- United States

- /

- Commercial Services

- /

- OTCPK:RENO

Introducing BioHiTech Global (NASDAQ:BHTG), A Stock That Climbed 41% In The Last Year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. To wit, the BioHiTech Global, Inc. (NASDAQ:BHTG) share price is 41% higher than it was a year ago, much better than the market return of around 27% (not including dividends) in the same period. So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 36% in three years.

See our latest analysis for BioHiTech Global

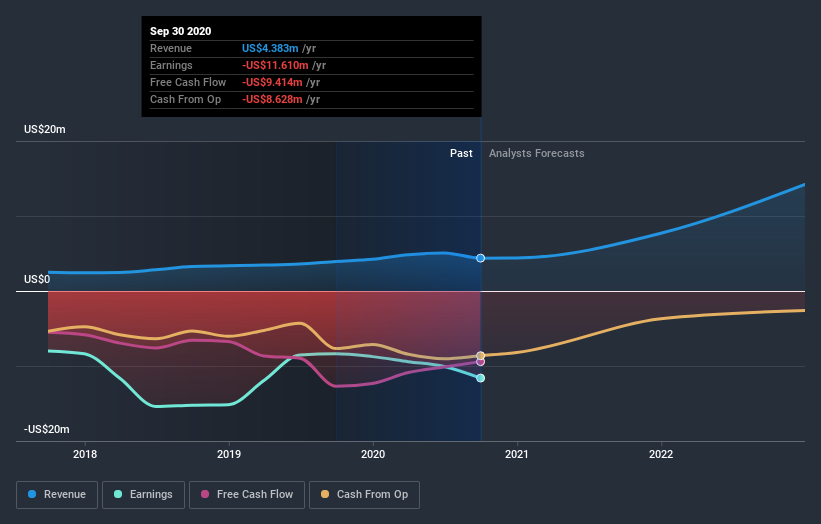

Because BioHiTech Global made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, BioHiTech Global's revenue grew by 11%. That's not great considering the company is losing money. The modest growth is probably largely reflected in the share price, which is up 41%. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at BioHiTech Global's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that BioHiTech Global shareholders have received a total shareholder return of 41% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 7 warning signs for BioHiTech Global (2 are concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading BioHiTech Global or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:RENO

Renovare Environmental

Through its subsidiaries, provides environmental management solutions worldwide.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives