- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

How Investors Are Reacting To LegalZoom.com (LZ) Embedding Services With Partners to Boost Conversions

Reviewed by Sasha Jovanovic

- LegalZoom.com, Inc. recently introduced an embedded legal services flow, enabling its partners to integrate LegalZoom's offerings directly into their platforms and streamline customer onboarding with pre-filled data integration.

- The initial rollouts with notable partners such as Wix resulted in a 30% improvement in conversion rates over previous referral models, highlighting the potential impact of deeper partner integration.

- We'll explore how LegalZoom's move to embed its legal services into partner platforms may influence its investment story and growth potential.

Find companies with promising cash flow potential yet trading below their fair value.

LegalZoom.com Investment Narrative Recap

To be a shareholder in LegalZoom.com, Inc., you need to believe in the company's ability to capture a larger share of the online legal services market by deepening integrations with digital partners and moving up the value chain toward recurring, high-margin offerings. The launch of embedded legal services flow reflects meaningful progress toward this goal, yet the biggest immediate risk, rapid commoditization of core services through AI and intensifying price competition, remains only partially addressed by this announcement.

Among recent developments, LegalZoom’s August 2025 partnership to integrate its legal resources with the OpenAI-powered ChatGPT agent stands out. This move directly relates to the expanding adoption of AI-driven service delivery, reinforcing the catalyst of broader market exposure and technology positioning that underpins the company’s investment story.

However, investors should be aware that despite these integration wins, a key risk stems from the intensifying pressure created by new AI-driven competitors and...

Read the full narrative on LegalZoom.com (it's free!)

LegalZoom.com’s outlook anticipates $876.4 million in revenue and $72.3 million in earnings by 2028. This projection relies on a 7.5% annual revenue growth rate and a $43.5 million earnings increase from the current $28.8 million.

Uncover how LegalZoom.com's forecasts yield a $11.64 fair value, a 11% upside to its current price.

Exploring Other Perspectives

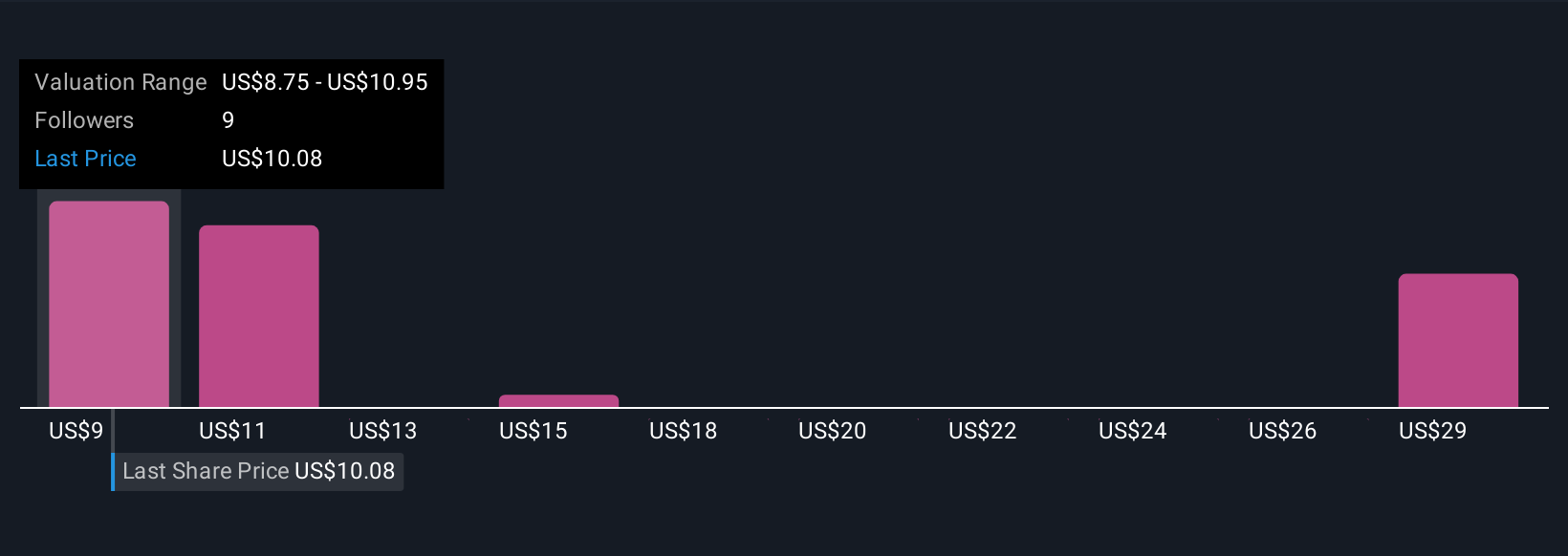

Fair value estimates from four Simply Wall St Community members range from US$8.75 to over US$30.95 per share, reflecting sharply different outlooks. With AI-driven competition increasing, take time to consider how your expectations for the sector may compare with others in the community.

Explore 4 other fair value estimates on LegalZoom.com - why the stock might be worth over 2x more than the current price!

Build Your Own LegalZoom.com Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LegalZoom.com research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LegalZoom.com research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LegalZoom.com's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives