- United States

- /

- Machinery

- /

- NYSE:WNC

Slammed 27% Wabash National Corporation (NYSE:WNC) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Wabash National Corporation (NYSE:WNC) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

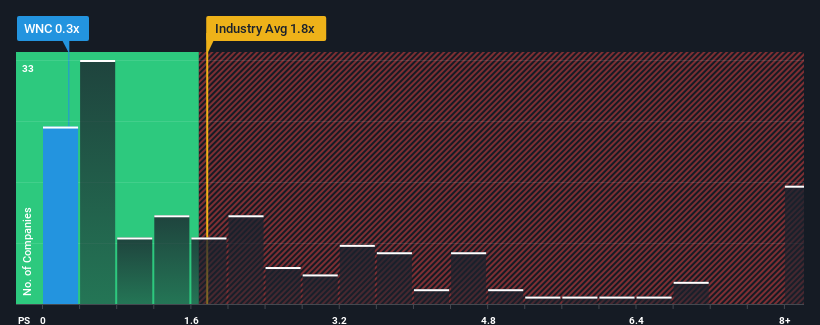

Since its price has dipped substantially, Wabash National may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Machinery industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Wabash National

How Wabash National Has Been Performing

With revenue that's retreating more than the industry's average of late, Wabash National has been very sluggish. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Wabash National.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Wabash National's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.0% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain somewhat buoyant, growing by 0.1% during the coming year according to the dual analysts following the company. Meanwhile, the broader industry is forecast to contract by 0.3%, which would indicate the company is doing better than the majority of its peers.

With this information, we find it very odd that Wabash National is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Wabash National's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Wabash National currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for Wabash National that you need to take into consideration.

If you're unsure about the strength of Wabash National's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wabash National might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WNC

Wabash National

Provides connected solutions for the transportation, logistics, and distribution industries primarily in the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives