- United States

- /

- Professional Services

- /

- NasdaqCM:LICN

Lichen China Limited (NASDAQ:LICN) Surges 33% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Lichen China Limited (NASDAQ:LICN) shares have been powering on, with a gain of 33% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 41% in the last year.

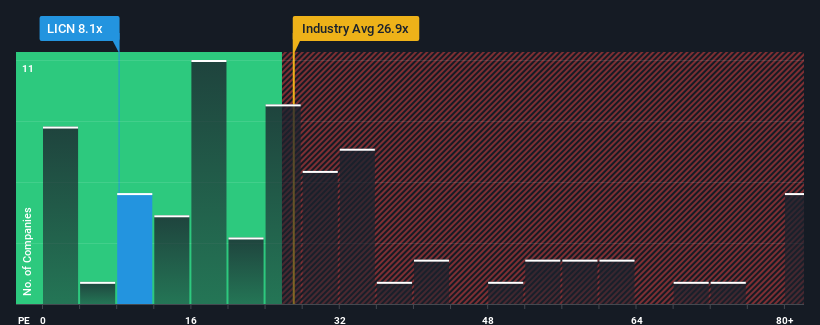

Even after such a large jump in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Lichen China as a highly attractive investment with its 8.1x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For instance, Lichen China's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Lichen China

Is There Any Growth For Lichen China?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Lichen China's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.0%. The last three years don't look nice either as the company has shrunk EPS by 22% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 12% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Lichen China's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Lichen China's recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Lichen China revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 5 warning signs for Lichen China (3 can't be ignored!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LICN

Lichen International

An investment holding company, provides financial and taxation, education support, and software and maintenance services in the People’s Republic of China.

Adequate balance sheet slight.

Market Insights

Community Narratives