- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

Will New Sightline AI Features Address Investor Doubts About ICF International’s (ICFI) Growth Outlook?

Reviewed by Sasha Jovanovic

- Earlier this month, ICF International introduced the next generation of its Sightline® platform, enhancing utility program management with AI-powered analytics and real-time grid insights to personalize energy efficiency initiatives and optimize demand-side management.

- This platform update arrives as utilities face rising electricity demand and grid challenges, but recent analysis spotlights investor concern over ICF’s declining backlog and anticipated sales drops despite technological progress.

- We’ll explore how the launch of Sightline’s AI capabilities may influence investor concerns about weakening demand and future growth at ICF International.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ICF International Investment Narrative Recap

To be a shareholder in ICF International, you need to believe that the company’s expertise in energy efficiency and utility analytics will drive recurring, higher-margin commercial contract wins, powered by proprietary platforms like Sightline®. The latest AI-driven Sightline® release promises more value for utilities grappling with rising electricity demand, yet it does little to immediately shift the key risk: ICF’s shrinking backlog and projected near-term revenue decline, which remain central concerns for investors.

Among recent announcements, ICF’s August $40 million contract for Southern California energy programs stands out as the clearest test for Sightline®’s upgraded capabilities. Adoption in a large-scale, real-world setting could help validate if platform innovation is enough to reignite contract momentum and address headwinds from federal contract slowdowns and sales softness.

In contrast, recurring signals about declining backlog and softening demand are reminders investors should watch for…

Read the full narrative on ICF International (it's free!)

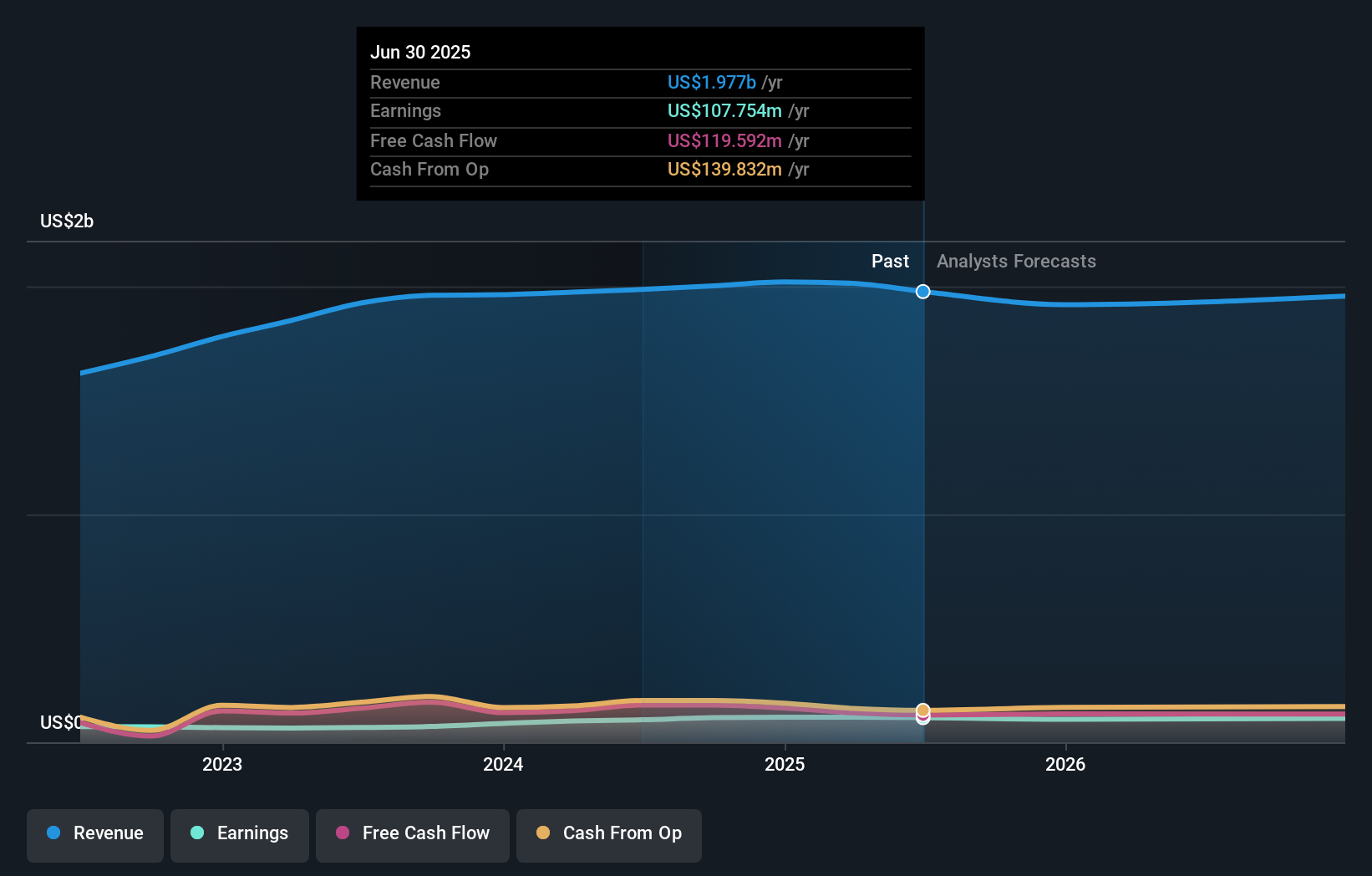

ICF International is projected to generate $1.9 billion in revenue and $97.8 million in earnings by 2028. This outlook assumes a 0.9% annual revenue decline and a $10 million decrease in earnings from the current $107.8 million.

Uncover how ICF International's forecasts yield a $103.25 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range from US$103.25 to US$111.39. While some see value upside, it is timely to weigh this against declining backlog and sales projections that may cap growth in the near term.

Explore 2 other fair value estimates on ICF International - why the stock might be worth as much as 26% more than the current price!

Build Your Own ICF International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ICF International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICF International's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives