- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Assessing Innodata’s Soaring Multi Year Gains and AI Hype in 2025

Reviewed by Bailey Pemberton

- Wondering if Innodata is still a smart buy after its massive run, or if most of the upside is already priced in? You are not alone, and that is exactly what we are going to unpack here.

- The stock is up 47.7% year to date and 31.0% over the last year, but that rides on the back of a huge 1,776.2% three year gain and 1,024.3% over five years, with a recent 1.5% rise in the last week despite a 9.8% pullback over the past month.

- Markets have been reacting to Innodata as one of the pure play beneficiaries of the surge in enterprise demand for AI data services and model training. Investors are increasingly grouping it alongside high growth AI infrastructure names. At the same time, coverage in tech and finance media has highlighted both its expanding pipeline of AI related contracts and the execution risks that come with trying to scale quickly into that opportunity.

- Despite the excitement, our valuation framework gives Innodata a 1 out of 6 valuation score, meaning it screens as undervalued on only one of six checks. Next we will look at what different valuation methods say about the stock and, at the end of the article, explore a more powerful way to think about its true value.

Innodata scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Innodata Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present using a required rate of return.

For Innodata, the model starts with last twelve months Free Cash Flow of about $39.2 Million and then uses analyst forecasts plus Simply Wall St extrapolations to map out how those cash flows may evolve. For example, Free Cash Flow is projected at around $27.3 Million in 2026, with further estimates stepping down modestly over the following years, before stabilizing around the mid to high teens of Millions by 2035.

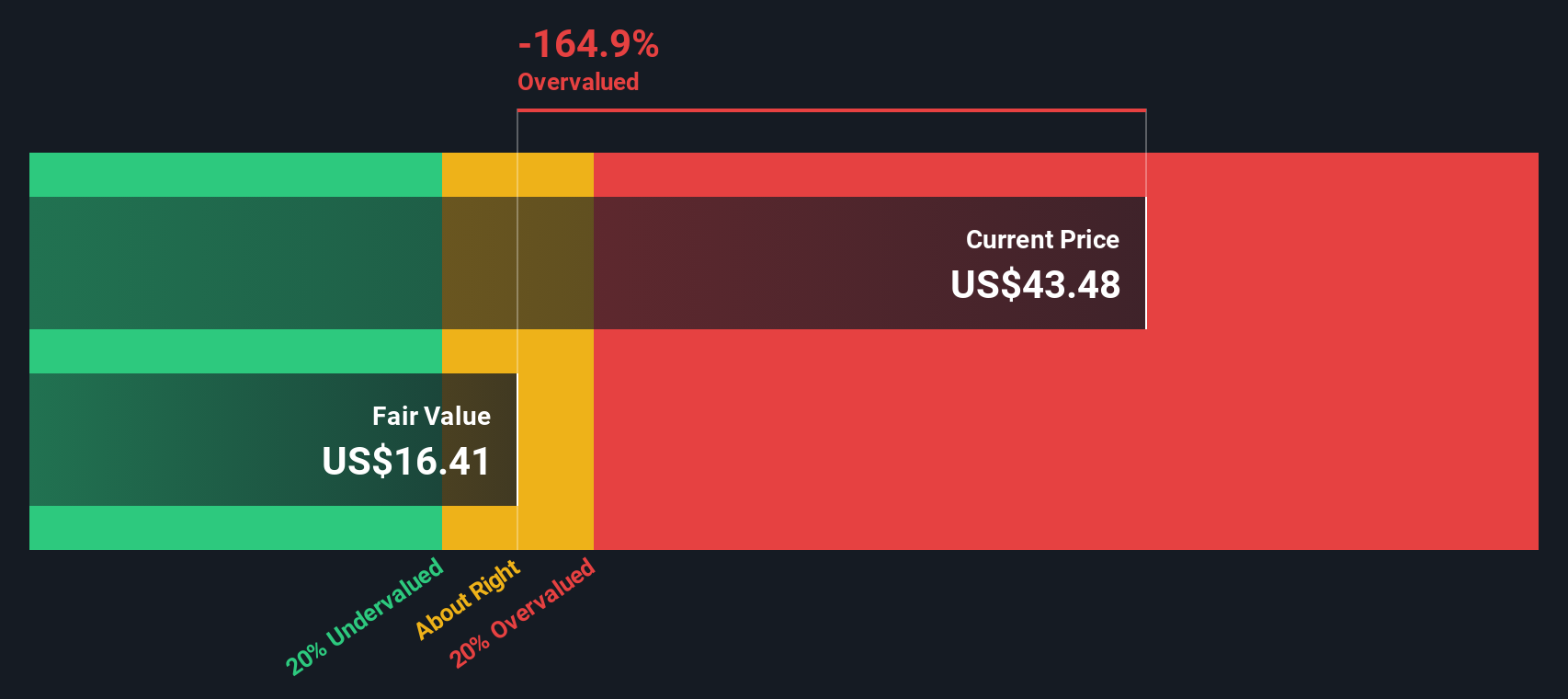

Aggregating and discounting these projected cash flows using a 2 Stage Free Cash Flow to Equity framework yields an estimated intrinsic value of $12.14 per share. Compared with the current share price, this output indicates that the stock is roughly 380.5% above the model’s estimate of intrinsic value, indicating that the market may already be pricing in a very optimistic AI growth story and additional upside.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Innodata may be overvalued by 380.5%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Innodata Price vs Earnings

For profitable companies, the Price to Earnings ratio is often the go to valuation gauge because it connects what investors are paying for each share directly to the profits the business is generating today.

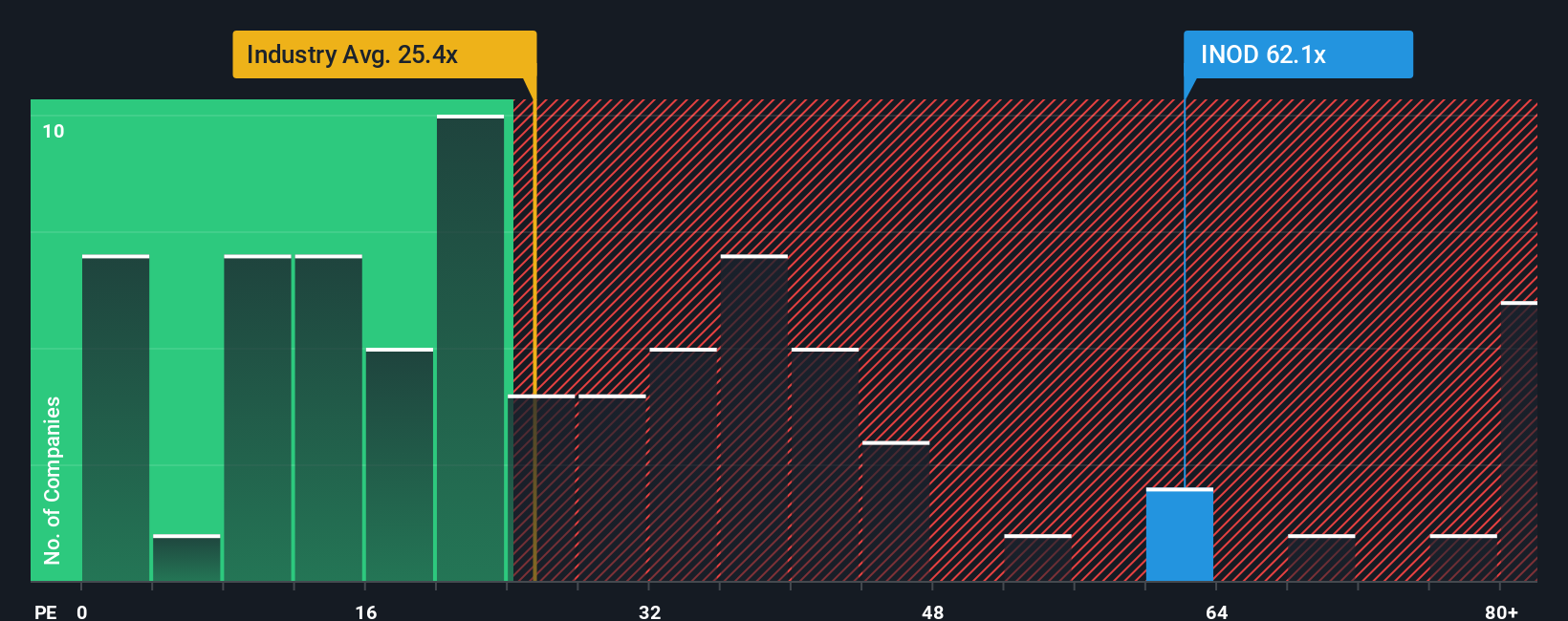

In broad terms, higher growth and lower risk usually justify a higher PE ratio, while slower growth or shakier fundamentals argue for a lower one. With Innodata trading at about 55.3x earnings, investors are clearly pricing in strong growth and a premium story. That stands well above the Professional Services industry average of roughly 24.9x and also ahead of its peer group, which trades around 39.0x.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating what PE multiple a stock should reasonably trade at, given its earnings growth outlook, industry, profit margins, market value and key risks. Because it blends all of these drivers, the Fair Ratio of 24.6x is a more tailored benchmark than simple industry or peer averages. Comparing this to Innodata’s actual 55.3x suggests the shares are pricing in much more optimism than the fundamentals alone support at this stage.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

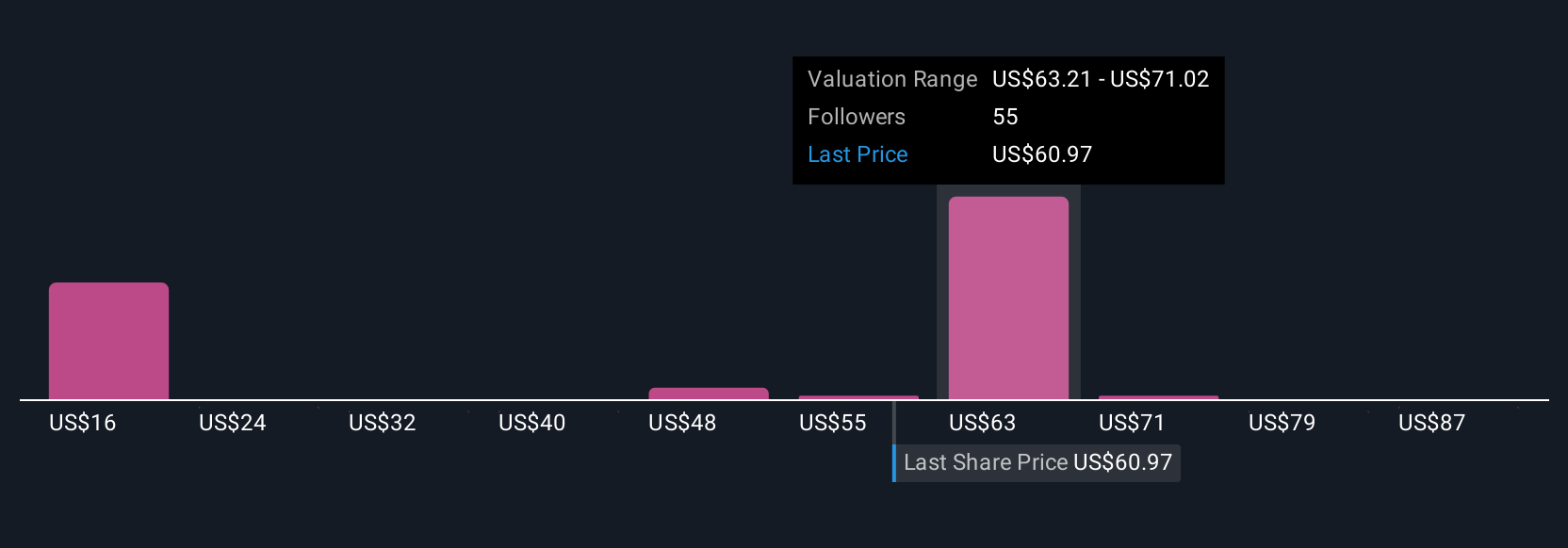

Upgrade Your Decision Making: Choose your Innodata Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Innodata’s story with concrete forecasts for its future revenue, earnings and margins, and then compare the resulting Fair Value to today’s price. A Narrative on Simply Wall St’s Community page lets you spell out your perspective, turn it into a numbers based forecast, and instantly see whether that story suggests Innodata is a buy, hold or sell right now. Because Narratives update dynamically when new information like earnings or major contract news lands, you are not locked into a static model. Instead, you are continuously refining your view as the facts change. For Innodata, one investor might build a bullish Narrative that assumes accelerating AI adoption, rising margins and a Fair Value above the most optimistic analyst target of $75. Another might focus on client concentration risks and margin pressure, arriving at a Fair Value closer to the most cautious $55 target. It is this ability to frame and compare different stories against the same live share price that makes Narratives such a powerful, yet accessible, decision making tool.

Do you think there's more to the story for Innodata? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026