- United States

- /

- Building

- /

- NYSE:WMS

A Look at Advanced Drainage Systems (WMS) Valuation Following Strong Earnings and Investor Optimism

Reviewed by Simply Wall St

Advanced Drainage Systems (NYSE:WMS) surprised many investors with its latest quarterly earnings, turning in results that topped Wall Street’s forecasts for both revenue and operating income. Even with hurdles like persistent wet weather slowing some projects and higher interest rates squeezing budgets, management showed it could adapt and keep profits on track. For investors who have been following the stock’s ups and downs, this kind of resilience stands out, especially when others in the construction supply space are facing headwinds.

It is not surprising that the market responded swiftly. Shares have climbed more than 24% since the earnings report, signaling that optimism about growth prospects is building. While the company spent the last year giving back some prior gains (the stock is still down 9% over that period), the recent upward momentum is hard to ignore. Over the past 3 months, shares are up roughly 34%, a major swing compared to its more muted three-year run and its massive five-year return of over 168%.

With that kind of turnaround, the real question now is whether Advanced Drainage Systems is actually trading at a bargain after its earnings-fueled pop, or if the market is already pricing in a bright future for the company.

Most Popular Narrative: 4.7% Undervalued

According to community narrative, Advanced Drainage Systems is currently seen as slightly undervalued, with analysts forecasting further upside potential if profitability trends continue.

Continuous expansion of the Allied Products and Infiltrator segments, both of which command higher margins and are growing faster than the core Pipe business, is shifting product mix toward higher profitability. This results in improved EBITDA margins and long-term earnings power.

The secret behind this bullish outlook? There is a bold expectation about which divisions will power future profit growth, a major assumption on margin gains, and a very specific future profit multiple that the entire price target relies upon. Want to see how analyst forecasts compare with company history, and what could make this “undervalued” call unravel? Dive into the full narrative to see the crucial numbers and debate.

Result: Fair Value of $154.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, weak demand across core end markets or a spike in input costs could quickly challenge optimism about sustained profit growth for Advanced Drainage Systems. Find out about the key risks to this Advanced Drainage Systems narrative.Another View: Digging Deeper With Cash Flow

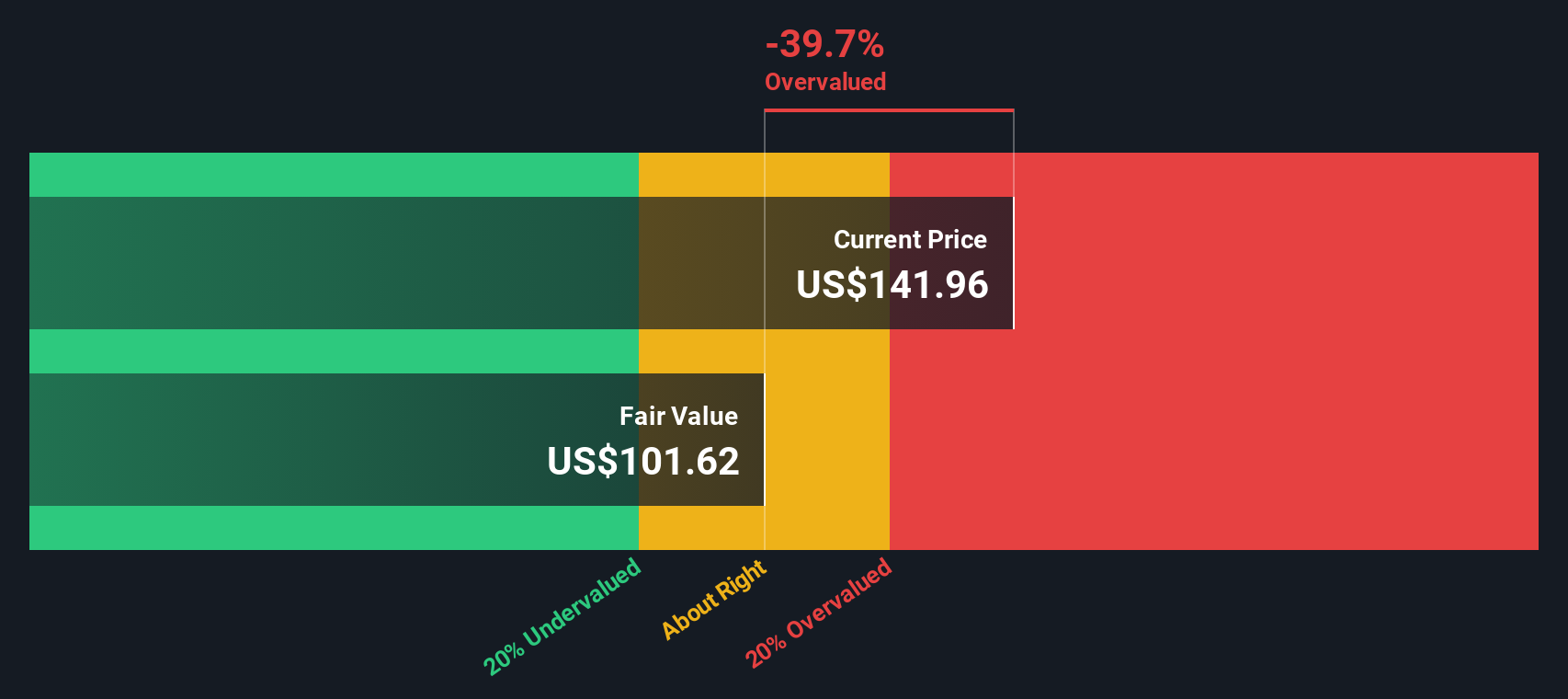

While price targets based on earnings multiples see Advanced Drainage Systems as fairly valued, our DCF model presents a different perspective. It currently suggests the company may be trading well above its intrinsic worth. Could the market be overlooking some risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Advanced Drainage Systems Narrative

If you would rather dig into the numbers on your own or want to approach the story from a different angle, crafting your own viewpoint takes just minutes. do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Advanced Drainage Systems.

Looking for More Smart Investment Moves?

Why limit your strategy to just one stock when there is a world of compelling opportunities waiting? Act now and give yourself an edge by zeroing in on sectors and themes that can boost your portfolio’s potential. Here are three standout ways to get started:

- Uncover stable returns by targeting dividend stocks with yields > 3%, perfect if reliable income is your priority.

- Jump ahead of the curve with AI penny stocks to back up-and-coming tech leaders reshaping industries through artificial intelligence innovation.

- Strengthen your portfolio with undervalued stocks based on cash flows. This is an easy route to find promising companies trading below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives