- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Paychex (PAYX) Partners With SoFi To Enhance Flex®? Perks For Financial Independence

Reviewed by Simply Wall St

Paychex (PAYX) recently announced a partnership with SoFi to integrate financial well-being resources into its Paychex Flex® Perks program, enhancing employee benefits. As the broader market, including the S&P 500 and Nasdaq, reached record highs, Paychex experienced a price movement of 1.8% decline over the last quarter. During this period, Paychex declared a significant dividend increase and repurchased shares, asserting its commitment to shareholder value. While these developments showcase Paychex's initiatives in employee and shareholder engagement, they contrast with broader market trends and rather highlight the company's independent trajectory amidst predominantly rising indexes.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

The recent partnership between Paychex and SoFi, aimed at enhancing employee benefits through Paychex Flex® Perks, aligns with existing strategies to boost employee and shareholder engagement. This integration can potentially solidify Paychex’s competitive position in the human capital management sector, possibly driving revenue growth by attracting a broader customer base. The integration of new benefits could also enhance client retention, supporting stable revenue streams.

Over the past five years, Paychex’s total shareholder returns, which include both share price appreciation and dividends, were very large at 121.64%. In comparison, Paychex's annual return matched the 12.4% return of the broader US market over the past year, also exceeding the 5.7% return of the US Professional Services industry. These figures illustrate its robust long-term performance, demonstrating resilience and consistent value delivery to shareholders.

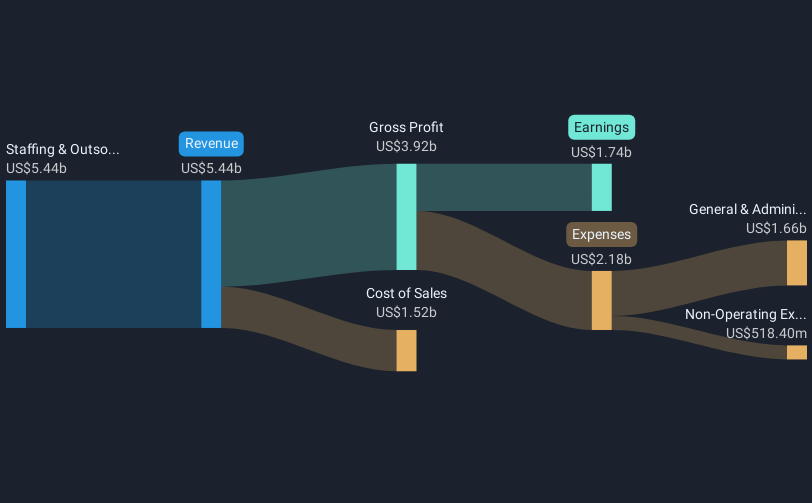

Revenue growth forecasts appear favorable, as analysts project a 13.1% annual increase over the next three years, driven by developments such as the SoFi partnership and AI-driven efficiency improvements. Despite a slight 1.8% decline in recent share prices counter to broader market trends, Paychex's price target is US$147.44. With the current share price at US$142.25, there remains a slender upside potential, reflecting an assessment of fair valuation by analysts based on expected growth in earnings, with forecasts potentially reaching US$2.3 billion by 2028 from US$1.66 billion today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAYX

Paychex

Provides human capital management solutions (HCM) for payroll, employee benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives