- United States

- /

- Commercial Services

- /

- NasdaqCM:LNZA

LanzaTech Global, Inc. (NASDAQ:LNZA) Shares Slammed 41% But Getting In Cheap Might Be Difficult Regardless

LanzaTech Global, Inc. (NASDAQ:LNZA) shareholders won't be pleased to see that the share price has had a very rough month, dropping 41% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

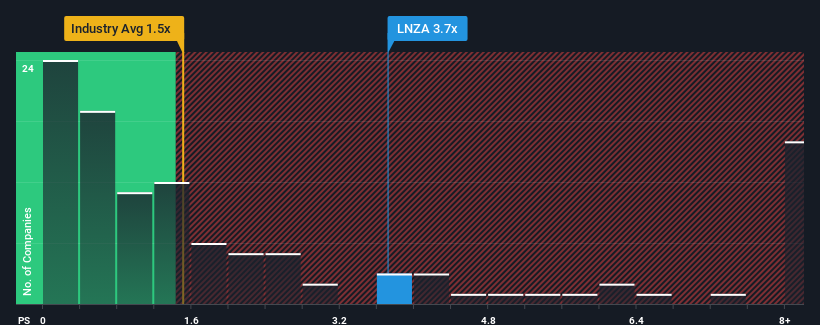

Even after such a large drop in price, you could still be forgiven for thinking LanzaTech Global is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.7x, considering almost half the companies in the United States' Commercial Services industry have P/S ratios below 1.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for LanzaTech Global

How LanzaTech Global Has Been Performing

There hasn't been much to differentiate LanzaTech Global's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think LanzaTech Global's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like LanzaTech Global's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 128% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 94% over the next year. That's shaping up to be materially higher than the 8.7% growth forecast for the broader industry.

With this in mind, it's not hard to understand why LanzaTech Global's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

A significant share price dive has done very little to deflate LanzaTech Global's very lofty P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into LanzaTech Global shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for LanzaTech Global that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LNZA

LanzaTech Global

Operates as a nature-based carbon refining company in the United States and internationally.

Slight and fair value.

Market Insights

Community Narratives