- United States

- /

- Machinery

- /

- OTCPK:ZEVY

It's A Story Of Risk Vs Reward With Lightning eMotors, Inc. (NYSE:ZEV)

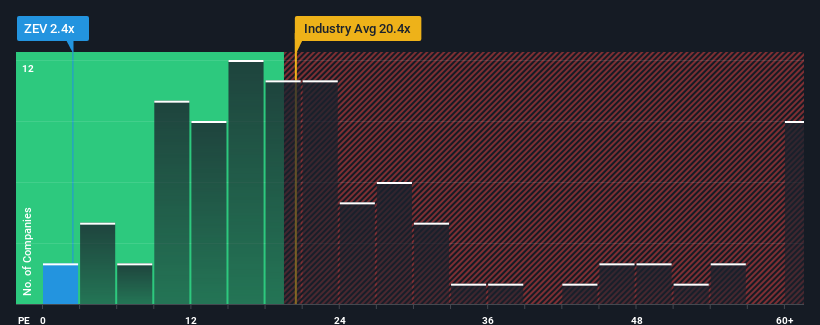

With a price-to-earnings (or "P/E") ratio of 2.4x Lightning eMotors, Inc. (NYSE:ZEV) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 15x and even P/E's higher than 30x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's inferior to most other companies of late, Lightning eMotors has been relatively sluggish. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Lightning eMotors

What Are Growth Metrics Telling Us About The Low P/E?

Lightning eMotors' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

The Bottom Line On Lightning eMotors' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

You should always think about risks. Case in point, we've spotted 5 warning signs for Lightning eMotors you should be aware of, and 3 of them can't be ignored.

You might be able to find a better investment than Lightning eMotors. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:ZEVY

Lightning eMotors

Designs, manufactures, and sells zero-emission commercial fleet vehicles and powertrains to commercial fleets, large enterprises, original equipment manufacturers, and governments in the United States.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives