- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

CECO Environmental (CECO): Examining Valuation After Earnings Beat and Upgraded Analyst Targets

Reviewed by Simply Wall St

If you are looking at CECO Environmental (CECO) today, you are probably asking yourself what comes next after its impressive second-quarter earnings beat. The company’s revenue not only rose compared to a year ago, but adjusted earnings per share also came in higher than analysts projected. On top of that, the upbeat results prompted analysts from H.C. Wainwright and Needham to boost their outlook on the stock, keeping their Buy ratings intact. This move has clearly fueled more optimism among investors.

This wave of good news has driven CECO’s shares to fresh highs, building on an already strong year. Over the past year, the stock has delivered an 80% return, vastly outperforming most benchmarks. Momentum has picked up even further lately, with CECO logging a 14% gain just this month and a substantial 73% jump in the past three months, suggesting that investor enthusiasm is still going strong after earlier gains.

With the stock trading at all-time highs and optimism high, the question is whether CECO Environmental offers a real buying opportunity now, or if the market is simply pricing in all the future growth we can expect.

Most Popular Narrative: 2% Undervalued

According to the most widely followed narrative, CECO Environmental is trading just below its estimated fair value, suggesting a modest undervaluation in the current share price based on projected future earnings and revenue growth.

Record-high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions. This is supporting topline revenue growth over the next 18 to 24 months.

What is really driving this valuation? There is a mix of growth opportunities, expanding global reach, and ambitious profit multiples at play. Curious which key financial projections and aggressive targets are fueling that price estimate? Read on to uncover why analysts are betting on these numbers to unlock higher upside.

Result: Fair Value of $51.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising expenses and debt, combined with any slowdown in revenue or bookings growth, could quickly put pressure on CECO Environmental’s margins and future earnings.

Find out about the key risks to this CECO Environmental narrative.Another View: Discounted Cash Flow Perspective

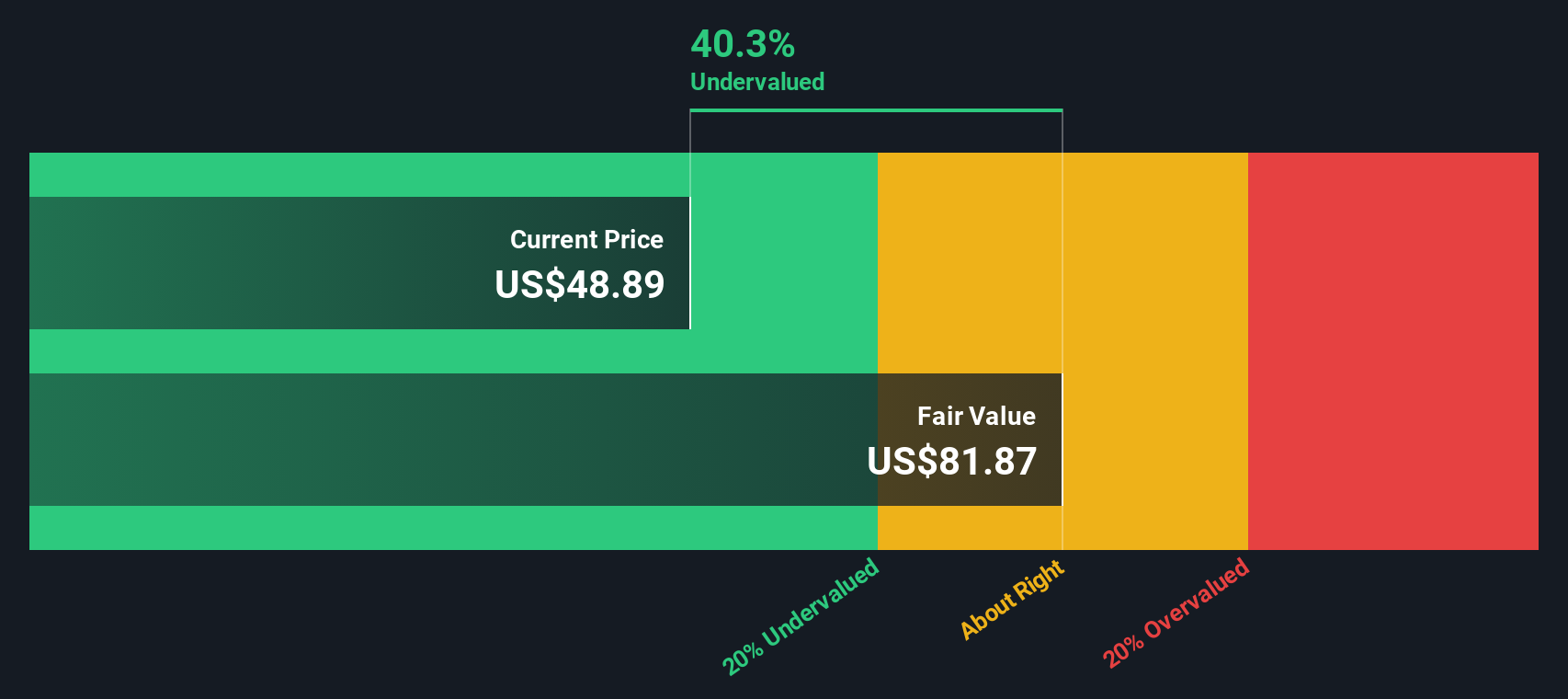

While analyst targets suggest fair value based on future growth multiples, our DCF model offers a different perspective. This approach considers long-term cash flows and currently suggests the market may be underestimating the company’s intrinsic potential. Which measure do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding CECO Environmental to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own CECO Environmental Narrative

If you'd rather challenge the prevailing views or dig into the details on your own, you can build and share your own analysis in just a few minutes. Do it your way

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for Your Next Smart Investment?

Don't just watch the market from the sidelines. Uncover powerful new opportunities that match your ambitions with these handpicked ideas only a click away.

- Tap into stocks powering artificial intelligence breakthroughs and get ahead of tomorrow’s tech boom with AI penny stocks.

- Capture high-yield income by scanning for companies offering generous payouts greater than 3% using dividend stocks with yields > 3%.

- Seize undervalued gems that are flying under the radar and capitalize on stocks backed by strong cash flows via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record with slight risk.

Market Insights

Community Narratives