- United States

- /

- Machinery

- /

- NYSE:WNC

Investors Aren't Buying Wabash National Corporation's (NYSE:WNC) Earnings

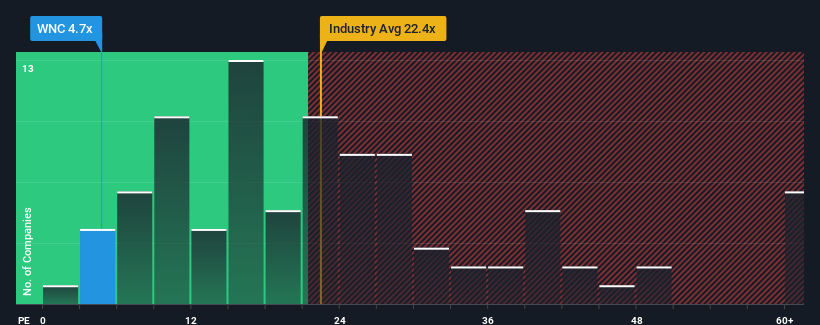

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Wabash National Corporation (NYSE:WNC) as a highly attractive investment with its 4.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Wabash National as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Wabash National

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Wabash National's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 36%. The strong recent performance means it was also able to grow EPS by 1,763% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 46% as estimated by the three analysts watching the company. Meanwhile, the broader market is forecast to expand by 13%, which paints a poor picture.

With this information, we are not surprised that Wabash National is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Wabash National's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Wabash National (1 is a bit concerning!) that we have uncovered.

Of course, you might also be able to find a better stock than Wabash National. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Wabash National might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WNC

Wabash National

Provides connected solutions for the transportation, logistics, and distribution industries primarily in the United States.

Undervalued with moderate growth potential.