- United States

- /

- Trade Distributors

- /

- NYSE:WCC

WESCO International, Inc. (NYSE:WCC) Soars 29% But It's A Story Of Risk Vs Reward

WESCO International, Inc. (NYSE:WCC) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 55%.

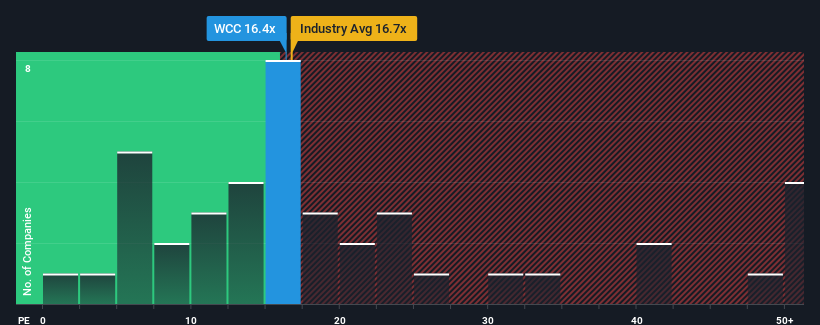

Although its price has surged higher, WESCO International may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.4x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 36x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, WESCO International's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for WESCO International

Is There Any Growth For WESCO International?

In order to justify its P/E ratio, WESCO International would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 150% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 12% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 11% per annum, which is not materially different.

With this information, we find it odd that WESCO International is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From WESCO International's P/E?

WESCO International's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that WESCO International currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 2 warning signs for WESCO International (1 is a bit unpleasant!) that we have uncovered.

If these risks are making you reconsider your opinion on WESCO International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives