- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Will Sluggish US Private Hiring Shift ADP’s (ADP) Outlook as Holiday Season Approaches?

Reviewed by Sasha Jovanovic

- Automatic Data Processing (ADP) recently reported that, for the four weeks ending November 8, private employers in the US shed an average of 13,500 jobs each week, raising concerns about labor market health as the holiday hiring period approaches.

- ADP’s chief economist highlighted lingering uncertainty over consumer strength, suggesting a possible link between weaker job creation and softened demand entering a crucial retail season.

- With this labor market softness in view, we'll explore how shifting US employment trends could affect ADP's long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Automatic Data Processing Investment Narrative Recap

To be an Automatic Data Processing (ADP) shareholder, you generally need to believe in the resilience and long-term demand for outsourced HR technology and payroll services, especially as businesses face complex workforce challenges. Recent data showing US private employers cut 13,500 jobs a week raises some concern over near-term employment-driven metrics, but the impact on ADP’s most important short-term catalyst, adoption of advanced cloud and AI products, appears limited. The largest current risk remains any sustained slowdown in payroll growth or elongated sales cycles on large deals, which could weigh on both organic revenue and earnings momentum if persistent, though no significant change to this risk has emerged from the latest labor data.

Amid questions about labor market strength, ADP has kept focus on its shareholders by announcing a 51st consecutive annual dividend increase, now at US$6.80 per share, highlighting management’s confidence in its cash generation. While this does not directly address the softer hiring landscape, continued dividend growth supports the company’s near-term credibility and shareholder returns as it contends with the evolving employment environment and shifting demand for HR services.

By contrast, investors should remain alert to the possibility that further slowing in US payroll growth will...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and a $1.0 billion earnings increase from the current $4.1 billion.

Uncover how Automatic Data Processing's forecasts yield a $293.23 fair value, a 15% upside to its current price.

Exploring Other Perspectives

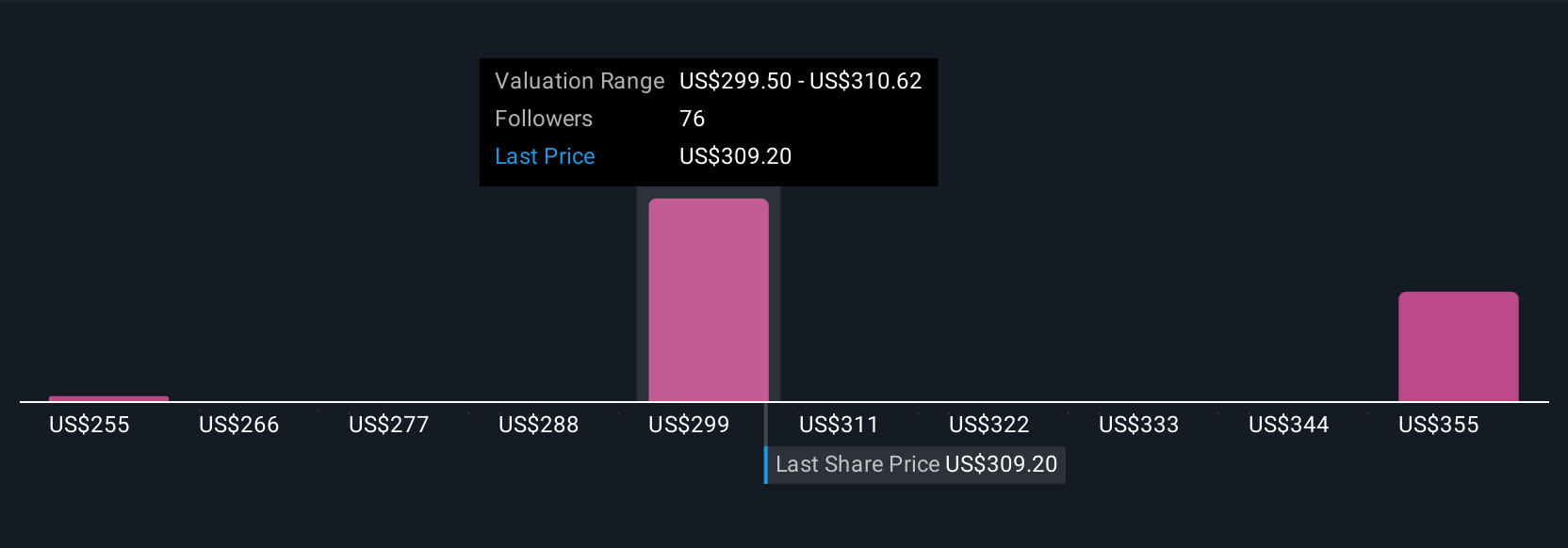

Retail investors in the Simply Wall St Community provided four fair value estimates for ADP ranging from US$276 to US$387.77 per share. Opinions are diverse but factor in risks such as lagging US payroll growth, bringing broad context to the company’s outlook.

Explore 4 other fair value estimates on Automatic Data Processing - why the stock might be worth as much as 52% more than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

No Opportunity In Automatic Data Processing?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026