- United States

- /

- Commercial Services

- /

- NasdaqCM:LNZA

LanzaTech Global, Inc. (NASDAQ:LNZA) Stocks Shoot Up 47% But Its P/S Still Looks Reasonable

Those holding LanzaTech Global, Inc. (NASDAQ:LNZA) shares would be relieved that the share price has rebounded 47% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 66% share price decline over the last year.

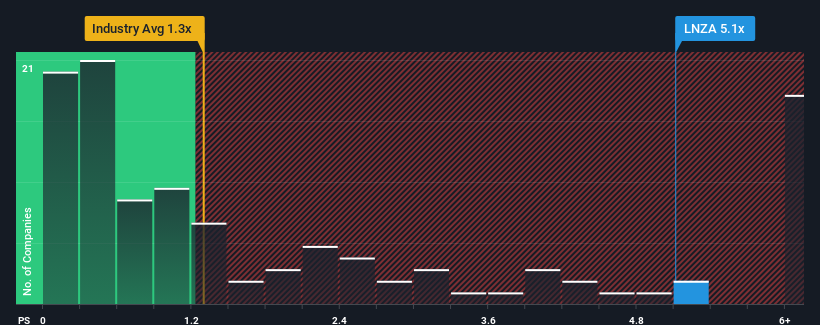

Following the firm bounce in price, when almost half of the companies in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider LanzaTech Global as a stock not worth researching with its 5.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for LanzaTech Global

How Has LanzaTech Global Performed Recently?

There hasn't been much to differentiate LanzaTech Global's and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on LanzaTech Global will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

LanzaTech Global's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. The latest three year period has also seen an excellent 128% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 77% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 8.8%, which is noticeably less attractive.

With this information, we can see why LanzaTech Global is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

LanzaTech Global's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that LanzaTech Global maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Commercial Services industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with LanzaTech Global (including 1 which is significant).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade LanzaTech Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LNZA

LanzaTech Global

Operates as a nature-based carbon refining company in the United States and internationally.

Slight and fair value.

Market Insights

Community Narratives