- United States

- /

- Trade Distributors

- /

- NYSE:WCC

Could Wesco International’s (WCC) AP Digitization Hint at a Broader Edge in Operational Excellence?

Reviewed by Sasha Jovanovic

- Genpact announced that in late September, Wesco International modernized its accounts payable operations by implementing the full Genpact AP Suite, leveraging AI agents for enhanced efficiency and real-time process visibility.

- This move highlights Wesco's ongoing integration of technology to streamline core financial processes, signaling a broader commitment to operational excellence and digital transformation within industrial supply chains.

- We’ll explore how Wesco’s digitization of accounts payable could further support expansion opportunities highlighted in its investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

WESCO International Investment Narrative Recap

To own shares in WESCO International, an investor must have confidence in the company's ability to capitalize on megatrends such as data center expansion and electrification, while managing margin pressures from competitive pricing and large-scale projects. The recent adoption of Genpact’s AI-powered AP Suite showcases WESCO’s operational focus, but is unlikely to materially change the short-term demand driver around hyperscale data center buildouts, nor does it resolve the largest risk of persistent gross margin pressure in lower-margin projects.

Among recent company updates, WESCO’s decision to raise its 2025 earnings guidance stands out as most relevant to the latest digital transformation, reinforcing data center and infrastructure spending as critical performance catalysts. Together, these signals point to a company that is aligning operational upgrades with sector opportunities, but for investors, the ability to maintain margin resilience remains an open question...

Read the full narrative on WESCO International (it's free!)

WESCO International's outlook anticipates $25.9 billion in revenue and $909.7 million in earnings by 2028. This forecast is based on a 5.2% annual revenue growth rate and a $275.5 million increase in earnings from the current $634.2 million.

Uncover how WESCO International's forecasts yield a $241.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

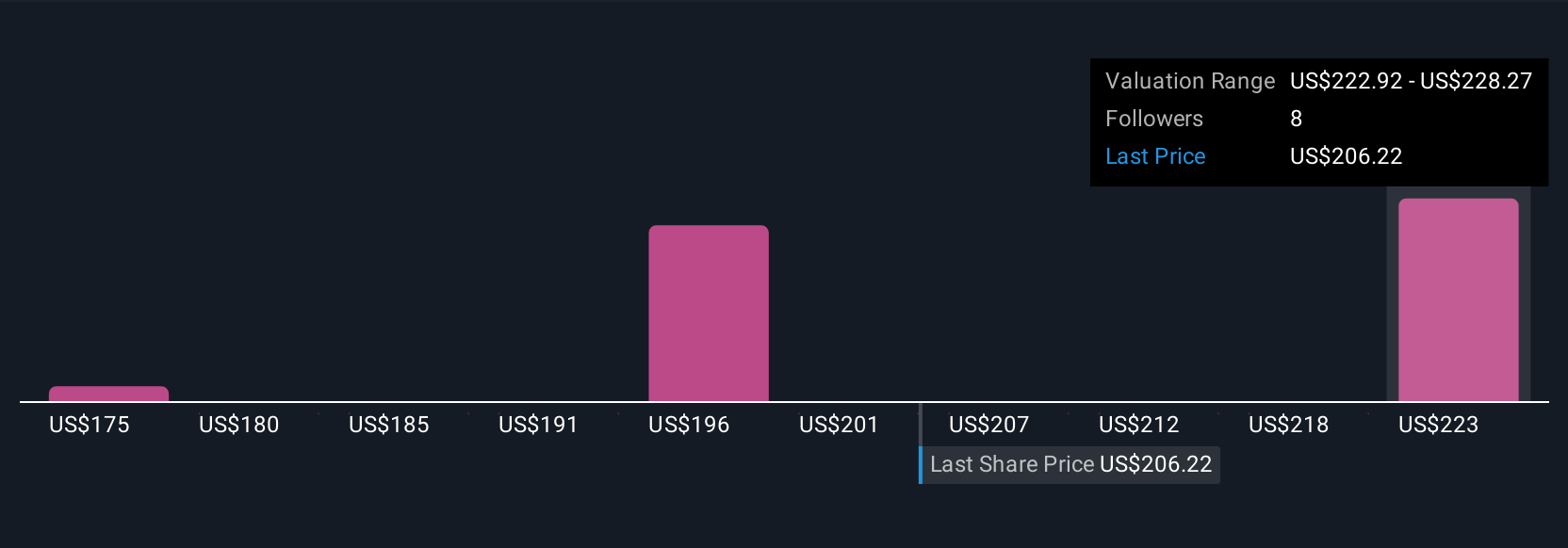

Private fair value estimates from three members of the Simply Wall St Community span from US$174.72 to US$241. This wide range sits alongside ongoing debate about whether WESCO can manage sustained margin pressure amid expanding data center demand, highlighting just how differently investors view future company performance.

Explore 3 other fair value estimates on WESCO International - why the stock might be worth 21% less than the current price!

Build Your Own WESCO International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WESCO International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WESCO International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WESCO International's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WESCO International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WCC

WESCO International

Provides business-to-business distribution, logistics services, and supply chain solutions in the United States, Canada, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives