- United States

- /

- Professional Services

- /

- NasdaqGS:EXLS

A Fresh Look at ExlService Holdings (EXLS) Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

ExlService Holdings (EXLS) stock has generated some interest recently, driven by shifting returns over the past month and year. Investors may be weighing recent performance trends as they look for value in the current market environment.

See our latest analysis for ExlService Holdings.

The share price of ExlService Holdings has cooled recently, down nearly 4% over the past month. Long-term investors have seen robust results, with a total shareholder return of almost 9% over the last year and an impressive 196% over five years. Momentum has faded lately, yet the company’s strong track record could keep it on watchlists as market dynamics shift.

If you’re keeping an eye out for standout performers beyond this sector, it’s a perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and holding a discount to intrinsic value, investors might wonder whether ExlService Holdings is trading at a bargain or if the company’s growth prospects are already reflected in the stock price.

Most Popular Narrative: 21.6% Undervalued

With the latest close at $42.46, the narrative fair value of $54.14 puts ExlService Holdings well above its recent trading range. This sets up the company's growth outlook and margin expansion as the key justification for the consensus premium.

The accelerated global adoption of AI and digital transformation in regulated industries is expanding the addressable market for ExlService, driving strong double-digit pipeline and growing annuity-like revenues. This trend supports sustained revenue growth and improved earnings visibility. Increasing reliance by clients on advanced data and AI-driven solutions for operational efficiency positions ExlService to generate higher-margin services, benefiting both revenue mix and long-term margin expansion as traditional usage-based contracts transition to outcome-based commercial models.

Curious how fast revenue must grow for this valuation to stick? There are bold expectations behind margins, earnings power, and future profit multiples you’ll want to see for yourself. The narrative hinges on numbers and assumptions that could surprise you. Don’t miss what actually drives that sky-high fair value. Find out more inside.

Result: Fair Value of $54.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as increasing compliance costs and wage inflation could pressure margins, which may shift expectations around ExlService Holdings's long-term growth trajectory.

Find out about the key risks to this ExlService Holdings narrative.

Another View: Multiples Tell a Different Story

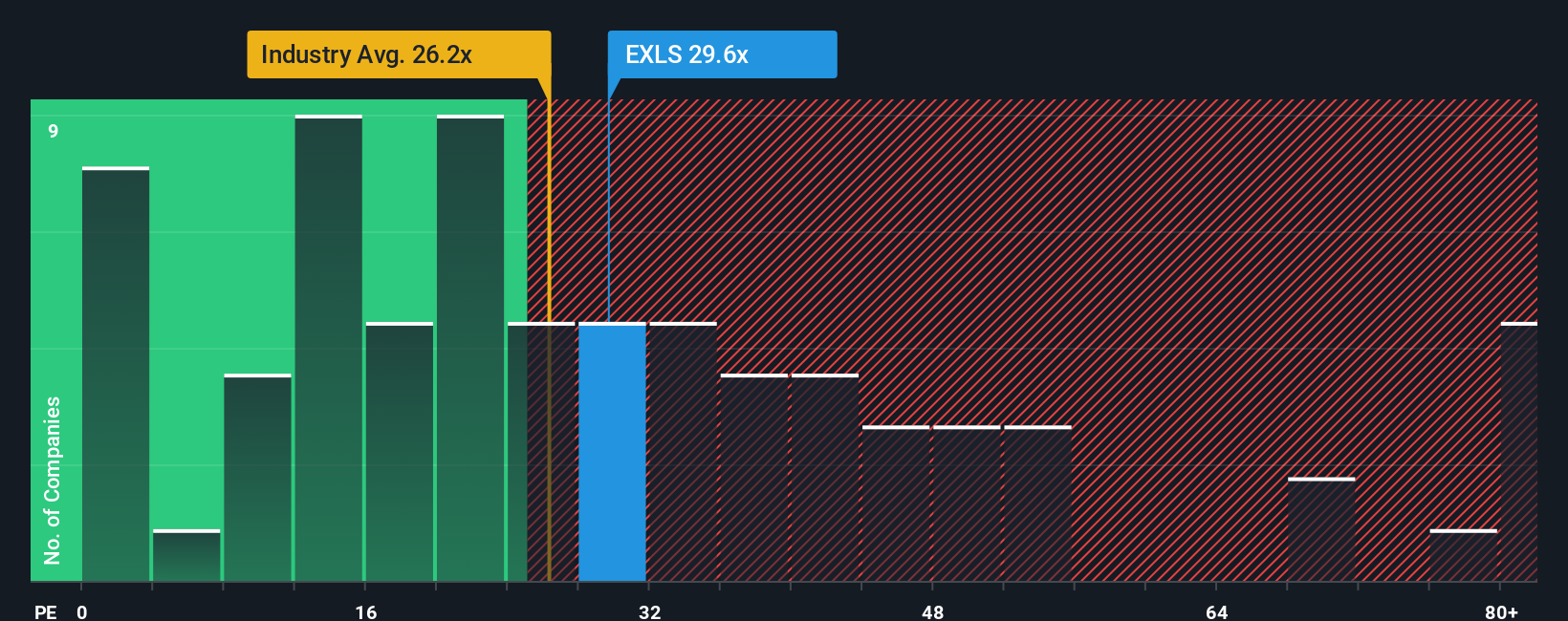

Looking at ExlService Holdings from a price-to-earnings perspective, the stock may not appear cheap. It trades at 29 times earnings, which is above both the industry average (26.5x) and what regression analysis suggests is a fair ratio (25.3x). This premium adds extra risk if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ExlService Holdings Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can put together your own take in just minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ExlService Holdings.

Looking for More Market Opportunities?

Unlock your edge by acting now. These handpicked stock screens spotlight growth, yield, and tomorrow’s trends waiting to be claimed before the crowd catches on.

- Uncover income potential by tapping into these 19 dividend stocks with yields > 3% offering yields above 3% and a consistent payout track record.

- Spot undervalued gems and sharpen your portfolio strategy using these 886 undervalued stocks based on cash flows focused on real cash flow discounts.

- Ride the next tech shift and stay ahead with these 25 AI penny stocks set to transform industries with artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ExlService Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXLS

ExlService Holdings

Operates as a data analytics, and digital operations and solutions company in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives