- United States

- /

- Pharma

- /

- NasdaqCM:ALTS

JanOne Inc. (NASDAQ:JAN) Stock Catapults 75% Though Its Price And Business Still Lag The Industry

JanOne Inc. (NASDAQ:JAN) shares have continued their recent momentum with a 75% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

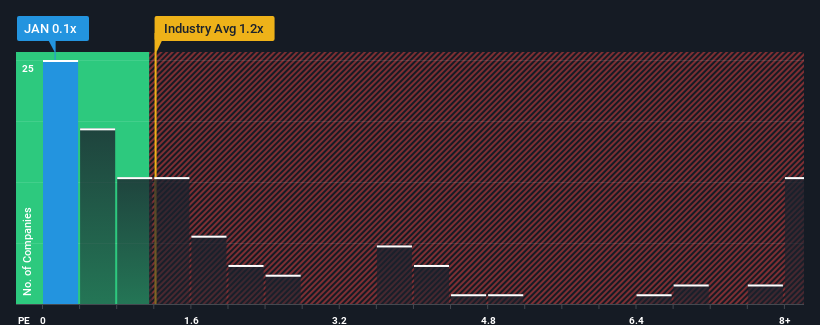

Even after such a large jump in price, JanOne may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Commercial Services industry in the United States have P/S ratios greater than 1.2x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for JanOne

What Does JanOne's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, JanOne has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on JanOne will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on JanOne's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as JanOne's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Thanks to this gigantic uplift, it also grew revenue by 9.6% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been quite good for the company but it has also been volatile.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 9.4% shows it's noticeably less attractive.

In light of this, it's understandable that JanOne's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does JanOne's P/S Mean For Investors?

Despite JanOne's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of JanOne revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 5 warning signs we've spotted with JanOne (including 3 which are concerning).

If you're unsure about the strength of JanOne's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ALTS

Adequate balance sheet low.