- United States

- /

- Professional Services

- /

- NasdaqGS:KELY.A

It's Down 26% But Kelly Services, Inc. (NASDAQ:KELY.A) Could Be Riskier Than It Looks

The Kelly Services, Inc. (NASDAQ:KELY.A) share price has fared very poorly over the last month, falling by a substantial 26%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

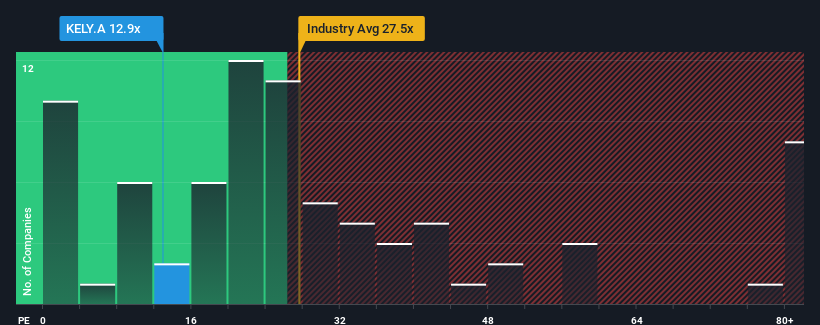

Following the heavy fall in price, Kelly Services may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 12.9x, since almost half of all companies in the United States have P/E ratios greater than 20x and even P/E's higher than 35x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Kelly Services as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Kelly Services

How Is Kelly Services' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Kelly Services' is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 86%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 57% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 102% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader market.

With this information, we find it odd that Kelly Services is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Kelly Services' recently weak share price has pulled its P/E below most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Kelly Services' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Kelly Services is showing 2 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kelly Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:KELY.A

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives