- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

How Investors May Respond To CSG Systems International's (CSGS) New Formula 1 Partnership for Brand Expansion

Reviewed by Sasha Jovanovic

- MoneyGram Haas F1 Team recently announced a new partnership with CSG Systems International, debuting their collaboration at the 2025 Formula 1 United States Grand Prix in Austin, Texas, to emphasize their shared commitment to innovation and performance.

- This partnership leverages the global exposure and fast-paced environment of Formula 1 racing to highlight CSG's expertise in empowering brands to engage customers and manage complexity.

- We'll now examine how CSG's new Formula 1 alliance could shape its investment narrative, focusing on brand visibility and sector diversification.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CSG Systems International Investment Narrative Recap

To believe in CSG Systems International as a shareholder, you need confidence in the company's ability to expand its foothold beyond traditional telecom clients, especially as it confronts slow revenue growth in North America and heavy customer concentration risk. The new Formula 1 partnership elevates brand visibility globally, but is unlikely to meaningfully shift near-term catalysts or address the core revenue headwinds the business faces at this time.

Of recent announcements, the Charter Communications contract extension is most relevant, extending a major customer relationship to 2031 and deepening digital platform adoption, which has direct implications for reducing the customer concentration risk that remains a critical concern for investors. While this development supports long-term stability, the balance between expanding newer verticals and maintaining large legacy contracts will be key in coming quarters.

Yet, in contrast to these growth efforts, investors should not overlook the outsized impact that any change with CSG's top customers could have...

Read the full narrative on CSG Systems International (it's free!)

CSG Systems International's outlook anticipates $1.2 billion in revenue and $120.4 million in earnings by 2028. This projection assumes a 0.3% annual revenue decline and a $38.4 million increase in earnings from the current $82.0 million.

Uncover how CSG Systems International's forecasts yield a $77.29 fair value, a 15% upside to its current price.

Exploring Other Perspectives

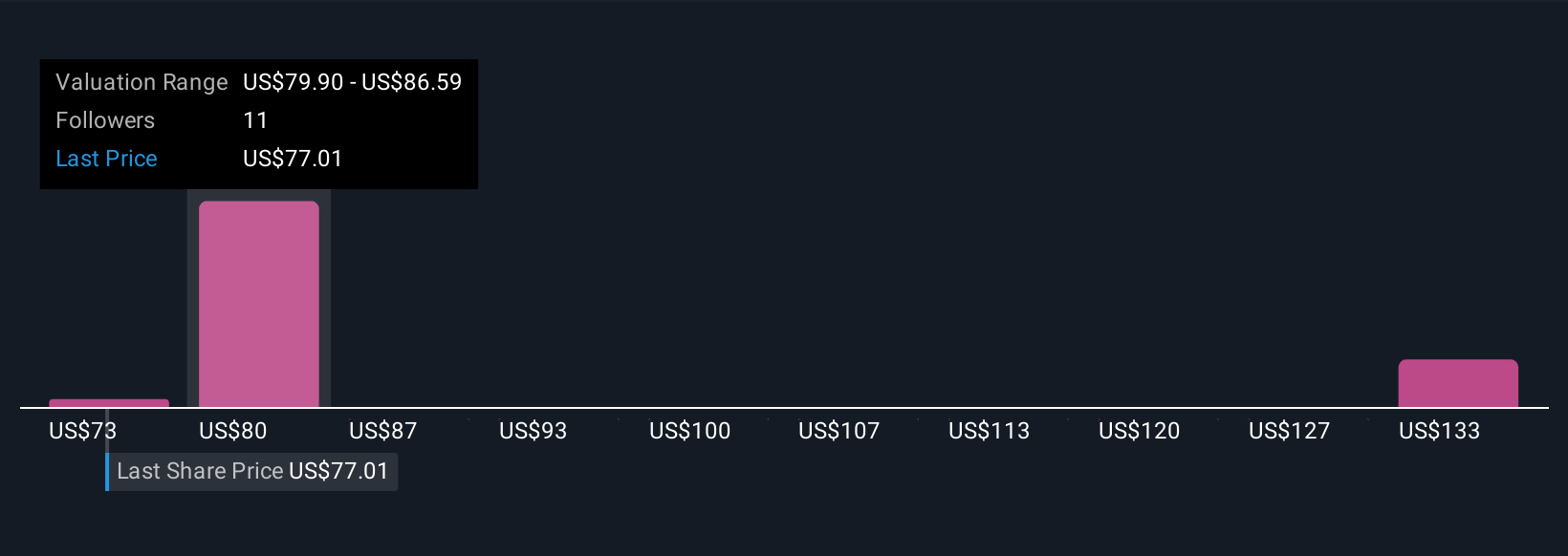

Three community members from Simply Wall St place CSG's fair value between US$73.20 and US$137.01 per share. Amid these wide-ranging views, ongoing reliance on large clients like Charter continues to shape risk perceptions and expectations around future growth, underscoring the importance of considering multiple approaches to assessing the company’s outlook.

Explore 3 other fair value estimates on CSG Systems International - why the stock might be worth just $73.20!

Build Your Own CSG Systems International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CSG Systems International research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CSG Systems International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CSG Systems International's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion