- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

Does ICFI’s Reaffirmed Guidance Strengthen Confidence In Its Long‑Term Growth Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, ICF International said its COO James Morgan and CFO Barry Broadus took part in a virtual fireside chat at the Sidoti Year End Virtual Investor Conference, with a webcast replay available for 90 days to broaden investor access to management’s commentary.

- On the same day, an analyst upgrade citing healthy free cash flow generation, reaffirmed full-year guidance, and confidence in a return to growth in 2026 highlighted how closely investors are watching ICF’s execution against its longer-term plan.

- We’ll now look at how management’s reaffirmed guidance and 2026 growth outlook could influence ICF International’s existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

ICF International Investment Narrative Recap

To own ICF International, you need to believe its mix of government consulting, commercial energy work, and digital services can move past today’s revenue declines and backlog pressure. The Sidoti conference appearance and analyst upgrade reinforce confidence in healthy free cash flow and the reaffirmed 2025 guidance, but they do not materially change the near term catalyst of improved federal contract flow or the key risk around ongoing U.S. government funding delays and cancellations.

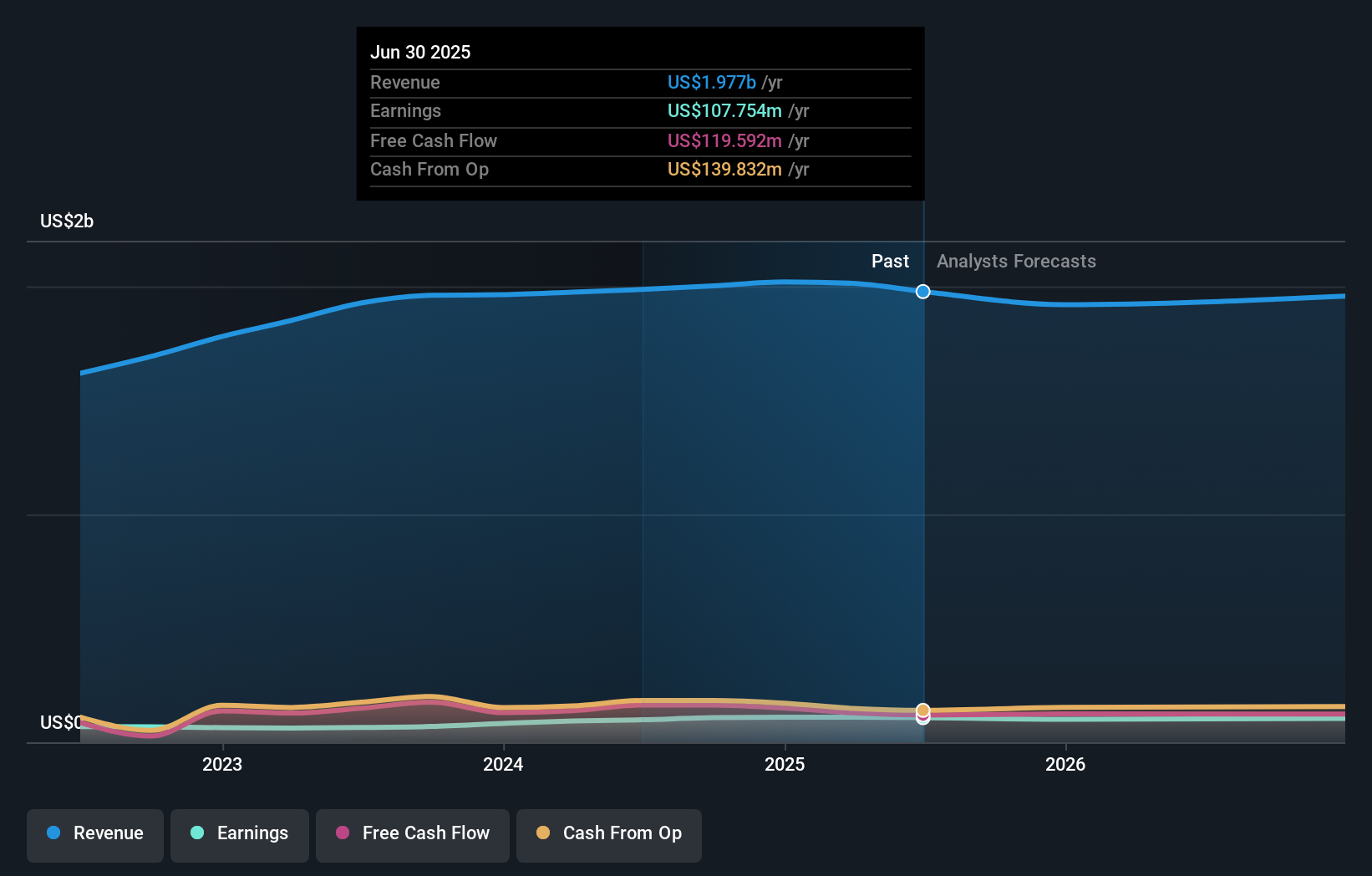

Against this backdrop, the reaffirmation of full year 2025 guidance, despite a forecast 10% revenue and earnings decline versus 2024, is the announcement that most clearly ties into this week’s news. It underpins the analyst’s focus on execution and free cash flow, while sitting squarely against risks such as slower backlog conversion and procurement bottlenecks that could still weigh on how quickly any 2026 growth outlook takes hold.

Yet investors should not ignore how prolonged federal funding delays and contract cancellations could...

Read the full narrative on ICF International (it's free!)

ICF International’s narrative projects $1.9 billion revenue and $97.8 million earnings by 2028. This implies a 0.9% yearly revenue decline and an $10.0 million earnings decrease from $107.8 million today.

Uncover how ICF International's forecasts yield a $103.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$103 to US$130 per share, underlining how far apart individual views can be. You can set those against the current concerns about federal revenue declines and backlog risk, and decide which scenarios you think will matter most for ICF’s performance.

Explore 2 other fair value estimates on ICF International - why the stock might be worth just $103.25!

Build Your Own ICF International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICF International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICF International's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026