- United States

- /

- Machinery

- /

- NYSE:WAB

How Should Investors View Wabtec After a 254% Five-Year Surge?

Reviewed by Bailey Pemberton

Are you on the fence about what to do with Westinghouse Air Brake Technologies stock? You are not alone. With the last close sitting at $193.43, there is plenty to unpack if you are sizing up your next move. The stock has dipped slightly over the past month, down 2.3%, and is off by 1.9% in just the past week. Zooming out, however, investors have seen a steady climb: up 2.4% year-to-date, rising 3.8% over the past year, and boasting gains of 116.7% in the last three years, with a staggering 254.5% increase over five years. Clearly, there is momentum over the long run, even if the short-term picture feels choppy.

Recent headlines have focused on broader sector shifts, as infrastructure investments and rail modernization plans have kept transport stocks in focus. For Westinghouse Air Brake Technologies, this context matters significantly. Public conversations around rail safety enhancements and supply chain upgrades have reinforced the company’s importance within industrial transportation. Yet, when we turn to valuation, it is a more complicated story. Based on six key value checks, the company scores a 0; none of the standard benchmarks are signaling undervaluation right now.

If you are trying to figure out how all these pieces fit together, you are in the right place. Up next, we will break down the company’s current valuation through different lenses, and later, I will share what might be an even more insightful way to judge whether this stock deserves a spot in your portfolio.

Westinghouse Air Brake Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Westinghouse Air Brake Technologies Discounted Cash Flow (DCF) Analysis

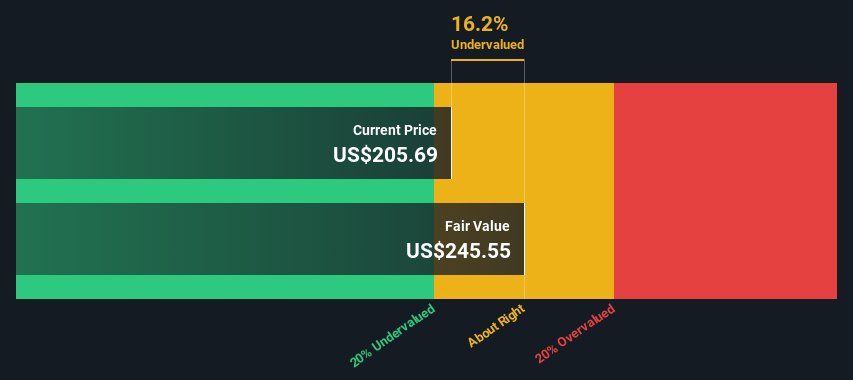

The Discounted Cash Flow (DCF) model estimates the true value of a business by projecting its future cash flows and then discounting those back to today's dollars. For Westinghouse Air Brake Technologies, this approach provides a clear framework for thinking about long-term potential versus current market pricing.

The company’s latest twelve-month Free Cash Flow stands at approximately $1.46 billion. Analyst forecasts extend out five years, anticipating growth in annual free cash flow to $1.82 billion by 2028. Beyond those five years, estimates are extrapolated. Simply Wall St projects continued modest increases through 2035. This method captures both analyst expectations and a more general sense of ongoing stability in Westinghouse Air Brake Technologies' underlying business.

Plugging these cash flow estimates into the DCF formula produces an intrinsic share value of $175.46. Compared to the current share price of $193.43, this implies the stock is about 10.2% above its fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Westinghouse Air Brake Technologies may be overvalued by 10.2%. Find undervalued stocks or create your own screener to find better value opportunities.

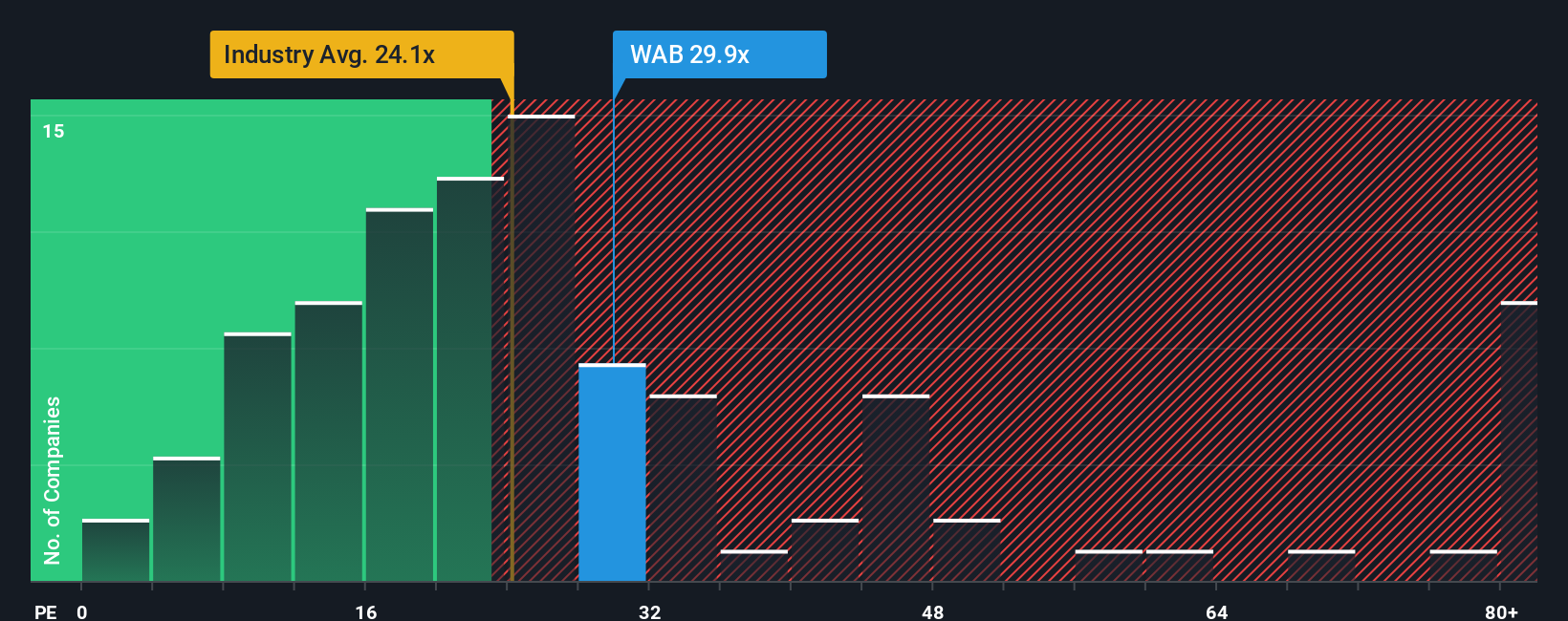

Approach 2: Westinghouse Air Brake Technologies Price vs Earnings

For profitable companies like Westinghouse Air Brake Technologies, the Price-to-Earnings (PE) ratio is a popular valuation yardstick. It gauges what investors are willing to pay for each dollar of earnings, helping to anchor expectations about growth, risk, and the sustainability of profits. Generally, stronger growth and lower risk justify a higher PE ratio, while slower growth or elevated risks suggest a lower “normal” or fair PE multiple.

Westinghouse Air Brake Technologies is currently trading at a PE ratio of 28.8x. That stands above both its Machinery industry average of 24.6x and the peer group average of 21.3x. While this might immediately suggest an expensive stock, the picture is more nuanced.

Simply Wall St’s proprietary “Fair Ratio” blends a range of fundamental drivers, such as long-term earnings growth, market cap, profit margins, and sector dynamics, to set a more personalized benchmark. For Westinghouse Air Brake Technologies, the Fair Ratio is calculated at 26.1x. This approach is preferred, as it accounts not only for direct peers but also for unique business features, relative risks, and broader market conditions.

With the company trading just a little above its Fair Ratio, the stock looks pretty close to fairly valued using this lens.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Westinghouse Air Brake Technologies Narrative

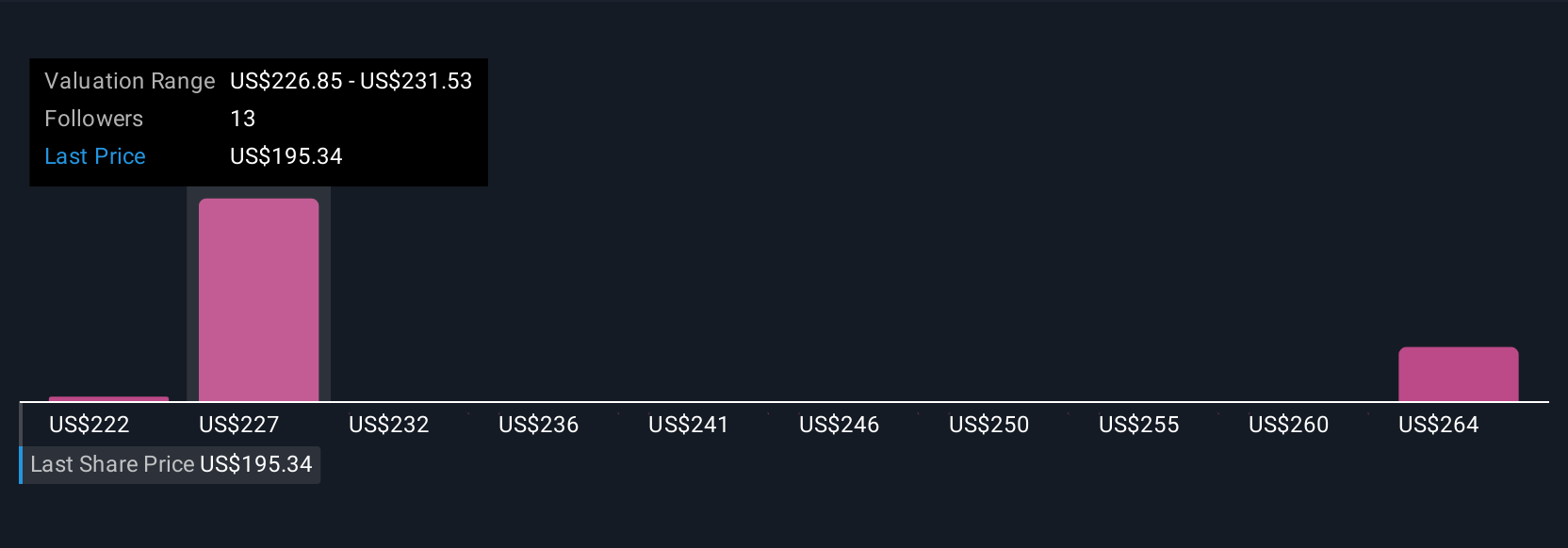

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story and outlook about a company, providing the “why” behind your financial forecasts and target price. Instead of relying solely on generic ratios, Narratives let you connect your perspective, including what you believe about a company’s revenue growth, earnings, and margins, to a fair value. This forms a bridge between your outlook and investment decisions.

Narratives are simple, interactive, and accessible right from Simply Wall St’s Community page, where millions of investors share and compare their valuation stories. This tool helps you make buy or sell decisions by matching your Fair Value to the current price, letting you clearly see if the stock suits your conviction or risk tolerance. Narratives are dynamic. Any time there is material news, earnings, or new forecasts, the platform updates your fair value automatically to keep you informed and on track.

For Westinghouse Air Brake Technologies, Narratives can look very different. One investor might be bullish, expecting global expansion and assigning a fair value of $250.00, while another, cautious about North American demand, might set a much lower target, just $200.00. Narratives turn static numbers into living stories that help you invest confidently, your way.

Do you think there's more to the story for Westinghouse Air Brake Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives