- United States

- /

- Professional Services

- /

- NasdaqGS:CRAI

CRA International (CRAI): A Closer Look at Valuation and Market Sentiment

Reviewed by Kshitija Bhandaru

CRA International (CRAI) has been quietly gaining attention among investors thanks to its consistent financial performance. With a track record of steady revenue and net income growth, the stock’s recent movement invites a closer look.

See our latest analysis for CRA International.

The past year has seen CRA International’s share price stabilise after earlier gains. The total shareholder return of 12% over the last twelve months highlights a steady wealth build for long-term holders. Recent price moves suggest sentiment is holding steady, even as broader markets shift.

If you’re in the mood to expand your watchlist, this could be the perfect moment to explore fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst price targets, investors may wonder if CRA International is undervalued right now or if the market has already factored in expectations for future growth.

Most Popular Narrative: 18.2% Undervalued

With the narrative's fair value sitting well above CRA International's recent closing price, the case for further upside is getting stronger. There's momentum building behind a specific rationale for this price target.

The surge in global regulatory complexity and heightened enforcement, especially in antitrust, is driving robust and sustained demand for CRA's advisory services, as evidenced by record performance in their Antitrust & Competition Economics practice; this is likely to support higher long-term revenue growth.

What is fueling this ambitious fair value? This forecast isn't just about steady gains. It is tied to scenarios where CRA leverages an industry shakeup, premium pricing power, and projected margin trends. Want to know what growth and profitability benchmarks underlie the valuation? There are key numbers behind the optimism that most investors haven’t seen yet.

Result: Fair Value of $239.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as a potential slowdown in M&A activity or difficulty retaining top talent. Either of these factors could limit future upside.

Find out about the key risks to this CRA International narrative.

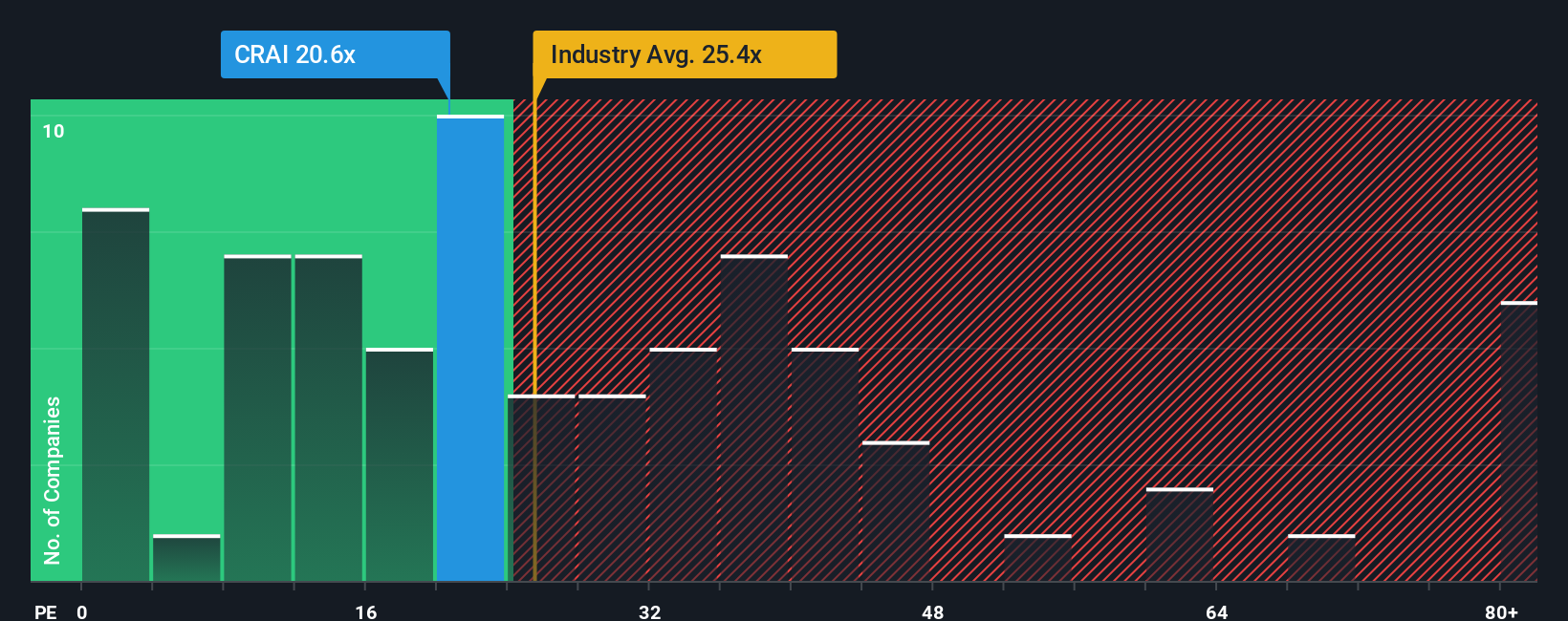

Another View: What the Market Multiples Say

Looking beyond analyst forecasts, CRA International's current price-to-earnings ratio of 22.9 times stands out. This is lower than both the industry average of 26.7 and its peers at 39.3. However, it remains above its fair ratio of 18.3. This signals a potential opportunity, but does it really account for all the risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRA International Narrative

If you want a different perspective or would rather reach your own conclusions, you can draft a personalized view in just a few minutes. Do it your way.

A great starting point for your CRA International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with fresh opportunities you might be missing. Leverage handpicked screeners to target companies with unique characteristics and proven potential for outperformance.

- Accelerate your growth ambitions and tap into the power of artificial intelligence by researching these 24 AI penny stocks that are positioned for tomorrow’s breakthroughs.

- Secure passive income with reliable companies by checking out these 19 dividend stocks with yields > 3% which offer attractive yields well above market averages.

- Step ahead of the crowd and gain exposure to the next digital revolution by uncovering these 78 cryptocurrency and blockchain stocks at the forefront of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRAI

CRA International

Provides economic, financial, and management consulting services worldwide.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives