- United States

- /

- Professional Services

- /

- NasdaqGS:SSNC

Investors Interested In SS&C Technologies Holdings, Inc.'s (NASDAQ:SSNC) Earnings

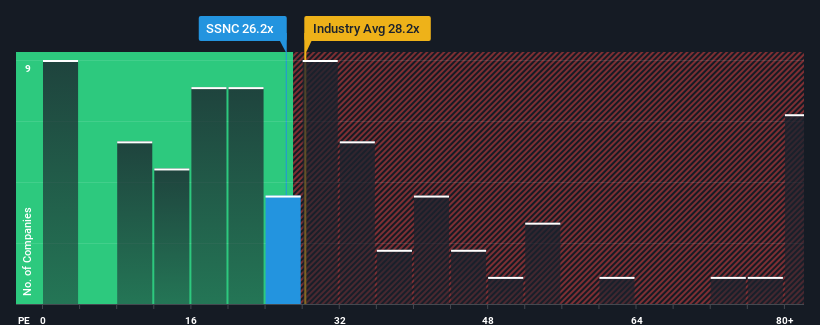

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may consider SS&C Technologies Holdings, Inc. (NASDAQ:SSNC) as a stock to potentially avoid with its 26.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

SS&C Technologies Holdings certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for SS&C Technologies Holdings

How Is SS&C Technologies Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as SS&C Technologies Holdings' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 14% each year over the next three years. With the market only predicted to deliver 10% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that SS&C Technologies Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From SS&C Technologies Holdings' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of SS&C Technologies Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for SS&C Technologies Holdings (1 is a bit concerning!) that you should be aware of.

If you're unsure about the strength of SS&C Technologies Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SSNC

SS&C Technologies Holdings

Provides software products and software-enabled services to financial services and healthcare industries.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives