- United States

- /

- Professional Services

- /

- NasdaqCM:EPOW

Global Internet of People's (NASDAQ:SDH) Solid Earnings May Rest On Weak Foundations

The recent earnings posted by Global Internet of People, Inc. (NASDAQ:SDH) were solid, but the stock didn't move as much as we expected. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

See our latest analysis for Global Internet of People

A Closer Look At Global Internet of People's Earnings

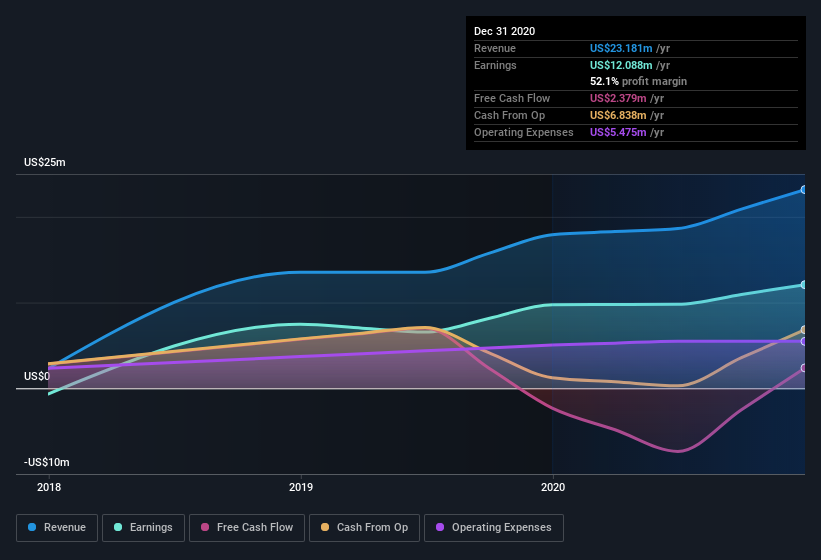

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to December 2020, Global Internet of People had an accrual ratio of 0.57. Ergo, its free cash flow is significantly weaker than its profit. Statistically speaking, that's a real negative for future earnings. To wit, it produced free cash flow of US$2.4m during the period, falling well short of its reported profit of US$12.1m. Notably, Global Internet of People had negative free cash flow last year, so the US$2.4m it produced this year was a welcome improvement.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Global Internet of People.

Our Take On Global Internet of People's Profit Performance

As we have made quite clear, we're a bit worried that Global Internet of People didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that Global Internet of People's underlying earnings power is lower than its statutory profit. The good news is that, its earnings per share increased by 24% in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. To help with this, we've discovered 3 warning signs (1 shouldn't be ignored!) that you ought to be aware of before buying any shares in Global Internet of People.

This note has only looked at a single factor that sheds light on the nature of Global Internet of People's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Global Internet of People, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:EPOW

Sunrise New Energy

Engages in the manufacture and sale of graphite anode material for EVs and other lithium-ion batteries.

Slightly overvalued very low.

Similar Companies

Market Insights

Community Narratives