- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

Should EXL’s Insurance Fraud Analytics Role in Australia Require Action From ExlService Holdings (EXLS) Investors?

Reviewed by Sasha Jovanovic

- On 20 November 2025, Shift Technology and EXL announced a collaboration with the Insurance Council of Australia’s counter-fraud unit and ICINA to build a national data analytics fraud detection and investigations platform for the Australian insurance industry, initially focusing on motor claims.

- This initiative highlights EXL’s role in privacy-conscious, industry-wide data sharing to combat insurance fraud, aligning its analytics capabilities with regulator-aligned governance and security standards.

- Next, we’ll examine how EXL’s role in building a shared fraud analytics platform for Australian insurers could influence its AI-driven investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

ExlService Holdings Investment Narrative Recap

To own ExlService, you need to believe it can keep turning its data and AI strengths into durable, higher margin growth despite rising competition and talent costs. The Shift Technology collaboration reinforces EXL’s position in privacy-conscious, regulated insurance analytics, but it does not materially change the near term earnings and valuation debate, where the key catalyst remains execution against its raised 2025 revenue guidance and the main risk is whether outsourcing and AI services pricing can hold up.

Among recent announcements, the October 2025 guidance upgrade to US$2.07–US$2.08 billion in 2025 revenue is most relevant, because it underscores how EXL is already monetizing its AI and analytics capabilities across clients. The Australian fraud platform fits into this picture as another proof point that EXL’s offerings are being adopted in complex, regulated sectors, which may help offset concerns about intensifying technology competition and long term pressure on margins.

Yet while EXL is helping insurers fight fraud, investors still need to weigh the rising risk that tighter global data privacy rules could...

Read the full narrative on ExlService Holdings (it's free!)

ExlService Holdings' narrative projects $2.7 billion revenue and $326.3 million earnings by 2028. This requires 10.9% yearly revenue growth and about a $90 million earnings increase from $236.3 million today.

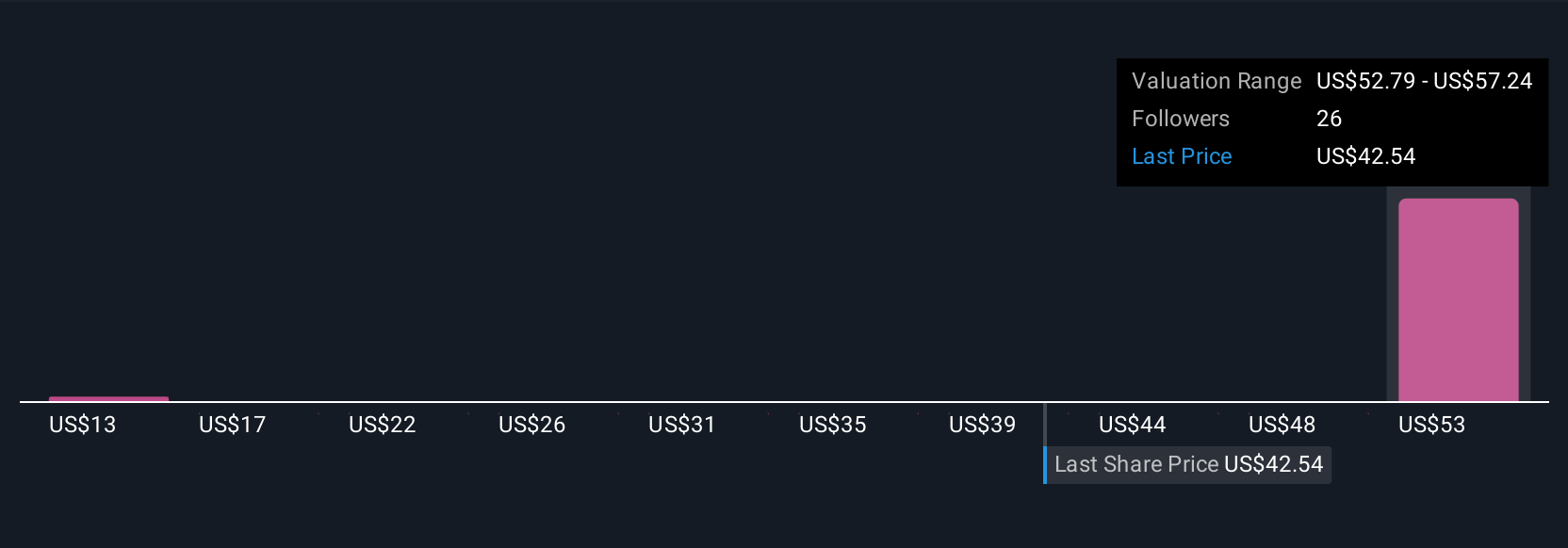

Uncover how ExlService Holdings' forecasts yield a $52.29 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members currently place EXL’s fair value between US$52.29 and US$57.15, highlighting how far opinions can spread. Set against that, the key question many are weighing is whether EXL’s raised 2025 revenue guidance can offset long term competitive and margin pressures, so it makes sense to compare several independent viewpoints before forming a view on the stock.

Explore 2 other fair value estimates on ExlService Holdings - why the stock might be worth as much as 44% more than the current price!

Build Your Own ExlService Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ExlService Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free ExlService Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ExlService Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026