- United States

- /

- Machinery

- /

- NYSE:WAB

How Investors May Respond To Wabtec (WAB) Securing Record $4.2 Billion KTZ Locomotive Deal

Reviewed by Sasha Jovanovic

- In September 2025, Wabtec Corporation announced a landmark agreement with Kazakhstan's national railway, KTZ, to deliver Evolution Series locomotives in a multi-year deal worth US$4.2 billion, the largest locomotive order in Wabtec's history.

- This contract not only expands Wabtec's footprint in Central Asia, but also emphasizes the company's growing role in transforming international rail fleets with fuel-efficient, next-generation locomotives and long-term services.

- We'll explore how this record-setting KTZ order could reshape Wabtec's global growth outlook and underlying investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Westinghouse Air Brake Technologies Investment Narrative Recap

For shareholders in Westinghouse Air Brake Technologies (Wabtec), the investment case typically centers on the company’s exposure to global rail modernization, adoption of next-generation locomotive technologies, and long-term demand for digital and fuel-efficient solutions, while balancing risks from North American freight market softness and dependence on large, lumpy contracts. The recent US$4.2 billion KTZ deal could offset short-term concerns over new equipment sales and strengthen the international growth catalyst, though continued backlog lumpiness remains a key risk to monitor.

One recent announcement that ties directly into this growth theme is Wabtec's raised 2025 revenue guidance, which adds US$200 million following the acquisition of Evident Inspection Technologies. This update, reflecting both organic and acquisition-driven expansion, aligns with the company’s strategy to build resilience and diversity in its business, reinforcing underlying drivers for long-term earnings visibility in the wake of major wins like the KTZ order.

In contrast, investors should be aware that even with new international contracts, the risk of...

Read the full narrative on Westinghouse Air Brake Technologies (it's free!)

Westinghouse Air Brake Technologies is projected to reach $13.0 billion in revenue and $1.8 billion in earnings by 2028. This outlook is based on an assumed 7.1% annual revenue growth rate and a $0.6 billion increase in earnings from the current level of $1.2 billion.

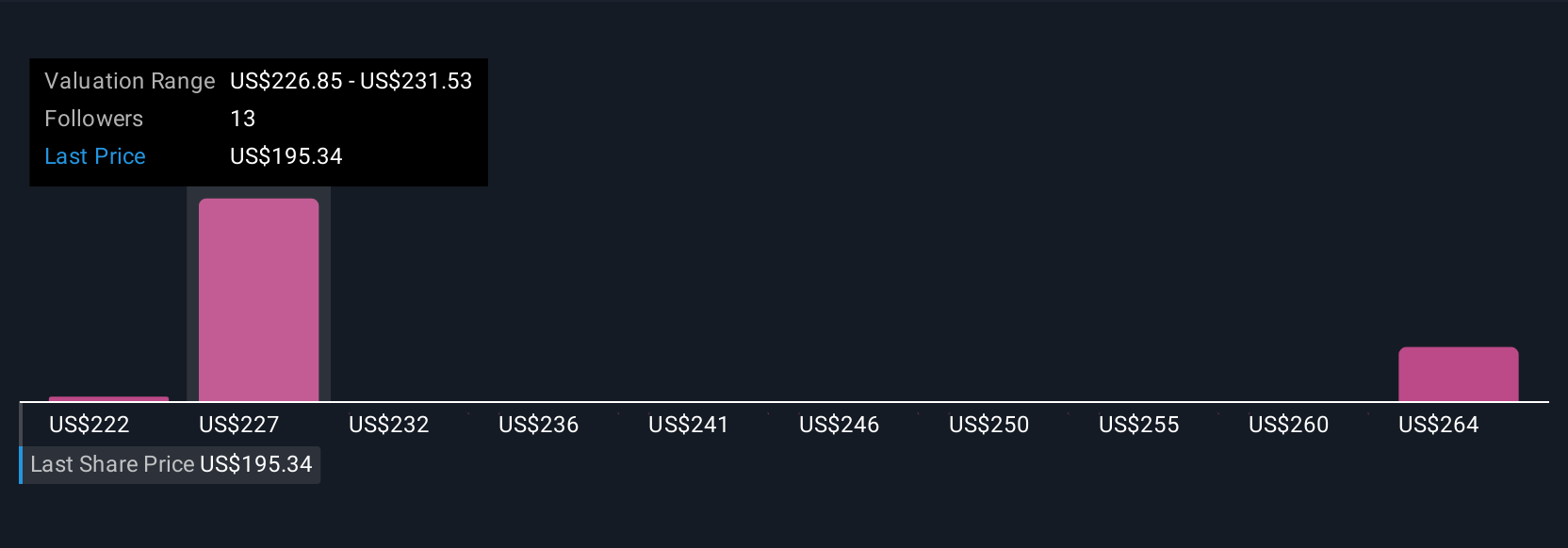

Uncover how Westinghouse Air Brake Technologies' forecasts yield a $226.12 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Three fair value opinions from the Simply Wall St Community range from US$176.88 to US$226.13 per share. With sustained global investment in rail infrastructure as a catalyst, many see broad opportunity yet also recognize that outlooks can widely differ.

Explore 3 other fair value estimates on Westinghouse Air Brake Technologies - why the stock might be worth as much as 14% more than the current price!

Build Your Own Westinghouse Air Brake Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Westinghouse Air Brake Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Westinghouse Air Brake Technologies' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives