load. The Voss Capital win and MiFID-authorized Dublin expansion support the near term catalyst around building GlobeOp and wealth mandates, but they do not materially change the key risk that higher interest rates could pressure earnings and cash flow.

The most relevant update here is the launch of SS&C Wealth Services Europe in Dublin under a MiFID license, which directly ties into the company’s push to build a pan European wealth and alternatives footprint. This move complements its GlobeOp growth efforts and supports the broader catalyst that technology enabled services, including AI driven automation, could gradually enhance efficiency across its expanding international client base.

Yet despite this growth opportunity, investors should still be aware that SS&C’s US$6.4 billion net debt could become more challenging if...

Read the full narrative on SS&C Technologies Holdings (it's free!)

SS&C Technologies Holdings' narrative projects $7.0 billion revenue and $1.2 billion earnings by 2028. This requires 4.8% yearly revenue growth and about a $400 million earnings increase from $806.4 million today.

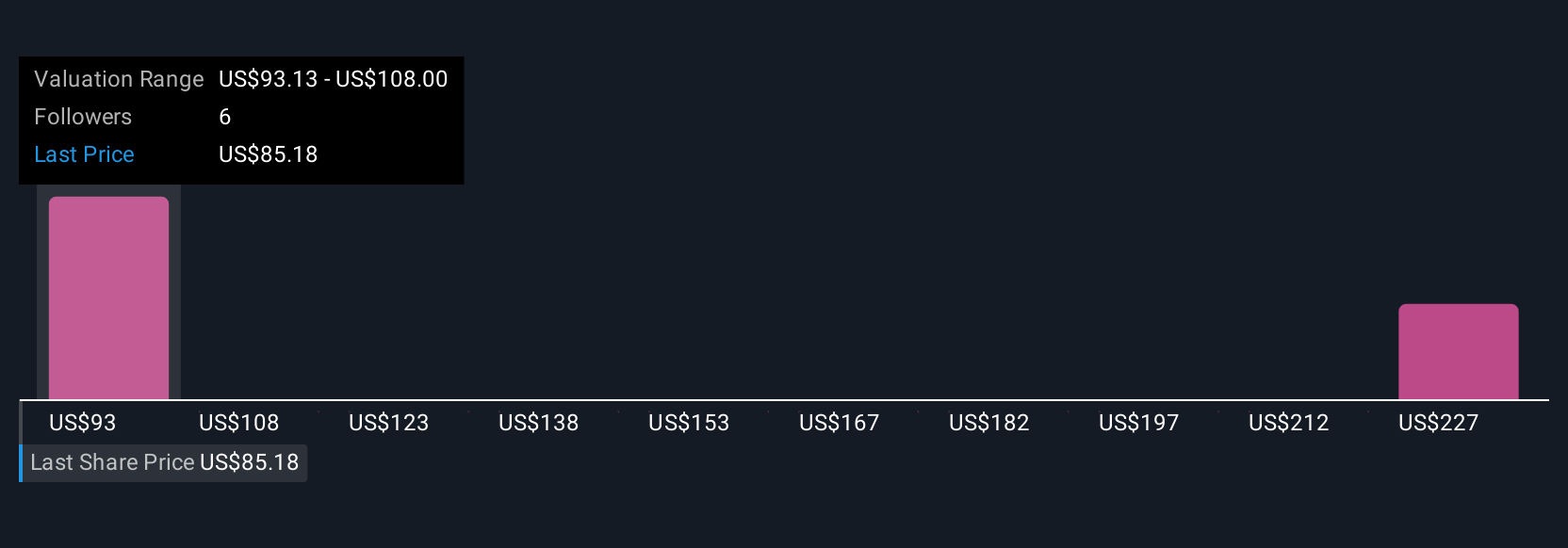

Uncover how SS&C Technologies Holdings' forecasts yield a $101.22 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for SS&C span roughly US$97 to US$158 per share, underlining how far apart individual views can be. You can weigh these against the growth catalyst in alternatives and European wealth services, which could be influential for how the company performs over time.

Explore 3 other fair value estimates on SS&C Technologies Holdings - why the stock might be worth just $97.04!

Build Your Own SS&C Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SS&C Technologies Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SS&C Technologies Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SS&C Technologies Holdings' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026