- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

ICF International (ICFI): Reassessing Valuation as Analysts Highlight Strong Value Metrics and Positive Earnings Outlook

Reviewed by Kshitija Bhandaru

If you have been keeping an eye on ICF International (ICFI) recently, you probably noticed the renewed attention around its value credentials. Analyst commentary has zeroed in on the company’s price-to-book, price-to-sales, and price-to-cash-flow ratios, all of which come in more attractive than industry averages. At a time when valuation is in the spotlight, ICF International’s earnings outlook and these ratios are sparking conversations about whether the stock is set up for a value-driven rebound.

Zooming out, the ride for ICF International over the past year has given investors plenty to consider. The stock has slid 44% over the past twelve months, far underperforming the broader market. This is despite a substantial 49% climb over the last five years. Even as earnings per share have climbed steadily, this has not translated to the same degree in share price appreciation, hinting that the market remains cautious or simply not convinced just yet. Meanwhile, recent insider purchases have added an extra layer of intrigue, suggesting that those closest to the business see potential from this point forward.

The big question now is whether the combination of a discounted valuation and positive earnings outlook makes ICF International attractive, or if the market is accurately pricing in the road ahead.

Most Popular Narrative: 8.8% Undervalued

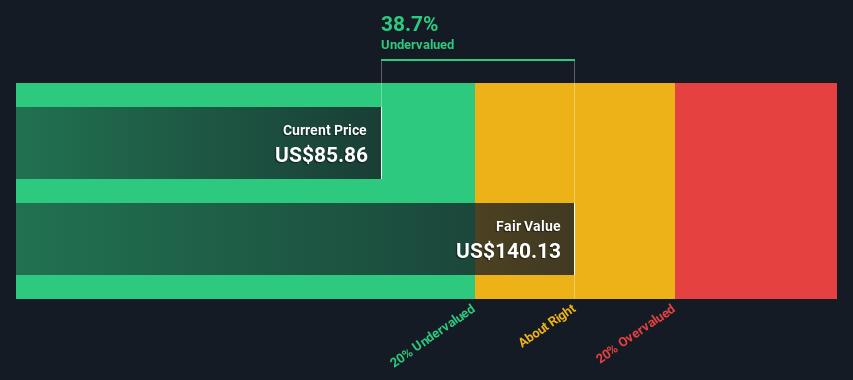

The prevailing narrative values ICF International as undervalued, projecting a fair value above the current market price based on future earnings and margin assumptions.

Rapidly rising demand for energy efficiency, electrification, flexible load management, and grid resilience services, especially from data center-driven electricity growth, is increasing multi-year commercial energy contract awards for ICF. This is supporting above-market revenue growth and a higher proportion of higher-margin commercial revenue.

Curious about what is driving this bullish outlook? The core of this narrative hinges on sharply diverging earnings projections and a future profit multiple that is higher than you might expect for a stock facing declining growth. Want to see which future scenario analysts have plugged in to support an above-market valuation? Discover which financial predictions have analysts eyeing a $100+ target for ICF International.

Result: Fair Value of $103.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing federal budget constraints and shifts in state energy policies could quickly challenge even the most optimistic analyst assumptions for ICF International.

Find out about the key risks to this ICF International narrative.Another View: What Does the SWS DCF Model Say?

Switching gears, our DCF model also points to ICF International being undervalued right now. Instead of following market multiples, this method estimates the company's future cash flows. However, could these projections be too optimistic, or are they missing something the market already knows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ICF International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ICF International Narrative

If these perspectives do not fully resonate with you or you value drawing your own conclusions from the numbers, you can develop a personal narrative of ICF International in just a few minutes: Do it your way.

A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities rarely wait around. With the right tools, you can spot tomorrow’s top stocks before the crowd does. Use these handpicked screens to uncover your next smart move:

- Uncover hidden gems in tech by browsing AI penny stocks leading innovations in artificial intelligence and shaping digital transformation across industries.

- Take advantage of dividend powerhouses that offer attractive yields and long-term income potential with our thorough guide to dividend stocks with yields > 3%.

- Get ahead of the market by tracking undervalued companies showing real potential, thanks to our tailored lineup of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives