- United States

- /

- Professional Services

- /

- NasdaqGS:RGP

We Think Shareholders May Want To Consider A Review Of Resources Connection, Inc.'s (NASDAQ:RGP) CEO Compensation Package

Key Insights

- Resources Connection's Annual General Meeting to take place on 16th of October

- Total pay for CEO Kate Duchene includes US$825.0k salary

- The total compensation is 44% higher than the average for the industry

- Over the past three years, Resources Connection's EPS fell by 114% and over the past three years, the total loss to shareholders 67%

The results at Resources Connection, Inc. (NASDAQ:RGP) have been quite disappointing recently and CEO Kate Duchene bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 16th of October. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Resources Connection

Comparing Resources Connection, Inc.'s CEO Compensation With The Industry

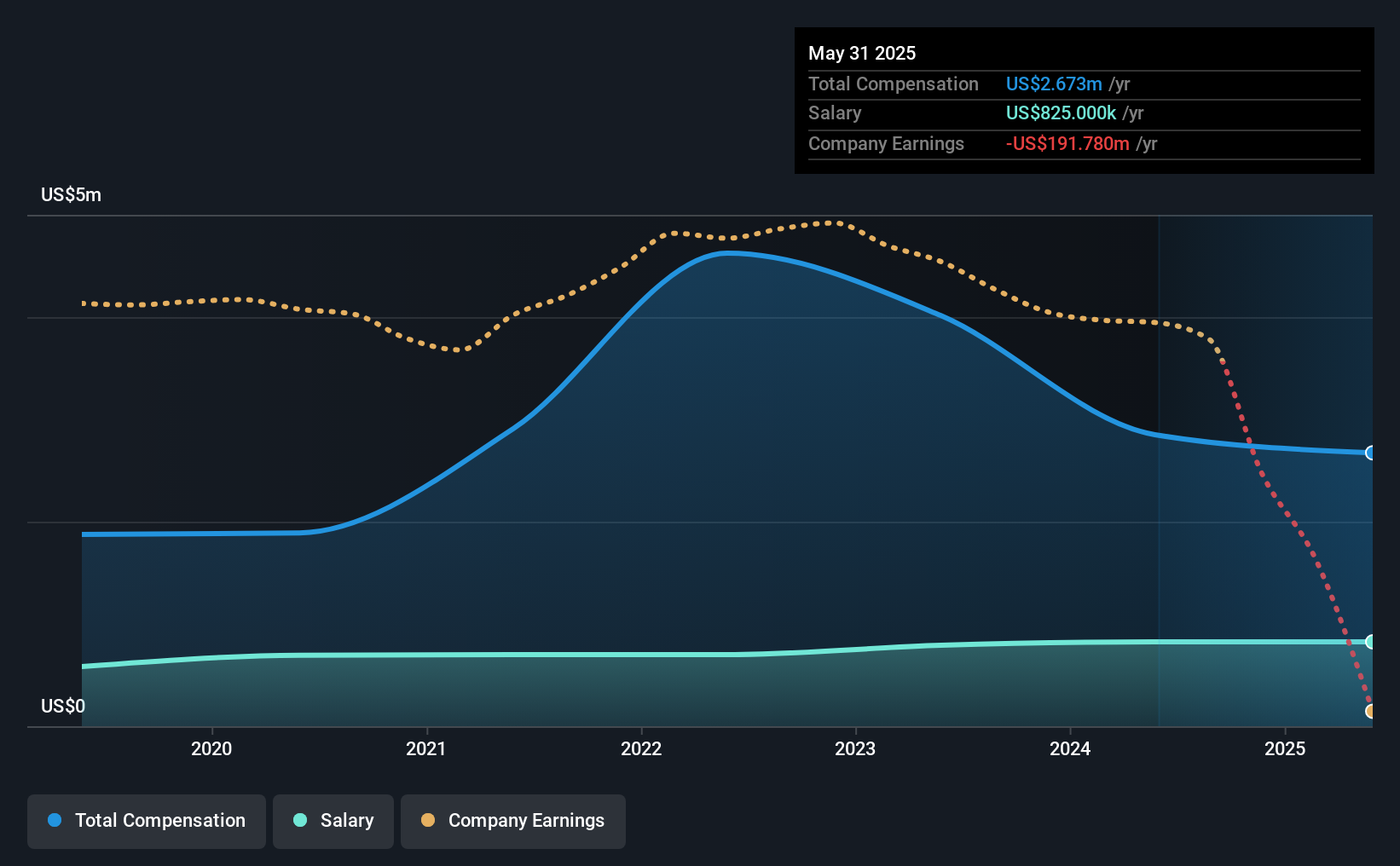

At the time of writing, our data shows that Resources Connection, Inc. has a market capitalization of US$162m, and reported total annual CEO compensation of US$2.7m for the year to May 2025. That's a slight decrease of 6.2% on the prior year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$825k.

On comparing similar companies from the American Professional Services industry with market caps ranging from US$100m to US$400m, we found that the median CEO total compensation was US$1.9m. This suggests that Kate Duchene is paid more than the median for the industry. Moreover, Kate Duchene also holds US$1.6m worth of Resources Connection stock directly under their own name.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$825k | US$825k | 31% |

| Other | US$1.8m | US$2.0m | 69% |

| Total Compensation | US$2.7m | US$2.9m | 100% |

Talking in terms of the industry, salary represented approximately 11% of total compensation out of all the companies we analyzed, while other remuneration made up 89% of the pie. According to our research, Resources Connection has allocated a higher percentage of pay to salary in comparison to the wider industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Resources Connection, Inc.'s Growth Numbers

Resources Connection, Inc. has reduced its earnings per share by 114% a year over the last three years. It saw its revenue drop 13% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Resources Connection, Inc. Been A Good Investment?

Few Resources Connection, Inc. shareholders would feel satisfied with the return of -67% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Resources Connection that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RGP

Resources Connection

Engages in the provision of consulting services to business customers under the Resources Global Professionals (RGP) name in North America, the Asia Pacific, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.